There is a protocol that is followed in every search and seizure operation conducted by the Income Tax Department. The Assessing officer has guidelines to follow and has to conduct the operation accordingly. Failing to do so can open doors to litigation by the Assesse. A similar case to this was seen and settled by the High Court of Delhi recently. The case pertains to charges pertaining to admission of undisclosed income the search and seizure process conducted and the penalties applicable to it. It was presided over by Justice S.Murlidhar and Justice Pratibha M. Singh. But first, let us get some perspective.

What is Section 271AAA?

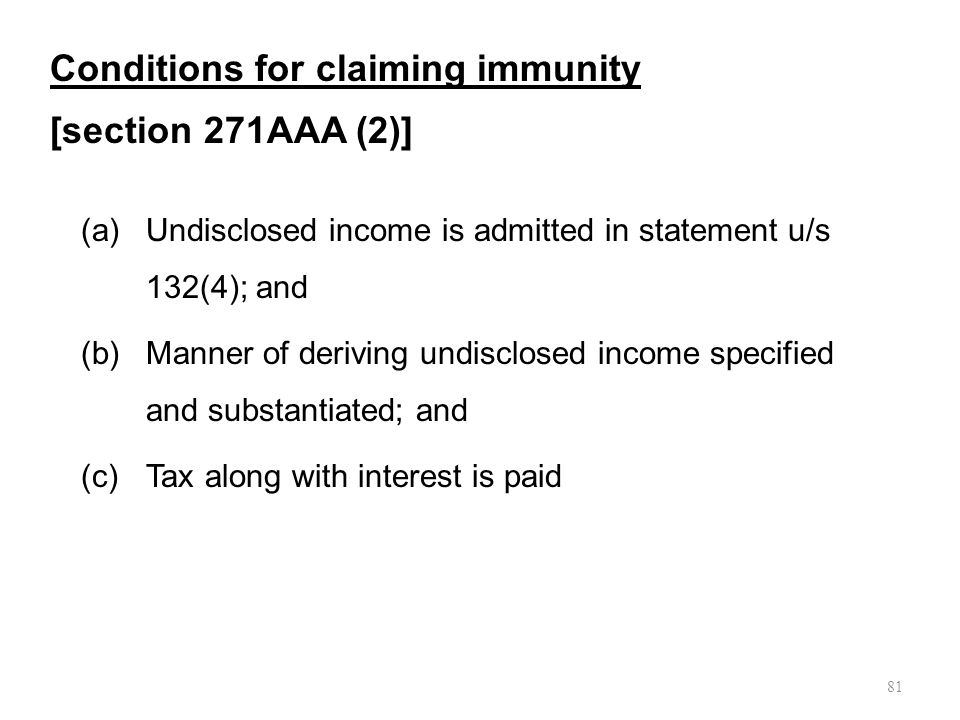

The section 271AAA deals with the penalties where a search has been initiated. It was inserted after section 271AA and specifies the penalties that apply to an assessee related to the income that has not been disclosed to the government. It states that if a search and seizure process is initiated under section 132 of the IT act 1961 after the 1st day of June 2007, the assessee can be penalized for paying an amount equal to 10 percent of the undisclosed income in addition to tax, if any. It also states the conditions under which the penalties are not applicable and the ways by which the outstanding penalties are imposed.

The Case in question

The case heard by the High court of Delhi was between the Principal Commissioner of Income Tax and Emirates Technologies Private Ltd. The Case pertained to section 132 and 271AAA of the Income Tax Act. Earlier, the CIT(A) and the Income Tax Appellant Tribunal gave and upheld the decision of removal of any penalties to the respondent-appellant in the case. The case went to and was heard by the Delhi High court and a judgment was given. In the judgment, the court concurred with the previous decisions of the Commissioner of the Income Tax (Appeals) and the Income Tax Appellant Tribunal (ITAT).

The Conclusion

The Commissioner of Income Tax (Appeal) noted in an order dating to 4th of November, 2013 that there was no specific query put to the Assessee by drawing attention to income tax act section 271AAA and asking to specify how the income, which was surrendered during the search, was derived. To impose penalties under the Income Tax act mentioned earlier, there are certain jurisdictional conditions that should be met. The court concurred with the Commissioner of Income Tax (Appeal) and the ITAT that the jurisdictional requirements of section 271AAA were not fulfilled. So the decision of deleting the imposed penalties was upheld and the appeal was dismissed.