Your ultimate guide for CA campus interviews

CA campus interviews

There are no magic tricks for standing out, getting noticed and landing an entry level job with a campus interview. If you do follow these tips and, be yourself, you might be well on your way to land yourself with the very first opportunity provided to by the ICAI through CA campus interviews.

Today, most of the newly qualified Chartered Accountants wished to join the industry. The best way for entering into the industry is through campus placement held by ICAI. A candidate should ensure to complete his GMCS training prior the commencement of the Campus Interviews.

- Preparing for campus interview is different from preparing for CA exams. Following are some useful tips which will help to prepare for the campus interviews:

- First and foremost, draft a neat and professional resume. You can google out for sample and jot down all the relevant points which you think can impress the hiring manager.

- Prepare a list of questions which are usually asked during an interview and prepare your answers. Go through them few times so that they are at the back of your mind and you can produce them in need.

- When attending campus interviews, you might need to attend several interviews during the same day. Make a comprehensive plan well in advance with respect to the date and the timing of the interview.

- You should always carry extra copies of resume, passport size photos, notebook, and pens with while going for an interview.

- There are chances some companies call for an open interview where you can also try even when you are not shortlisted by them. Don’t be in a rush and keep your eyes and ears open.

- You must dress professionally and follow the dress code prescribed by ICAI.

- Learn about the company for which you will be appearing the interview. It is a very helpful as you could showcase your knowledge about the company and its business operations during the interview process. It will help you get some extra points in the interview process

Sectors to look out for- where CAs can expect to grow big

IT/ITES

The Indian IT sector is currently self-possessed to grow at an increasing growth rate of 9 percent, as per the figures from staffing and recruitment company Randstad. Companies are looking to reinforce their operations and recruitment is expected to grow as well with better pay.

Pharma

As per the report provided by KPMG on Pharmaceuticals, the pharma market of the country is assessed at `2,40,000 crore, and is anticipated to grow at a rapid pace of 12 percent CAGR over next 3 years. By the year 2020, India might be among the top 3 pharmaceutical marketplaces by its incremental growth and 6th largest globally in terms of absolute size. With an increase in market size, the business would need more workforce to tackle this high demand and would be a better choice for professionals seeking stable and high performing jobs.

Telecom

Most of the incumbent players in the telecom industry are intensifying their 3G & 4G networks and their growth is being followed by the expansion of their networks via fiberisation. As per the study by industry body GSM Association, the country would be the 4th largest market for smartphone by the year 2020. Hence, telecom sector can offer professionals a high growth career.

Sectors you should avoid

Infrastructure

This industry has been seeing large-scale layoffs lately, with L&T axing 14,000 employees. The infrastructure sector has felt the adverse demonetization impact deeply, as the cash flows and the capital expenditures have been affected. The outlook of the business might take further hits as the infrastructure companies are looking to reduce costs. It is advisable to avoid this sector for the time being and seek opportunities in other sectors.

Manufacturing

The manufacturing sector has also felt a big blow due to demonetization. Sales of equipment and machineries have taken a hit and are seeing a drop. However, this situation is expected to correct itself as and when more cash comes in the banking system.

Negotiating Salary with recruiter

If you want to get the pay which you deserve, it’s important to know the market pay scale for the position you are looking for in any industry and in your relevant geographic location. If you get into a salary negotiation and are not aware of it, you will be at the mercy of the hiring manager who would solely control the conversation. You could do this by searching on sites like Glassdoor or Payscale, or by asking from people in the field

One of the other ways of doing this is by picking up the calls from the recruiters. They will know the pay scale for professionals with your expertise and experience, so better use it to benefit yourself!

While doing the research, you would find the range which would represent your market value. It could be alluring to ask for something in the middle of that range, but you should go towards the top. You must assume that you’re entitled to the top pay. Your employer would undoubtedly negotiate down, so you require a wiggle room to end up with a number which pleases you.

Prepare a sheet, a one pager which shows just how remarkable you are. In that sheet list all your achievements and accomplishments, awards, and other recognitions. You need to establish your value to your would-be boss.

Finally, rehearse, rehearse and rehearse. Jot it down whatever you would like to say, and practice on video or a mirror or with your friends till you’re very comfortable with having this conversation.

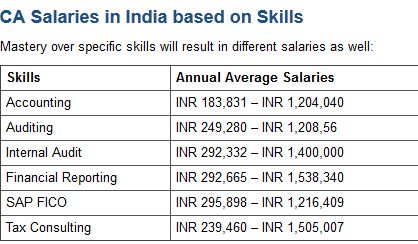

Salary expectations

The salary package of CA varies and is dependent on your experience, skills, costs of living in cities, industry etc. However, a qualified CA is entitled to a satisfying pay. The average salary package for a CA is INR 706,946 per annum. The most high paying jobs for CAs are associated with SAP Financial Accounting and Controlling (SAP FICO), Budget Management, Financial Advisor, Evaluation and Management Auditing and Strategic Accounting.

