Levy of Penalty under section 272A(2)(K)- The Case of Argus Golden Trades India Ltd vs. JCIT (ITAT Jaipur)

Levy of Penalty under section 272A(2)(K)

Penalty under section 272A(2)(K)- A judicial interpretation- What penalties were levied?

Penalty under section 272A(2)(K) had been levied . This stated that a copy of the statement was not produced in time which had been specified in section 200(3) of the act or proviso to section 206C (3) of the Act. However, nothing of that sort had happened in the mentioned case. Rather the e-TDS returns were not filled up on time. But this is not covered under the section 272A (2) (K). Instead it is covered under the section 272A (2) (C) of the Act. So due to the unsure levy of penalty by the AO, the penalty was quashed.

Change in e-TDS form filling- With last moment change in format, all data was not available with assessee

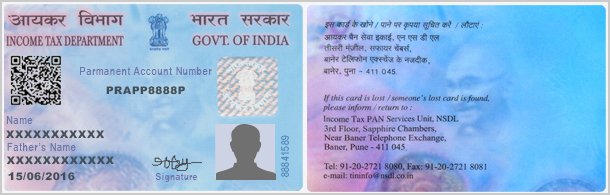

During the year 2010-11, there was a change in the manner of filling of e-TDS returns. The payee’s valid Permanent Account Numbers were to be mentioned and that was made compulsory. The TDS could be validated and uploaded only if the filling of the e-TDS was done in that manner.

Statement of the CBDT- CBDT agreed that delay in few days of filing of TDS return, Revenue did not entail any loss as the TDS had been deposited

The Central Board of Direct Taxes or CBDT, as on 31st May 2010, stated that due to the presence of large number of deductees in all corners of the country, some time was required by them to collect all the PANs. The presence of so many deductees was an issue which was not disputed by the Revenue. Due to the delay in the collection PAN, the updation of the e-TDS returns to the IT system was also delayed. This IT system is maintained by the Revenues. But the taxes were all collected and were also deposited at the rate that was prescribed with delay of only a few days. So the Revenue did not incur any loss because of the delay which had occurred to the filling e-TDS returns. It must be noted that this delay was totally unintentional.

Delay in filing of TDS Return due to Non Availability of PAN- Cases that drew attention

The decision of the Coordinate benches in some cases had been referred. These cases were Collector Land Acquisition v. ACIT (2012) 22(Chd.), State Bank of India v. ACIT [2014] 268 (Cuttack – Trib), UCO Bank vs. ACIT [2013] 45 (Cuttack – Trib) and CIT Branch Manager (TDS). In all these cases, the non-availability of PAN was considered to be a rational cause that inflicted the delay of filling the e-TDS return.

Why non-availability of PAN was not considered in this case and penalty was removed?

The non-availability of PAN was not considered in this case as the circumstances were peculiar. The change in the system made it compulsory that every deductee must produce a PAN. There are a large number of deductees in a country like India and collecting all of their PAN took time and naturally the process of updating it was delayed. But the Revenue did not incur any loss so penalty was removed.

Conclusion of the Case- Penalty dropped as also since AO himself was not sure of the section under which he is to levy Penalty

The e-TDS returns were not updated in the stipulated time because of the PAN of all deductees was not available. The delay caused was unintentional and moreover no loss had occurred to the treasury. Penalty was also levied under the wrong section and it reflected that the AO was not sure about what charges he was levying. So keeping all facts in mind the penalty was removed.