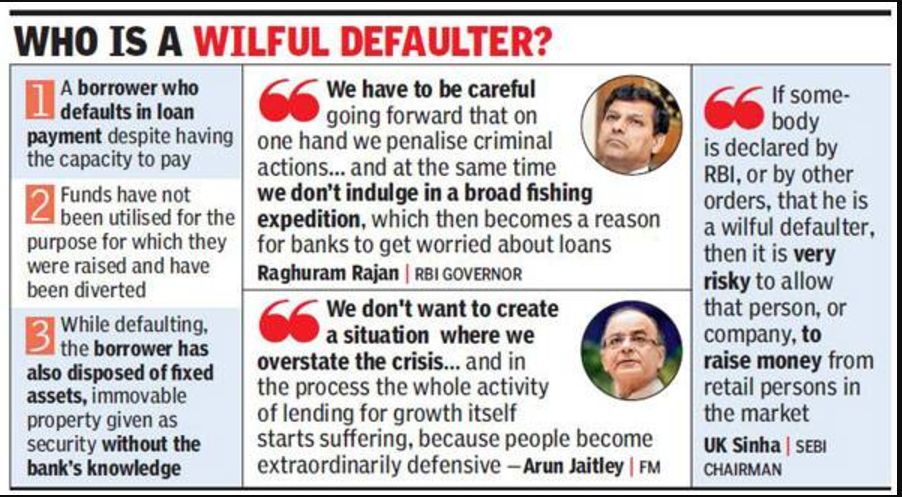

A person who has borrowed funds from bank and is essentially not using the fund for the right purpose or when he doesn’t pay back bank loans when he can do so or when he siphons off the funds advanced by banks and disposes the assets pledged for availing the loan without the knowledge of the creditors is classified as a Wilful Defaulter.

RBI classifies willful default under the following circumstances –

- The deliberate intention of not repaying the loan borrowed from the bank and the default occurs in repayment obligations when it has the capacity to fulfill the said obligations.

- The funds borrowed are not used for the specified purpose for which it was availed but have been utilized for some other purposes.

- When the fund was availed for a specific purpose, but have been siphoned off and no assets are available to justify the usage of funds.

- When the assets pledged while taking fund have been sold off without the knowledge of the bank.

Actions Taken By Bank Against Wilful Defaulters

- List of suit-filed accounts of wilful defaulters is prepared by the bank and is submitted to the Credit Information Bureau (India) Ltd (CIBIL) at the end of every quarter.

- Companies’ director names which are associated with the defaulters is reported by the bank, which helps other banks on guard to such defaulters.

- A willful defaulter can be punished by chokes off most credit channels since the defaulter cannot avail the facility from the bank/institution.

- A willful defaulter cannot indulge/ start a new business for a period of five years from the date being declared as wilful

Banks have the right to change the management of a willful defaulter company. RBI has made rules which define the wilful default and is processed by the banks for declaring an individual who borrowed money and fulfills such illegal criteria, as willful defaulter. If a bank classified you as a willful defaulter then there is no remedy for that. Banks can take action against such illegal process under laws like the SARFAESI Act.

Parliamentary Standing Committee on Finance presented a report on February 24, 2016, which recommends each bank must make a list of names of willful defaulters public as a measure of public accountability. Rules and Regulations should be amended to enable banks to make names public. Also, it would enable the bank to withstand pressure and interference in dealing with the promoters for recovering further loans. According to law willful defaulters owe public sector a total amount of 64,335 crore, which constitutes about 21% of the total NPAs.

The Bottom Line

From a borrower’s perspective, the best practice is to have a healthy credit score and do a good job with any of your loan repayment. Your credit history may soon become all kinds of financial services, and you certainly would not like to be classified as a wilful defaulter and blacklisted from the financial institutions. Hence, maintain a good your credit and experience a financial future free of any worries.