| Experience | Annual Average Salary |

| Less than a year | INR 2.4 lakh to INR 11 lakh |

| 1-4 years | INR 3 lakh to INR 11 lakh |

| 5-9 years | INR 3.5 lakh to INR 20 lakh |

| 10-19 years | INR 5 lakh to INR 25 lakh |

| 20 years and more | INR 5 lakh to INR 30 lakh |

Industry vs Practice

Starting your own practice as a sole proprietor is a tough task for a fresh CAs. It is the initial challenge from the profession, one need to face if you want to start your career as a sole proprietor. Today, several domains have emerged. One requires a team for audit, direct taxes and indirect taxes, etc. Usually, clients prefer to work with CAs who are experienced and have some specialization together with a good reputation. However, it is not feasible for a CA who has just qualified and started his professional career.

Going for a job seems to be an easier option but the current market scenario is not that great. It is difficult to get a good job, however, it all depends on the ability of the candidate to land a good job. In case you prefer to start your own practice, it is advisable to work in a firm initially for some time or join other firms as a partner and understand the scheme of things and grow your network. The gestation period for private practice on an average scales up to 2-3 years. Certainly, your hard work during the gestation period will bring you good better opportunities. Starting your own practice does has several associated risk, however, the rewards are equally great.

Bankruptcy Lawyer in Pittsburgh

Bankruptcy Lawyer in Pittsburgh  3 Ways to Get Help With Your Legal Case

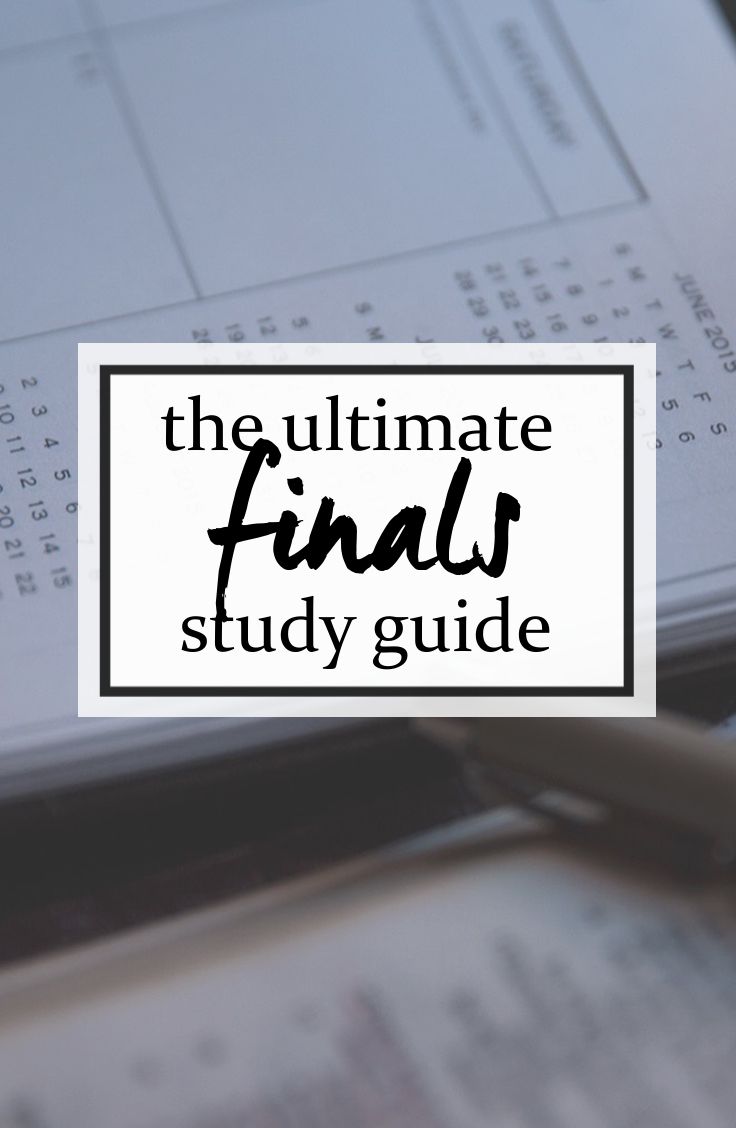

3 Ways to Get Help With Your Legal Case  Guide to preparing for CA Final Exams – Part 2

Guide to preparing for CA Final Exams – Part 2  Guide to preparing for CA Final Exams – Part 1

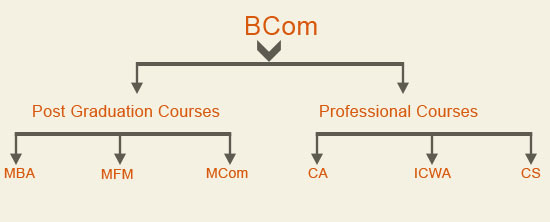

Guide to preparing for CA Final Exams – Part 1  MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?

MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?  How Much You Can Earn As A Cost and Works Accountant?

How Much You Can Earn As A Cost and Works Accountant?  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?