No inquiry could be raised on Income tax returns if no notice

No inquiry could be raised on Income tax returns if no notice

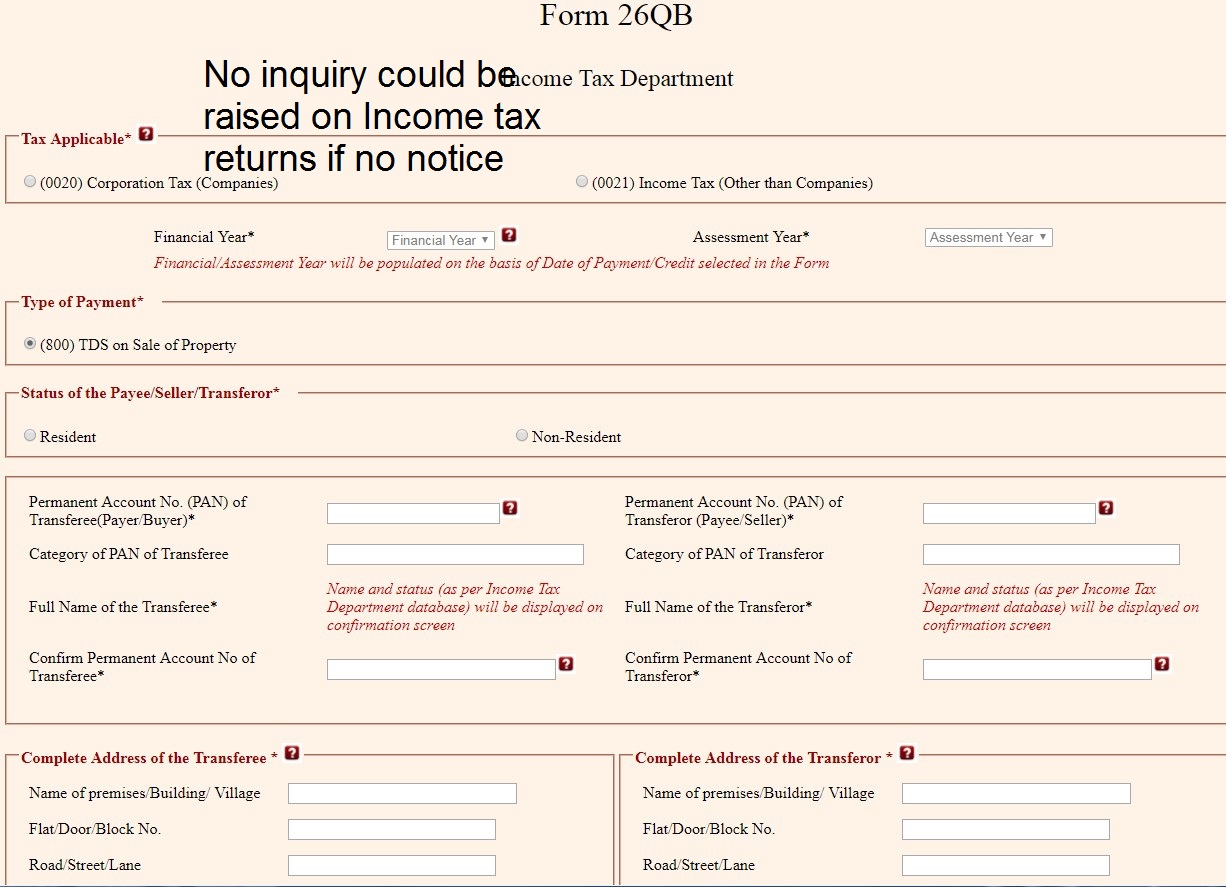

Every year the return has been filed by every earning member of the country. There are various queries regarding the Income tax return, now if there would be no notice received for the returns files then there would be no inquiry on it. There was a taxpayer who filled their Income tax return for the financial year 2009-10 within the due date then i.e. within the due date as 31, August 2010. The return has to be processed under the summary assessment procedure as per the Income-tax Act by the Income-tax Officer. The case was opened and under section 148 notice has been issued on the date 1st April 2013 and which was received by the taxpayer on 8th April 2013 which implies that No inquiry could be raised on Income tax returns if no notice.

A window of 30 days under Section 148

Under Section 148, any income which has been escaped will need to be filled and refile the Income tax return within a span of 30 days. The Income-tax officer issued another notice to the taxpayer under section 143(2) on 3rd May 2013. The taxpayers need to report the office by 13th May 2013. The taxpayer replied on 23rd May 2013 under Section 148 that the original return to be treated as the final return. The confirmation of the pass Income tax return was issued on 19th March 2015 by the Income-tax officer after completing an assessment. An appeal was being filed by the taxpayer regarding some additions in return of Income and this appeal was disallowed by first appellate authority.

What to do after the refusal of the first appeal?

After the refusal of an appeal, the taxpayer appealed before the tax Tribunal which is the second level of appeal. The taxpayer confronted assessment order on the technical ground which was finally passed by the Income-tax officers. The argument was made that after the submission of the claim by taxpayer on 23rd May 2013, there was no order issued under section 143(2). So the assessment order made by the Income-tax officer is invalid and bad in terms of the law. The taxpayer had made the basis of the various judgment passed in this case by the High Court of Mumbai and Delhi on these types of issues.

On reviewing the cases, tax tribunal had stated that after filling of the return only notice under section 143(2) could be given. In this case, the notice could be issued after filing of the return finally by the taxpayer which is 23rd May 2013. So any notice under section 143 (2) could be issued to the taxpayer after validly filling of the Income-tax return i.e. 23rd May 2013.

Can notice be given only on the basis of Section 148?

Now the next question in front of tax tribunal is that whether the assessment of tax return could be possible without giving notice under section 143(2) and only on the basis of section 148. There was a case in the Bombay High Court where it was decided that the notice is necessary to be given under section 143(2) before starting any inquiry on the Income tax return. The inquiry could not be made under section 148 only. Then through Delhi High Court, it was further clarified that the Income-tax officer could issue a notice under section 143 (2) after fully assessing the Income tax return made by the taxpayer.

On the basis of both the rules stated under section 148 and 143(2), the tax tribunal has given the decision that as there was no notice given to the taxpayer under Section 143(2) after filling of return on 23rd May 2013. Therefore the assessment made by the Income-tax office is bad in law and the order of assessment has been canceled.