The Indian Income Tax Act of 1961 is a very complicated piece of law. After several amendments, the law now stands with 298 sections with a number of their own sub-sections. As a normal professional, you don’t have the time to go through all of them to find the specific section that you need. So, here’s a little detail to ease your pain. Regarding payment of compensation, the Income Tax Act has enlisted certain specification under Section 194L and Section 194LA in the Act.

Understanding Section 194L of Income Tax Act 1961

This section deals with the “payment of compensation on acquisition of capital asset”. The section guides or has set the law that must be followed while payment of income tax and deductibles based on compensation regarding capital asset. The law dictates that, if any person is responsible for paying to a resident any sum of money be it in the form of compensation or the enhanced compensation or even the consideration or enhanced consideration on account of a compulsory acquisition, which when falls under any law that is in force for the time being, of any capital asset will be, at the time of payment of any such assets through cheques, drafts or any other mode of payment, whichever is earlier, deductible at an amount equal to ten percent of the acquired sum as income tax on income that comprises therein:

Provided that no deduction should be made under this section where the amount of such payment, or as the case may be, the aggregate amount of all such payments made to the resident during the financial year does not exceed a total sum of Rs. 100,000.

This section was inducted from July 1, 1999.

Section 194LA of Income Tax Act -Payment of Compensation

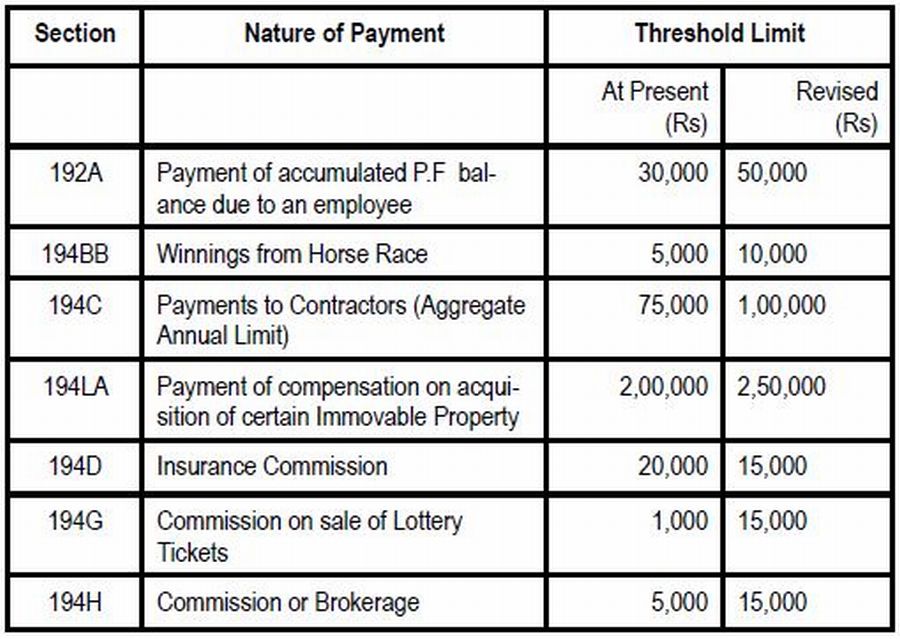

After Section 194L, Section 194LA is included in the Act. The section deals with “payment of compensation on acquisition of certain immovable properties”. The law dictates that, if any person who is responsible for paying a resident any sum, whether it’s in the nature of compensation or the or the enhanced compensation or even the consideration or enhanced consideration on account of a compulsory acquisition, under any law that was in force at the time, of any immovable property (which excludes agricultural land), shall at the time of payment of any such sum through cheques, drafts or any other mode of payment, whichever is earlier, can deduct an amount equal to 10% of the paid sum as income-tax therein:

Provided that there will be no deduction made under this section where the amount of such payment or, as the case shall present, the aggregate amount of all such payments made to the resident during the financial year does not exceed a sum of Rs. 100,000.

There are some explanations for terms used in this particular section:

- “Agricultural land” means agricultural land in India as described under items (a) and (b) of sub-clause (iii) of clause (14) of Section 2.

- “Immovable property” means any land 9excepot agricultural land) or any building or part of a building.

This section was inducted on October 1, 2004.