New rules for filing income tax For 2013-14

Some recent amendments have been introduced by the Income Tax Department for filing Income tax Return by the assessees for the Assessment Year 2013-14. These rules have substituted many Income Tax Return Forms.

Some recent amendments have been introduced by the Income Tax Department for filing Income tax Return by the assessees for the Assessment Year 2013-14. These rules have substituted many Income Tax Return Forms.

The new Income tax Return forms are to be used while filing Income Tax Return for the Assessment Year 2013-2014.

Return has to be filed in the specified mode and is required according to the provisions of the Income Tax Law.

Date of filing of return:

The assessees have to file their Income Tax Return for the Financial Year 2012-13 relevant to the Assessment Year 2013-14 mostly by 31.7.2013.

The Corporate assessees or the people who are required to file audit reports for them return have to be filed within 30.9.2013.

In the Income-tax (3rd Amendment) Rules, 2013 some amendments have been brought in which are very important to know for filing a return.

PAN card holders not required to file returns:

It is not required by people having PAN card whose income is not taxable to file a return.

Revealing all bank Accounts is useful:

Even if someone has not disclosed all of his bank accounts the Income Tax Department can easily find out all his bank accounts in a scrutiny.

It is risky to neglect filing return in case of taxable income:

If one has a taxable income it is not safe to neglect filing of return. An Income Tax Return is useful in case of many transactions where it is necessary to produce the return.

Online filing of return is useful:

At present all the manual filing of returns are also processed online. Hence it is useful to file return online.

Provisions not applicable to people claiming any double taxation tax benefit:

Provisions not applicable to people claiming any double taxation tax benefit:

Income Tax Return forms not applicable to individuals claiming double taxation tax benefit under the provisions of Income-tax Act, 1961.

New schedule introduced:

A new “Schedule AL” has been introduced in the Income Tax rules this year. It contains the details of the assets as well as liabilities of any person or HUF. It has to be filled up in cases where the income of the person or HUF is more than Rs. 25 lakhs.

Electronic filing of return in some cases:

Individuals having required filing tax audit should submit the audit report with the Income Tax Return electronically.

Tax payers claiming relief of tax under the provisions of section 90 or 90A or 91 of the Income Tax Act and are filing their Return for the Assessment Year 2013-14 and the following years are going to be required to file their Income Tax Returns electronically.

But in case of the charitable trusts and educational institutions that are to file their Returns in Form No 7 need not file the Return electronically whatever be their income.

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

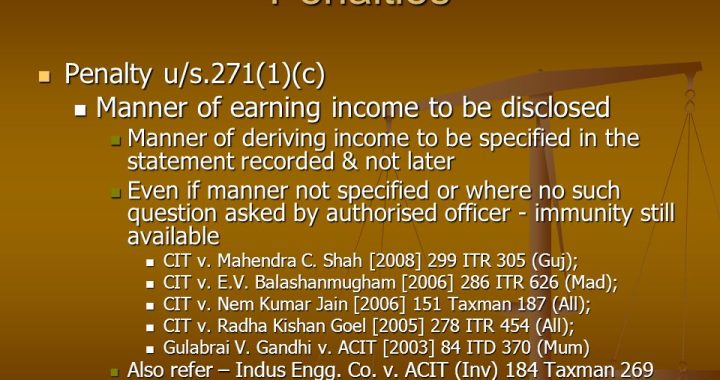

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?  Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA

Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA  What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return

What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return  Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter