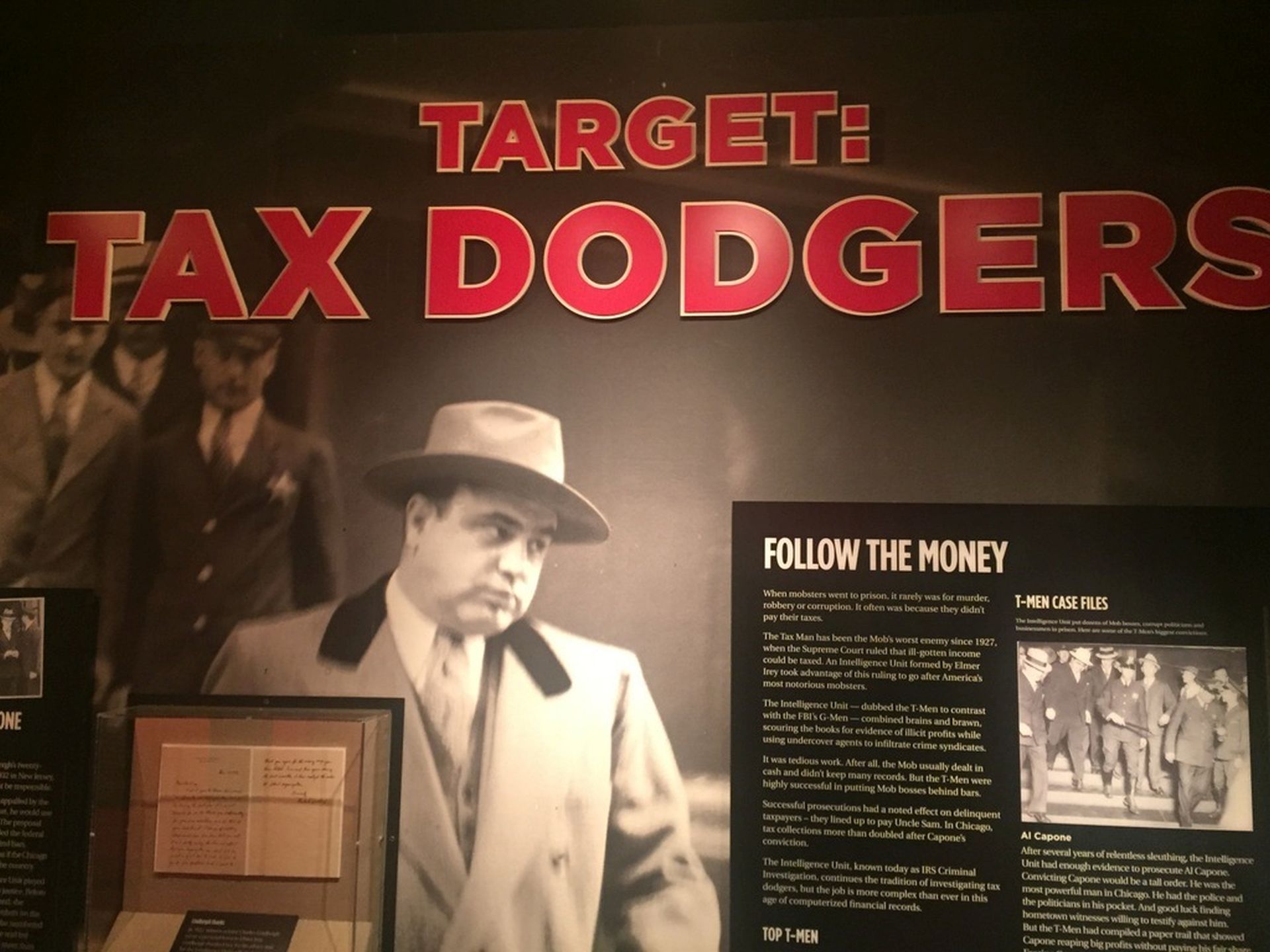

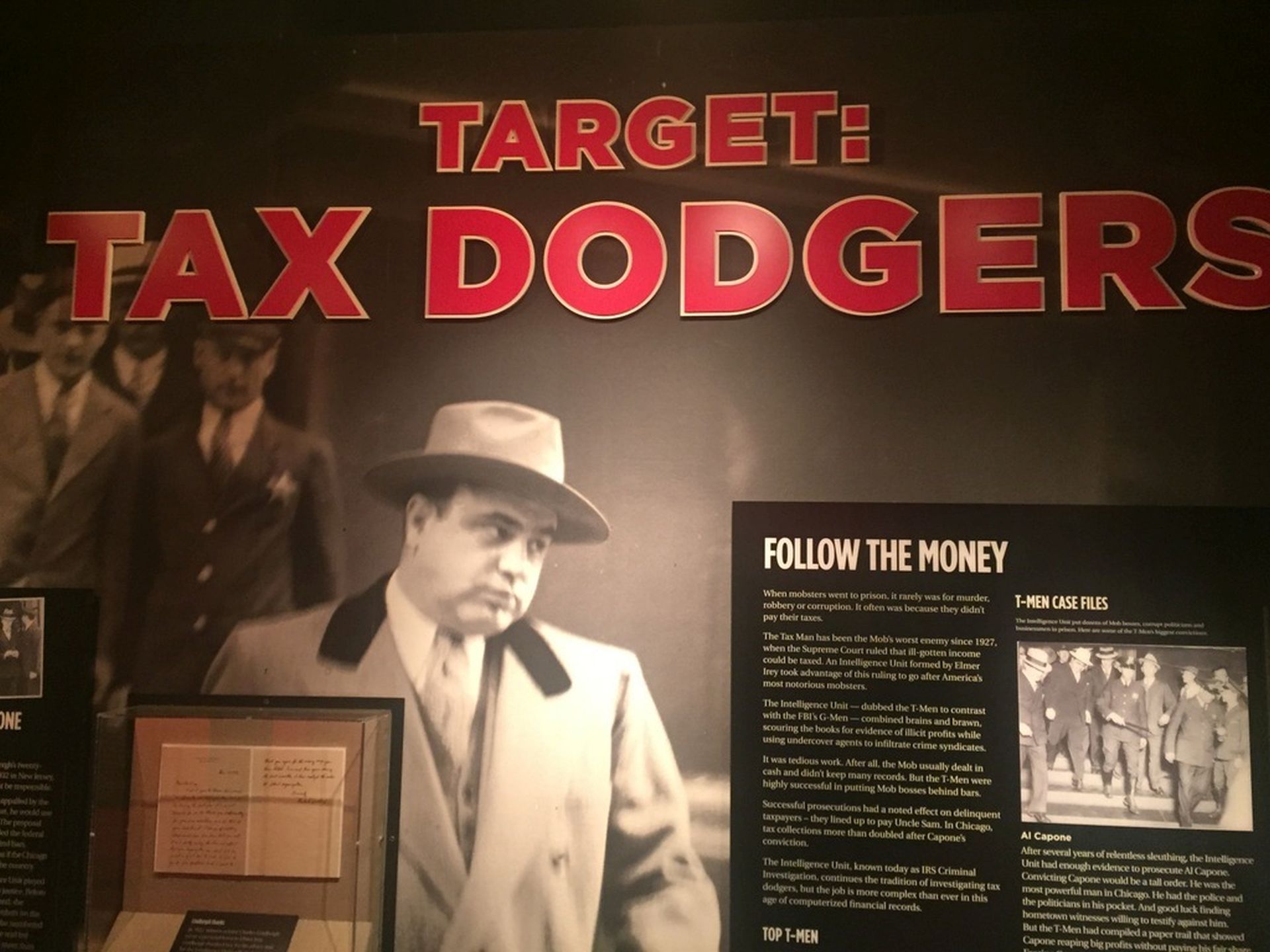

How Tax Evaders are Now Trapped by I-T Dept’s New Rules? A strategically aggressive enhanced action plan to prosecute serial dodgers !

prosecute serial dodgers

You don’t need any expert to tell you that filing income tax return is one of the most important duties as a citizen. If you have failed to do that, then it may interest you to know that government has introduced strict laws to punish anyone who tries to evade income tax. The Income Tax Department has taken stern steps to make it impossible for you to adopt any means of tax evasion. A strategically aggressive enhanced action plan has been drawn up by the Central Board of Direct Taxes (CBDT) to prosecute serial dodgers. This step has come as a follow up to Modi government’s fight against black money and corruption.

Prosecuting tax evaders- Income Tax Department Now aggressive to punish the Tax Evaders

The I-T Department has made it clear that if there is a presence of strong evidence of tax evasion then for prosecution it is not necessary for the assessment to finish. Hence, the department will be able to prosecute serial dodgers, if they find hard evidence to support the fact that the taxpayer is evading tax returns, and then even though the assessment is incomplete, the department is in full power to prosecute him/her.

Section 276CC calls for imprisonment to Tax Evaders- Tax Evasion is Out Tax Planning is in

