Penalty cannot be levied for concealment in a case an assessee has not filed his return

The Madras High Court in the case of Santosha Nadar v. First Addl. ITO and Another, (1962) 46 ITR 411 (Mad.) has analyzed the issue whether non-filing of return of income tax invites penal con-sequences.

The Madras High Court in the case of Santosha Nadar v. First Addl. ITO and Another, (1962) 46 ITR 411 (Mad.) has analyzed the issue whether non-filing of return of income tax invites penal con-sequences.

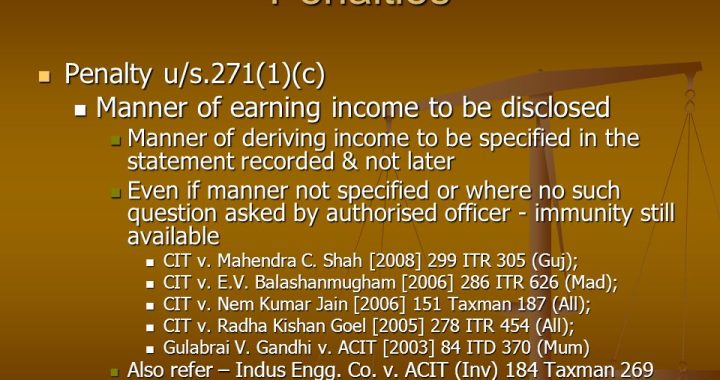

As a general rule non-compliance of the provisions of any statute invites penal con-sequences to prevent incidences of such non-compliance. According to the Income Tax Act, penalty is levied under the provisions of section 271(1) (c) of the Income Tax Act in a case where a person conceals his income or files incorrect details of his income.

But it is not been clearly stated anywhere in the statute whether the ingredients of Section 271(1) (c) of the Act are applicable to any person who has not filed his return of income. The issue is where a person has not filed his return, can it be treated as a case of concealment of income or of filing inaccurate details of income.

Facts of the case:

The issue was taken up for consideration before the Madras High Court in the aforesaid case. In the said case, the assessee filed his income tax return after the expiry of the limitation period. For such late filing, the return was treated as invalid. The assessment was done by the Assessing Officer without taking notice of the return.

In the order of assessment the Assessing Officer held that the assessee had concealed his income and imposed penalty under the Indian Income Tax Act. The question that arose for consideration of the Madras High Court was in a case where no return is filed at all, whether it can be treated as one of concealment of income or willful furnishing of incorrect particulars of income.

It was argued by the assessee that as there was no valid return filed by him, it could not be said that he has concealed his income or has deliberately provided incorrect particulars of income. It was also contended that if there is no return at all, there cannot be any possibility of concealment of income or that of furnishing incorrect details of income.

The Judgment:

The Madras High Court observed that it is not possible to construe penal proceedings relating to a case except where a return had been filed wherein any particulars of income had been concealed or any particulars had been willfully furnished with incorrect details.

According to views of the Hon’ble High Court, the expressions “inaccurate particulars of income” do not apply to a case where no return is filed for which penalty can be levied.

The Madras High Court concluded that for proving a default by the assessee Section 271(1) (c) of the Act, there should be a return filed. The Court supported the view that filing a return of income is a must, to hold an assessee liable to penalty under the Act.

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?