What is the procedure of Compliance of TDS on Sale of Immovable Property under Section 194-1A?

The Finance Bill 2013 has incorporated a new section 194-IA in the Income Tax Act. According to the provision TDS at the rate of 1% has to be deducted by purchasers in case of sale of immovable property. If there is no valid PAN of the seller, tax deduction will be at a higher rate which is 20%.

The Finance Bill 2013 has incorporated a new section 194-IA in the Income Tax Act. According to the provision TDS at the rate of 1% has to be deducted by purchasers in case of sale of immovable property. If there is no valid PAN of the seller, tax deduction will be at a higher rate which is 20%.

This provision is applicable with effect from 1stJune, 2013 in case of sale of immovable property except an agricultural land where the amount of consideration is Rs. 50,00,000/- and above. This provision will not be applicable in respect of transactions effected before 1st July, 2013. The purchaser is not required to obtain TAN, which is applicable to all other deductor.

Object of the provision:

It is observed that transactions in immovable properties are usually undervalued. Most of the transactions lack the PAN of the parties concerned. Levy of TDS was aimed for imposing tax upon capital gains. It is meant to widen the purview tax and to introduce tax deduction at source for transactions in immovable properties.

Depositing tax under section 194-1A:

TDS deducted under section 194-IA has to be deposited within seven days from the end of that month in which it was deducted. Tax will be deposited through Challan-cum-statement in Form 26QB. TDS will be deposited electronically to the Reserve Bank of India or the State Bank of India or any other authorized bank.

The Director General of Income Tax (Systems) has provided the procedure for such electronic filing.

Rules regarding TDS certificate:

TDS Certificate for deduction under section 194-IA has to be issued by deductor according to the format provided in Form No 16B. Form 16B should be issued within fifteen days from the due date of depositing tax. Form 16B has to be downloaded from website of the Income Tax.

Electronic Payment:

The authorities have already provided a link “TDS on sale of Property” under e – Payment of Taxes for electronic deposit of the TDS.

Quoting of PAN is mandatory for both seller and purchaser. Complete addresses of both of them are to be given. In the online form complete address, amount of consideration, date of agreement and details of mode of payment are to be provided.

In case there is an error in quoting PAN:

Deductor has to be very careful in filling up the details of PAN. In case there is an error in quoting PAN, the same cannot be corrected online. The only option is to approach the Assessing Officer.

Electronic Payment by deductors without net-banking facility:

If for Section 194-IA transactions the deductor does not have net-banking facility, an alternate option is given. The deductor has to fill up the form online and then opt for e – tax payment.

Upon completion of the form, an acknowledgement will be produced. The deductor can go to a bank branch for payment along with the acknowledgment number.

Bank will go through the web site to retrieve payment information on the basis of the acknowledgement number. Thereafter it will proceed towards the electronic payment.

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

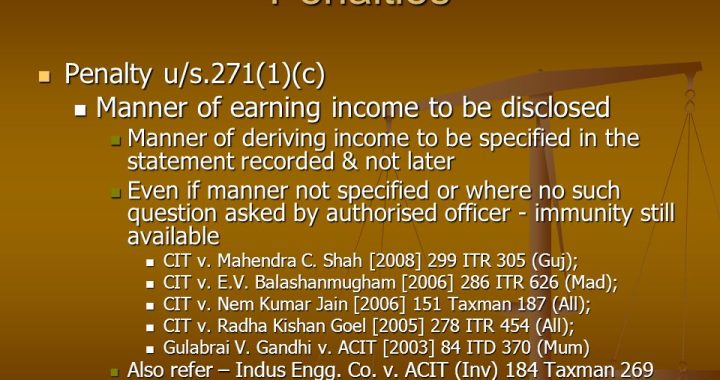

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?