Personal Finance Changes As Per Budget 2013-14

Budget 2013-14 has brought several changes that can affect an individual’s tax slab. Among many changes, personal finance changes are quite essential for an individual. The major changes in some areas are stated here.

Changes Relating To Agricultural And Non-Agricultural Properties

- Earlier exemption on home loan was Rs. 1.5 Lakhs u/s 80EE. Now this limit has been increased to Rs. 2.5 Lakhs.

- Now buyer will have to deduct 1% TDS on the property having value of more than Rs. 50 Lakhs and this amount will be paid to government. This is not applicable for agricultural land.

- Now buyer/seller will also pay tax if the property’s stamp value is higher than purchase value. The difference will be considered as gain and tax will be deducted on the difference. This difference will be calculated on date of transfer or agreement. Seller pays such tax as capital gain tax also. So, gaining party will pay the tax.

- The municipality notification rules have been eliminated from definition of agricultural land. Now it is linked to population as mentioned here under

- For population of 10,000 to 1 Lakh, 2 KMs

- For population of 1 Lakh to 10 Lakhs, 6 KMs and

- For population of more than 10 Lakhs, 8 KMs

Changes Relating To Various Security And Commodity Taxes

Security transaction tax has been reduced significantly in some areas for sellers. The present arte are as under

- On equity funds, 0.01%

- MF and ETF at fund counters and at exchange, 0.001%

- Commodity Transaction Tax will be implied on non-agro commodities futures at 0.01%

- Dividend distribution Tax on all types of Debt mutual funds is brought to unique rate of 25%.

Changes In Banking And Insurance

- Contribution of Rs. 1,000 Crores for special Women Oriented banks by FM. This will work for financing women for their businesses.

- Banking KYC norms to be used for insurance sector also. Bank KYC rating will be used by insurance companies directly.

- Banks can now act as broker and sell insurance plans for various insurance companies not restricting themselves to one company.

- Tax exemption from insurance premium is raised to 15% of sum assured for disabled and sick people.

Bonds

- Tax-free bonds up to Rs. 50,000 Crores will be allowed in FY 2013-14.

- Inflation index bonds may be issued for providing safety against inflation.

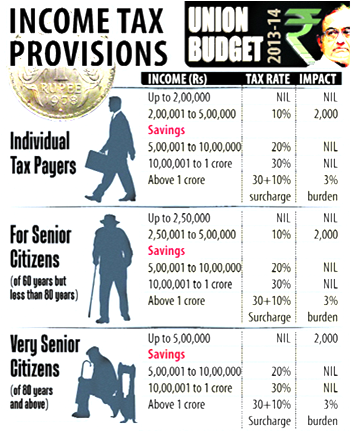

Income Tax Slabs

There are no novel changes as such in the income slab but introduction of Sec. 87A will give tax rebate of Rs. 2000 to individuals having net income less than Rs. 5 Lakhs.

Government Schemes

Cutoff for Rajiv Gandhi Equity Saving Scheme has been increased from 10 Lakhs to 12 Lakhs.

Deduction u/s 80D was available under Central Government Health Scheme which is now extended for other health schemes of Central and state government.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income