Supreme court Judgement: Tax Exemption Ambiguity-Benefit in favor of the Revenue Department

Supreme court Judgement: Tax Exemption Ambiguity-Benefit in favor of the Revenue Department

The Supreme Court has ruled that the Assesse has to bear the burden to prove whether his/her case comes within the purview of the exemption clause or exemption notification. Revenue Department will get the advantage of any ambiguity in a tax exemption provision/notification on entitlement or the tax rate to be paid by the assessee. This landmark judgment has come from the Supreme Court of India which says that any Ambiguity-Benefit in favor of the Revenue Department.

Ambiguity-Benefit in favor of the Revenue Department-Assesse has to Fight for himself in case of Ambit of any Tax Exemption

A five-judge Constitution bench headed by former Chief Justice of India Mr Tarun Gogai and four other namely Mr. NV Ramana, Mr. R Banumathi, Mr. Mohan M Shantanagoudar and Mr. S Abdul Nazeer has ruled that it is the sole responsibility of the assessee to prove that he/she comes under the ambit of any tax exemption or notification. An exemption notification has to be interpreted strictly by the Assesse.

After Sun Export Case judgment- Taxing Statue are strictly handled

Reversing a 1971 judgment (Sun Export case), the court after examining the various aspects and giving anxious consideration held that every taxing statue including charging, computation, and exemption clause (at the threshold stage) should be interpreted strictly. The benefit of any ambiguity related to exemption notification must be in favor of revenue and not be claimed by the Assesse.

The case was between Commissioner of Customs and the Company owned by Dilip Kumar and Others

In this case, M/s Dilip Kumar and Company claimed the benefit of concessional rate of duty at 5 percent, instead of standard 30 percent for an imported consignment of Vitamin E50 powder. Customs Department, however, denied the relief which resulted in the litigation.

As per Justice Ramana, the contradictory ruling has created confusion and resulted in an unsatisfactory state of law. All the decisions which have a similar view related to Sun Export Case are overruled. He also said, in the event of ambiguity the benefit should go to the subject/assessed may warrant visualizing different situations.

The act of Legislature Cannot foresee all Consequences- Justice Ramana

Ramana said that it is for the courts to see if a particular case falls within the universal principles of law enacted by the Legislature. An Act of Parliament/Legislature cannot foresee all types of situations and all sorts of consequences.

The Constitution Bench was comprised to examine the correctness of the ratio in Sun Export Corporation, Bombay vs Collector of Customs, Bombay. The aim behind this was to find which interpretative rule to be followed while interpreting a tax exemption provision/ notification in the event of ambiguity as to its applicability regarding the entitlement of the assessee or the tax rate to be applied?

Conclusion- Ambiguity-Benefit in favor of the Revenue Department

Pinky Anand, the Additional solicitor general had argued that if the situation of ambiguity arises, the benefit has to be in favor of revenue and that such ambiguity in tax exemption provision must not be interpreted to benefit the assessor who fails to demonstrate without any doubt that the tax exemption notification covers such assessed.

Common mistakes people make after a criminal charge

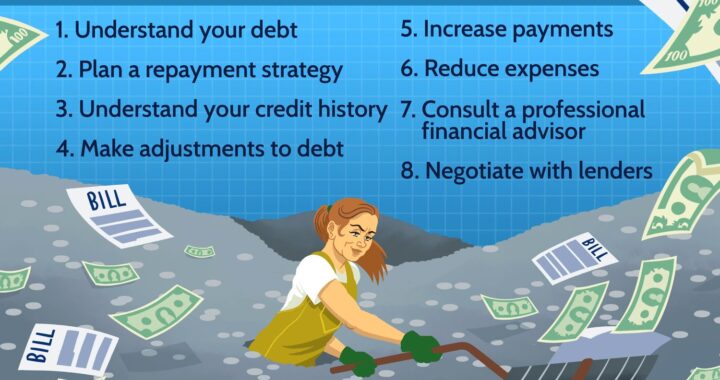

Common mistakes people make after a criminal charge  Take Control of Your Loans: Expert Strategies for Better Management

Take Control of Your Loans: Expert Strategies for Better Management  Dealing With a Workplace Accident

Dealing With a Workplace Accident  Qualities That Make For A Great Expert Witness

Qualities That Make For A Great Expert Witness  Marketing Business Ideas and Opportunities for Residual Income

Marketing Business Ideas and Opportunities for Residual Income  New Title: There is Help When Financial Disasters Strike

New Title: There is Help When Financial Disasters Strike  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?