Procedure for electronic filing of appeal before the CIT(Appeals)

The Central Board of Direct Taxes has made an announcement vide press release dated 30.12.2015 with respect to the Procedure for electronic filing of appeal before the CIT(Appeals) (Commissioner of Income Tax Appeals). Subsequently, vide notification no. 11/2016 dated 01/03/2016, the concerned rule (i.e., new rule 45 substituted for old rule 45) has been notified.

Procedure for electronic filing of appeal before CIT(Appeals)

Why Electronic Filing of Appeals?

The electronic filing of appeal is introduced for the purposes of reducing paperwork, minimizing the transaction cost for the taxpayers, decreasing the burden of compliance on taxpayers, helping in the digitization of the Departmental functions, eliminating human interface, offering error free and efficient services to the taxpayers as well as facilitating the fixation of hearing of the appeals electronically.

Applicability of e-filing of appeals

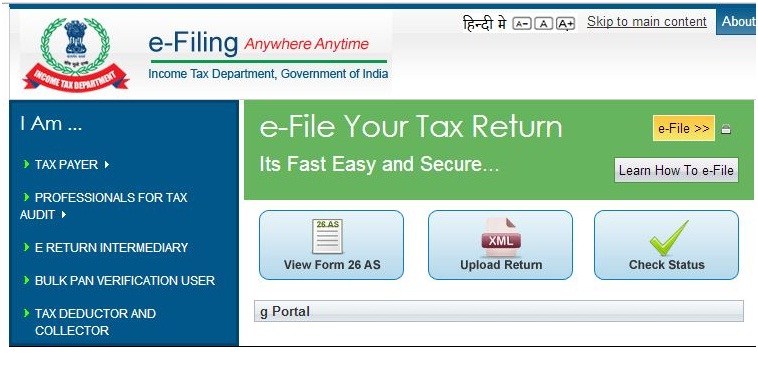

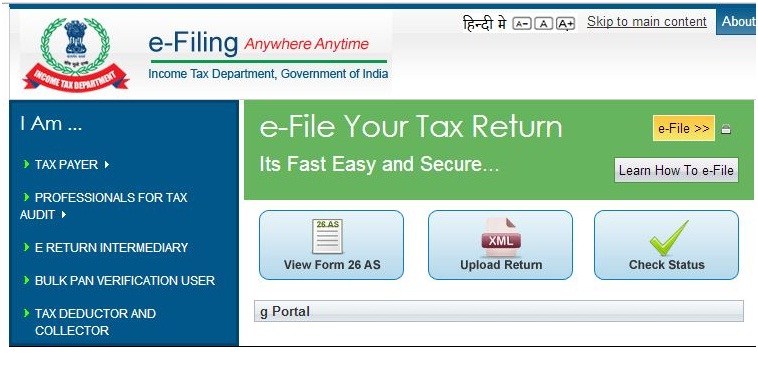

e-filing of appeals is made mandatory for the people who file their return of income electronically. Other persons have the option of voluntarily filing the appeal in the paper form or electronically. The same needs to be filed through online income tax portal www.Incometaxindiaefiling.gov.in.

Form to be filled for filing of Appeals before CIT(Appeals)?

Form no. 35 is required to be filed. The old form has been replaced by the new Form No. 35. In the CBDT Press Release, It is said that new form is much more structured, systematic, objective and aligned with the present provisions contained in the Income Tax Act, 1961. The form has in-built validations that would minimize deficiencies in the filing of appeals. But currently, only the old form is available for e-filling.

What’s new in Form No.35?

(a) The new form has more structured columns for filing name and address of the appellant.

(b) Now it is required to provide an e-mail address

(c) The new form provides an option for selecting whether the communication/notices to be sent to the appellant via e-mail.

(d) The new form now requires TAN No. of the appellant (if available).

(e) Financial year (FY) is required to be provided where the assessment year (AY) is not relevant.

(f) If the appeal for any other financial year/ assessment year is pending with the Commissioner of Income Tax (A), the appeal number and date of filing of such appeal is required to be provided in the new form.

(g) Where the appeal is related to any assessment, the specific details of the assessed income, disallowance of losses, an addition made to income and disputed amount of demand etc. are required to be provided.

(h) Where the appeals are related to penalties, now in the new form the amount of penalties levied and penalties disputed are also required to be provided.

(i) If the return has been filed, now in the new form the date of filing of the return and the acknowledgment number is also required to be provided.

(j) If the return is filed, now in the new form the BSR Code and the Sr. No. are required to be provided in addition to the tax paid equivalent to the advance tax amount.

(k) Where the appeal is related to tax deductible U/s. 195 borne by the deductor, now in the new form BSR Code, Sr. Number, Amount etc. are required to be additionally provided for the tax deposited U/s. 195(1).

(l) Now in the new form, the list of the documentary evidence relied upon are to be provided.

m) Now in the new form the list of the documentary evidence according to Rule 46A, if any, are to be provided.

(n) Now in the new form the delay in filing of the appeal, in case any, is required to be specifically mentioned.

(o) In the case of delay, the grounds for the condonation of delay are required to be provided now in the form.

(p) Now Date of Payment, the BSR Code, Sr. Number. And the amount is required to be provided in respect of the appeal fees paid.

Requisites for Filing of Appeal online before CIT (Appeals)

When the new form no. 35 will be provided on the website-

(a) The new Form No. 35 should be duly filled. The statement of facts and grounds of appeal are to be filled in the form no. 35 in the relevant columns itself. Each of the grounds of appeal must be less than 100 words. The statement of facts must be less than 1000 words.

(b) The scanned copies of the order appealed against, challan for appeal fees and notice of demand are required to be attached. All of these attachments must be in pdf/zip format. The total attachments in must not exceed 50mb in size.

Requirement of Digital Signatures for filing Appeals

(a) In case the return form is filled electronically with Digital Signatures, then the form no. 35 is also required to be filed electronically with Digital Signatures.

(b) In case the return is filed electronically without the Digital Signatures, then the form no. 35 is required to be filed electronically with the help of the electronic verification code.

(c) Where filing form no. 35 is not compulsory, but optional, then it could be filed with Digital Signatures or with the help of the Electronic Verification Code.

Other Facilities for filing appeals online before CIT(Appeals)

The Form No. 35 could be filled directly and submitted on the portal www.incometaxindiaefiling.gov.in. Or it could be filled partly/ fully and then the draft appeal could be saved for filing later after the completion, editing, checking etc.

Procedure for e-Filing

(i) Login to incometaxindiaefiling.gov.in with the user account

(ii) Then, navigate to the menu e-File → Prepare and Submit Online Form (Other Than ITR)

(iii) Then in the dialogue box which appears, the PAN will be prefilled. Under the “Form Name” choose “35”, then below the “Assessment Year”, choose the assessment year for which appeal is required to be filed.

(iv) Then the instructions, Verification and attachment menu would be displayed. Then one could follow the self-explanatory procedure for e-filing

The e-filing of appeals before the Central Board of Direct Taxes (A) is an important stance towards digitization, minimizing the human interface and the related problems. It would also save resources and time of the tax payers.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income