Previously, the department could have raised a tax demand. But now they are at liberty to take the taxpayer to court. The I-T Department is allowed to issue a charge sheet to the tax evader under Section 276CC of the I-T Act, after arriving at a decision based on the tax assessment on whether the case is fit for prosecution or not. The Section 276CC has provided for prosecution of tax evaders with rigorous imprisonment of 3 months to 7 years along with fine, depending on the amount of money evaded. If evidence is found that the taxpayer has “willfully” evaded paying his/her tax, then the Assessing Officer can file a complaint with the department. Based on this complaint the department will take strong action to prosecute serial dodger.

Benami Transactions Act given more teeth

The tax department is also looking into a serious problem of Benami transactions. This came into effect after the execution of the Benami Transactions Act. The new action plan is implemented to adopt various ways to investigate Benami transactions in the country. The CBDT has enforced the I-T Dept to investigate, identify and take prompt action against anyone who violates the rules. It has also fixed a timeline within which the I-T Dept will have to supply evidence and wind up the matter.

In lieu of this, the tax department will have to finalize a number of Benami cases for financial years ’14, ’15 and ’16, by the end of July 2017 and the remaining cases must be filed by March 2018. The tax officials are also directed to dispose of any suspicious transactions that are being reported by banks and other intelligence units. The new law has encouraged the officials at the level of the additional directorate to conduct and seize at least two searches every week. The official figures denote that the I-T department has conducted more than 1000 searches in 2016, prosecuting around 100 tax evaders.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income