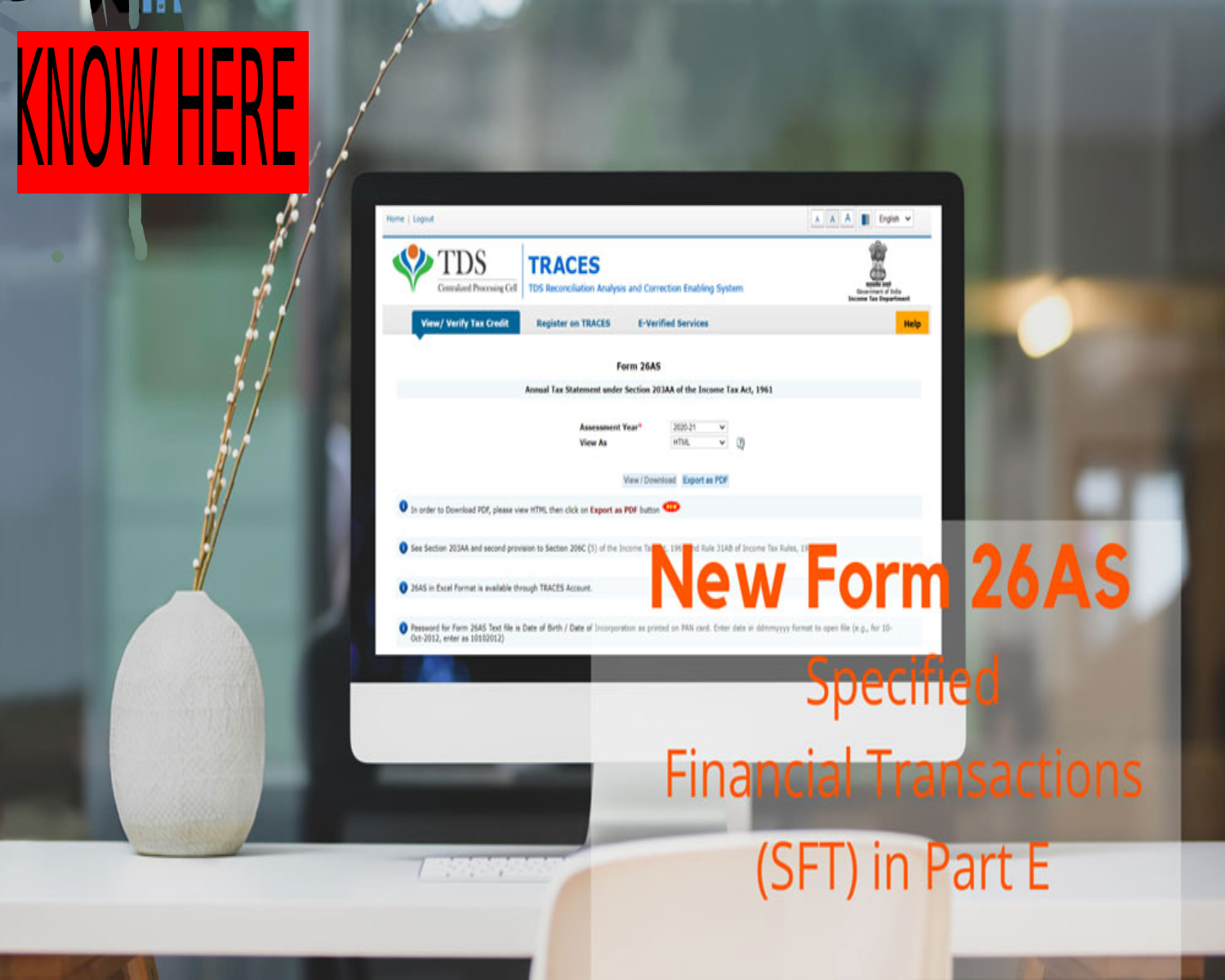

New Form 26AS to Show Specified Financial Transactions (SFT) in Part E

To make voluntary compliance and tax accountability easy and to facilitate the e-filing of the tax returns, it is stated that any information received by the IT department from the filers of specified SFTs will be shown in Part E of Form 26AS. The same can be made use by the assessee to file the ITR by correctly calculating the tax liability efficiently, expecting to bring transparency and responsibility in the administration of tax.

As per the press release made by the IT department on July 18, any specified transaction made by the specified institutions like banks, bond issuing institutions, mutual funds, registrars and sub-registrars, will be shown in Part E of Form 26AS. This is done to make ITR hassle-free and without missing any important monetary transaction.

The addition of SFTs in the form will enable the taxpayers to recall all their major monetary dealings approved by the CBDT, which is ultimately crucial for correct filing of their taxes. The Form would now onwards display an additional Part E. The Form will have different fields like the nature of the transaction, full name of the SFT filer, date of the business, number, and details of parties involved, the amount of the dealing, and the mode of payment and remarks.

For the intention of providing the SFT, the following persons are termed as ‘Specified’ u/s 285BA (1):

- A taxpayer

- Any Government Office

- Public body/association or a restricted authority

- Registrars

- Sub-registrars

- The Motor Vehicle Reg. Authority

- The post office

- In case of a land acquirement, a Collector is involved.

- Stock exchange

- RBI

- Any depository

- An agreed reportable fiscal institution

The above-mentioned persons are required to report only the prescribed transactions. Any unapproved transaction shall not be reported under the section.

The ten reportable persons among the above-mentioned persons as per Rule 114E, for whom the specific requirements have been suggested by the board are as follows:

- Banks, and co-operative banks.

- Post office/ PO General

- Nidhi company

- NBFC

- Companies issuing the credit cards

- Any company

- Mutual funds

- A person authorized under the FEMA, 1999

- Registrar/Sub-Registrar

- Anyone liable for audit u/s 44AB

As per Rule 114E, the above-specified reporting persons are required to mention the financial information in the SFT.

The Rule 114E (1) approves the statement of financial dealings in Form No. 61 A which is further divided into four major parts.

Part A consists of information that is basic to all types of transactions. This is just ‘statement-level’ information. The remaining three parts would relate to the ‘report level’ information which will be displayed in one of them.

- Part B is more of a person-based reporting.

- Part C is purely account-based reporting.

- Part D deals with fixed property transaction reporting.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income