Section 80IBA Assures 100% Deduction For Affordable Housing Projects

Section 80IBA To Provide Full Tax Benefits on Affordable Housing Prokects

The tax pillars for the housing industry was a bit tougher in comparison to other sectors. But recently the Finance ministry of the government in power introduced a new section

Section 80IBA to Provide incentive to builders to give flip to affordable housing projects

In Income Tax Act 1961 as Section 80IBA with intentions to provide tax relief to builders who are promoting affordable housing schemes in the country. The section provides with full deductions for the builders engaged in promoting affordable housing schemes.

A Quick Overview Of Section 80IBA:

The section briefs that an assessee involved in developing and building the affordable housing projects shall be eligible for a tax deduction equal to 100% of profits and gains of such business from the gross total income. However, there are certain terms and conditions which need to be satisfied to be eligible to get the deduction under the Section:-80IBA. These are briefly discussed herein.

Approval Time Period for the Project to be covered under section 80IBA

For eligibility of deduction under this section, a certain project should be approved after June 1st, 2016 be on or before March 31st, 2019.

Completion Of A Project & Penalty for Non-compliance Within The Mentioned Time Period:

- To be eligible for the deduction u/s 80IBA the housing project must be completed within three years from the date of its official approval by the competent authority.

- Also, the whole housing project shall be considered as completed on obtaining of completion certificate from the competent authority.

- If by any chance an assessee requires taking approval for two times for a single project due to any reason, in that case, the three years period would be counted from the date of the first approval.

- In the case of non-compliance within the said time, the total deductible amount claimed and allowed in one or more previous years, will be chargeable to tax under the all over Profits and Gains of Business or Profession for the previous year in which the completion period expires.

Location requirements for Projects to be eligible for benefit under section 80IBA:

Metro Cities: Within the city boundaries of Mumbai, Delhi, Kolkata, and Chennai or within the 25 kilometers from the municipal limit of these cities

Non-metro Cities: all cities despite the above list which are within the Jurisdiction any Municipality or Cantonment board. Bangalore should be considered under this only.

Requirement of Area of Projects:

For Metro cities, the minimum size of the plot of land should not be less than 1000 sq. meters. Whereas for non-metro cities, it should not be less than 2000 Sq. meters.

Residential Unit Size to get Benefit under section 80IBA

The built up area of a single residential unit which includes balconies, projections increased by the thickness of the walls and extended portion of a resident and which covers the facilities for living, cooking, and sanitary requirements, should not exceed 30 sq. mtrs in Metro cities and 60 sq.mtrs in Non-metro cities. This excludes common areas utilized by other residential units under the whole project. The residential unit must have a separate door to be accessed in and it should not be enter-able through another residential unit’s living area.

Project Utilization Of Floor Area Ratio for getting benefit u/s 80IBA

For eligibility of full deduction under section 80IBA, a project must not utilize less than 90% of the permissible floor area ratio as per government rules in Metro cities. Whereas, in the case of Non-metro cities, this shouldn’t be less than 80% of the permissible floor area.

Earmarking of Area for Shop or Other Commercial Establishments in Such Projects registered under section 80IBA:

For both Metro & Non-metro cities, this shouldn’t exceed 3% of the total aggregate built-up area of the whole project.

Other Key Requirements to get the benefit:

- The assessee requires maintaining separate books of accounts for each such project to be eligible for the 100% deduction under section 80IBA

- There shall not be more than one housing project built on each plot. And if two housing project comes under one plot of land then that won’t be considered under this section.

- Where a residential unit is allotted to a person in the project, such unit shall not be

allotted to the spouse of that person or to the minor children of him/her. - Section: 80IBA does not stand applicable to contractors who is responsible for the execution of such housing project awarded either from Central government or from the government in power of the state or from any other person.

So, with all these advantages under this section 80IBA, promoters are expected to build more numbers of an affordable housing project and simultaneously contribute to the Central government’s initiative: ‘House For All’.

Also Read House Transfer within 3 years under family arrangement, sec. 54F relief can’t be denied

Tax Implications by Owning Residential Property by an NRI in India

Tax Implications by Owning Residential Property by an NRI in India  New House is in wife’s Name – Forget about tax-relief from the sale of the house

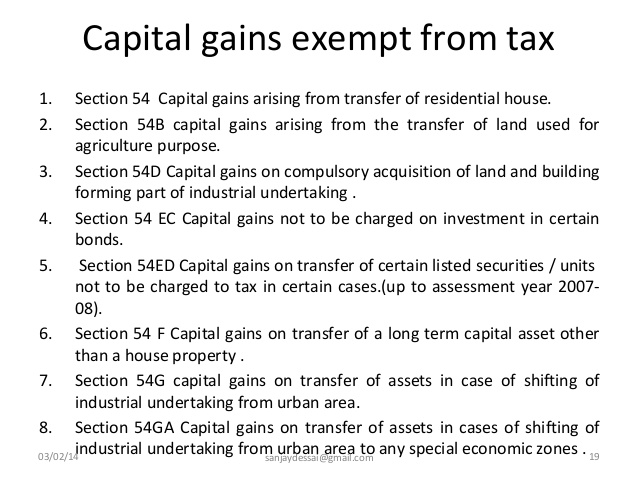

New House is in wife’s Name – Forget about tax-relief from the sale of the house  How can you get tax exemption by selling your asset under Section 54F Income Tax Conditions?

How can you get tax exemption by selling your asset under Section 54F Income Tax Conditions?  How to Minimize Tax Liability with House Rent Allowance

How to Minimize Tax Liability with House Rent Allowance  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?