TDS For Property Sale in India under Section 194-IA

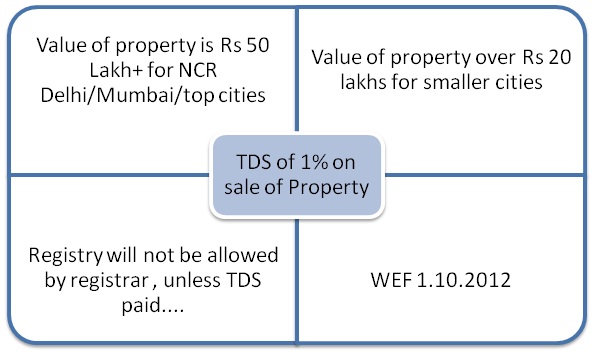

TDS for Property Sale that is applicable from 1st June 2013 and is deducted at source on sale of immovable property including land and building (excluding agricultural land). For Tax deduction under Section 194-1A of the IT Act 1961, the cost of the property must be equal to or more than INR 50 Lakhs.

As per the new finance bill of the current financial year 2013-14, tax levied @ of 1% will be deducted by the purchaser of the asset while making the payment for that asset.

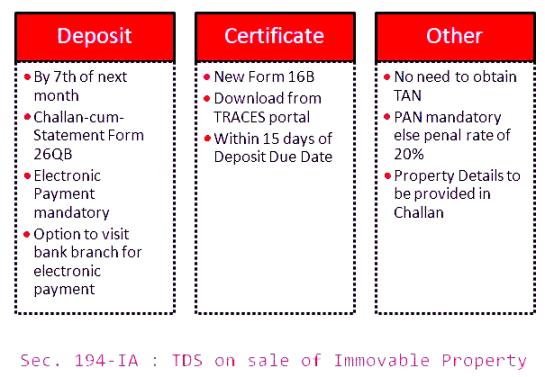

The deducted tax will be deposited to the Government Account with the help of any authorized bank branches using e-tax payment option accessible at National Securities Depository Limited (NSDL). In order to make e-payment it is mandatory to have a Net-banking account with any of these authorized banks.

How to pay the tax online tax:

The following are the steps to pay online taxes

- First Logon to site- www.tin-nsdl.com

- On the left hand side of the column click on the TDS on Sale of Property which is the seventh option under PAN column.

- Select the form for ‘Payment of TDS on purchase of property’

- You will see a menu list on the right hand side of that column

- Select the option “Online form for furnishing TDS on property (FORM 26QB)”

- Select ‘Form 26QB’ and let Form 26QB page open

- Fill the required detailed in that form

- After clicking on ‘Proceed’ button, you will be directed to Confirmation Page, which is displayed to verify the details, which you have entered.

- If the all details entered are all not correct or you can clear the form on clicking ‘Clear Home’ button and can enter your information again.

- If all the details including the name displayed (as per ITD) is correct then click on the ‘Submit’ button.

- On submitting the information, you will be directed to the page of ‘TIN e-Tax Payment’ where your nine-digit alphanumeric e-tax Confirmation number is generated.

- To make the required TDS payment click on the ‘Submit to the Bank’ button.

- After clicking on ‘Submit to the Bank button’, deductor needs to login to the net banking site with his/her Username and Password, which is given by the bank for net-banking purpose.

- After login, you have to enter payment details at the bank site

- If the payment is successfully done then a challan, will be generated and displayed which contain CIN (Customer Identification Number), payment details and bank name by which payment is made.

- This challan form is the proof of the payment. Print it and keep it safe for all future references.

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

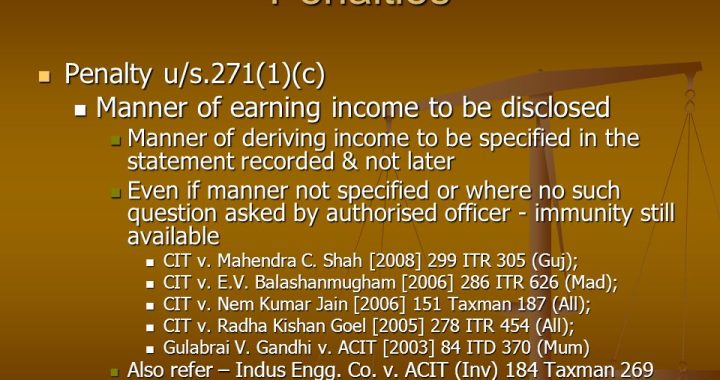

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?