What is Input credit tax (ITC)?

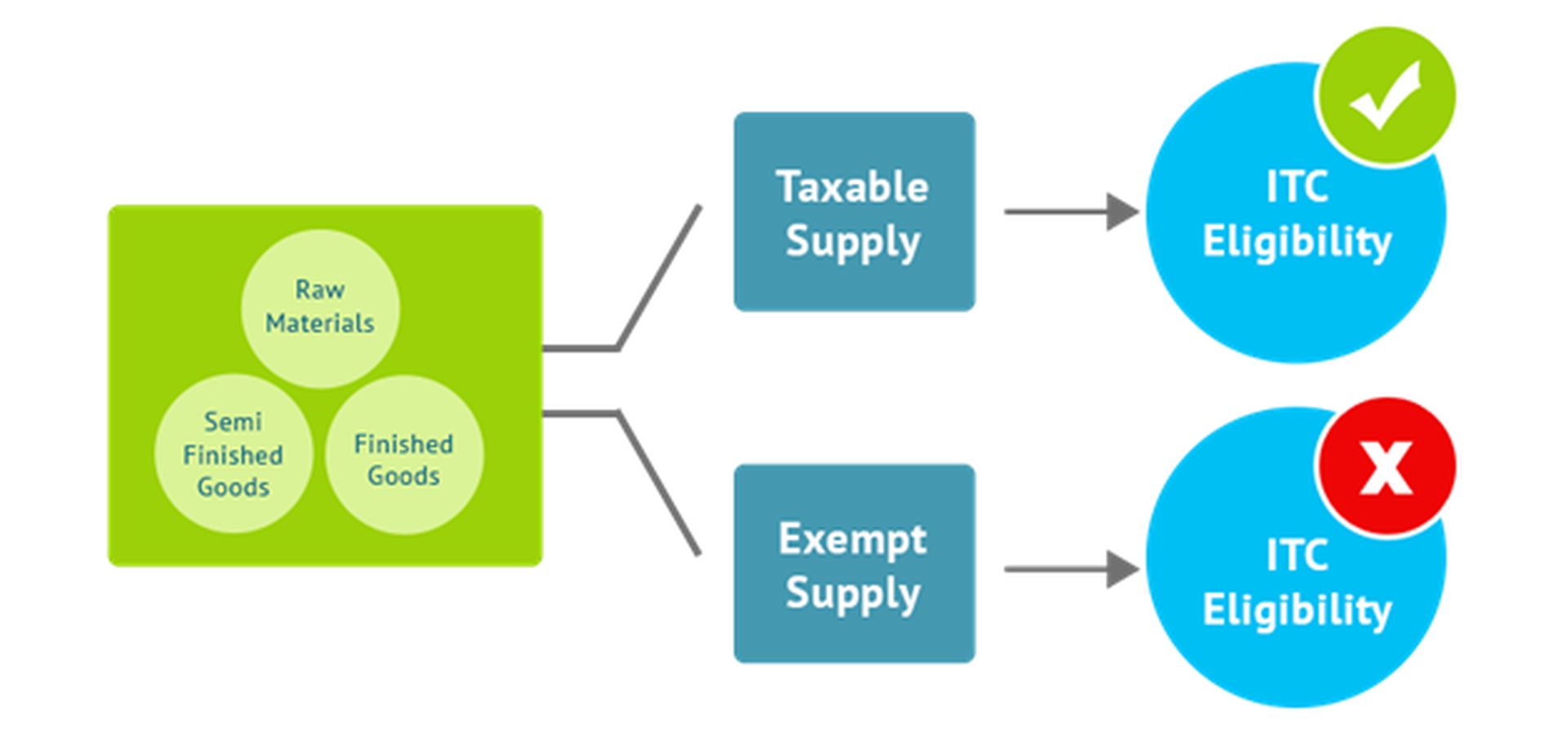

Recently the Government of India has combined all the taxes and made it into single Goods & service tax (GST). This is a simple single tax for the end consumer, but when it comes to the manufacturer or seller, the tax includes another component – Input Tax Credit (ITC). When a manufacturer purchases a ‘taxable raw material’, he has to pay Input credit tax and when he sells it, he also has to pay Goods & service tax.

Can I claim back my Input Tax Credit after paying Goods & service tax?

Yes, any manufacturer or seller can claim back the Input Tax Credit paid to the government. Input credit tax being the backbone of Goods & service tax, the government had made certain conditions to be met to qualify for the claim. A registered person qualifying the below conditions are eligible for claiming Input credit tax:

- Transfer or supply of goods:

Motor vehicles and other conveyances when it is used for trading, transport of passengers or goods, driving education or training.

- Transportation of goods/supplies and/or service:

If a seller or a person delivers the goods and/or service to the customer, either as a single supply or a part of composite supply, Input credit tax can be claimed back.

- The employer who rents a cab or vehicle to supply or deliver goods to his employee or to help the employee, he can claim back Input credit tax.

As the government has made it obligatory for the employers to provide to its employees, there is some relaxation.

- Employment and supplies between contract workers:

Assume a person X under a contract with certain person Y, employs another person under some contract. When a person Z works under a contract, he is an input for X. Now X is liable for Input Tax Credit claim.

- When the registered person ceases to Composition Scheme (CS) & becomes a taxable person:

- The Inputs/ capital goods invoice should be less than 12 months,

- When the person inputs held in stock or semi-finished goods in stock

- On capital goods on the day immediately preceding the date of cease in CS.

- When a Non-resident taxable person import goods/services

When do the above conditions become invalid?

- When the Vehicle & motor conveyance is not used for the supply or delivery.

- Food & Beverage, Outdoor catering, Beauty treatment, Cosmetics and plastic surgery

- If the person claiming Input Tax Credit holds any kind of membership at any club, health centre or fitness centre

- Usage of rent-a-cab service for other than government obligations, health insurance, Life insurance

- Travel benefits of the employee extended to vacation or home travel concession

- Work contract service when supplied for immovable property except machinery and plants.

- Goods and/or services used for personal use

- Goods/Service where the tax is already paid with Composition scheme

- Goods/service received by Non-resident taxable person (other than imports)

- Goods which are reported lost/ stolen/ destroyed/ written off/ disposed as free gift/ sample

- Any tax paid for non-payment of tax, short payment, and excessive refund. Also Input credit tax cannot be claimed if there is any fraud/ misstatement/ suppression of facts.

- Seized goods/supplies

- Goods & service tax not registered within 30 days of liability

- When depreciation is claimed of the Capital goods (or) plant & machinery under Income Tax Act.

- On exempted goods/ services

- When the recipient fails to pay the supplier within 180 days of the invoice, the recipient has to reverse the input credit taken and has to pay the interest.

Know your Goods & service tax and Input credit tax:

Know your Goods & service tax and make yourself eligible by following the procedure and claim your Input credit tax back. Every transaction has to be submitted with proper bill and it has to be claimed within time.