Do you know the consequences of non-deposit of TDS?

Penalty for non-deposit of TDS

Recently, the Income Tax Department and the CBDT are taking the late payment and non-deposit of TDS very seriously. They have imposed new rules to sanction interest and penalty for late payment, but that is not the end as they have also taken steps for a criminal prosecution against those who are responsible for deduction and payment of TDS.

How is TDS deducted- Provisions for Deduction of TDS?

The TDS that is deducted from your income is in turn deposited by the deductor to the government against your PAN number. This process is followed in a way to let you view and verify with Form 26AS that the TDS has been deducted against your income.

However, there are instances when you or the deductor fails to deposit the TDS in time or depositing it against a wrong PAN number.

Consequences of Non Deduction of TDS in time

There are certain consequences set by the department on non-deposit of TDS by the taxpayer. The taxpayer will face any or all of the consequences if he/she was found out to have not deposited TDS.

- Dis-allowance of expenditure: As per Section 40(a) (ia) any sum that is payable to a resident which is subject to TDS will attract a disallowance of 30% if it is paid without TDS.

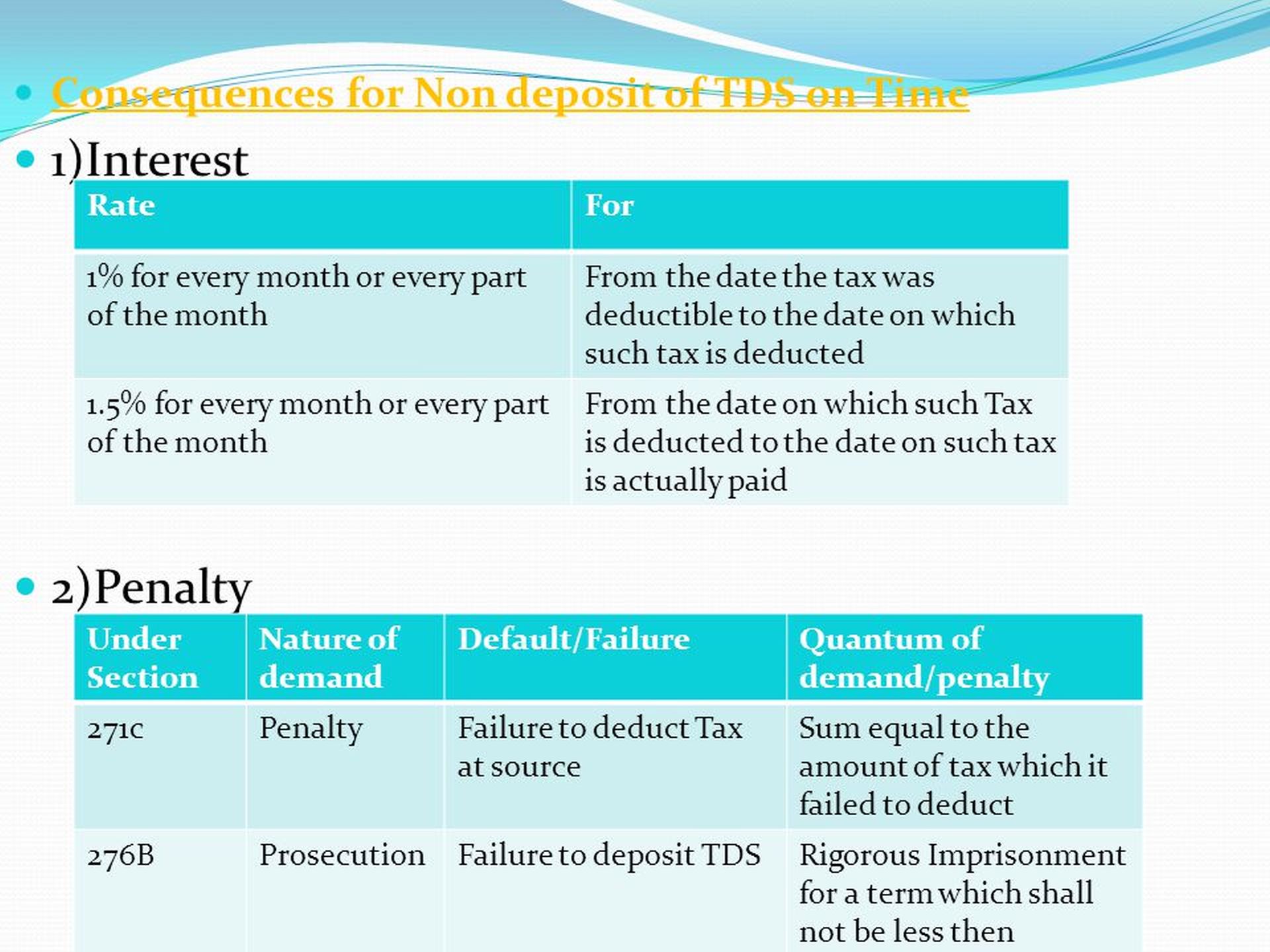

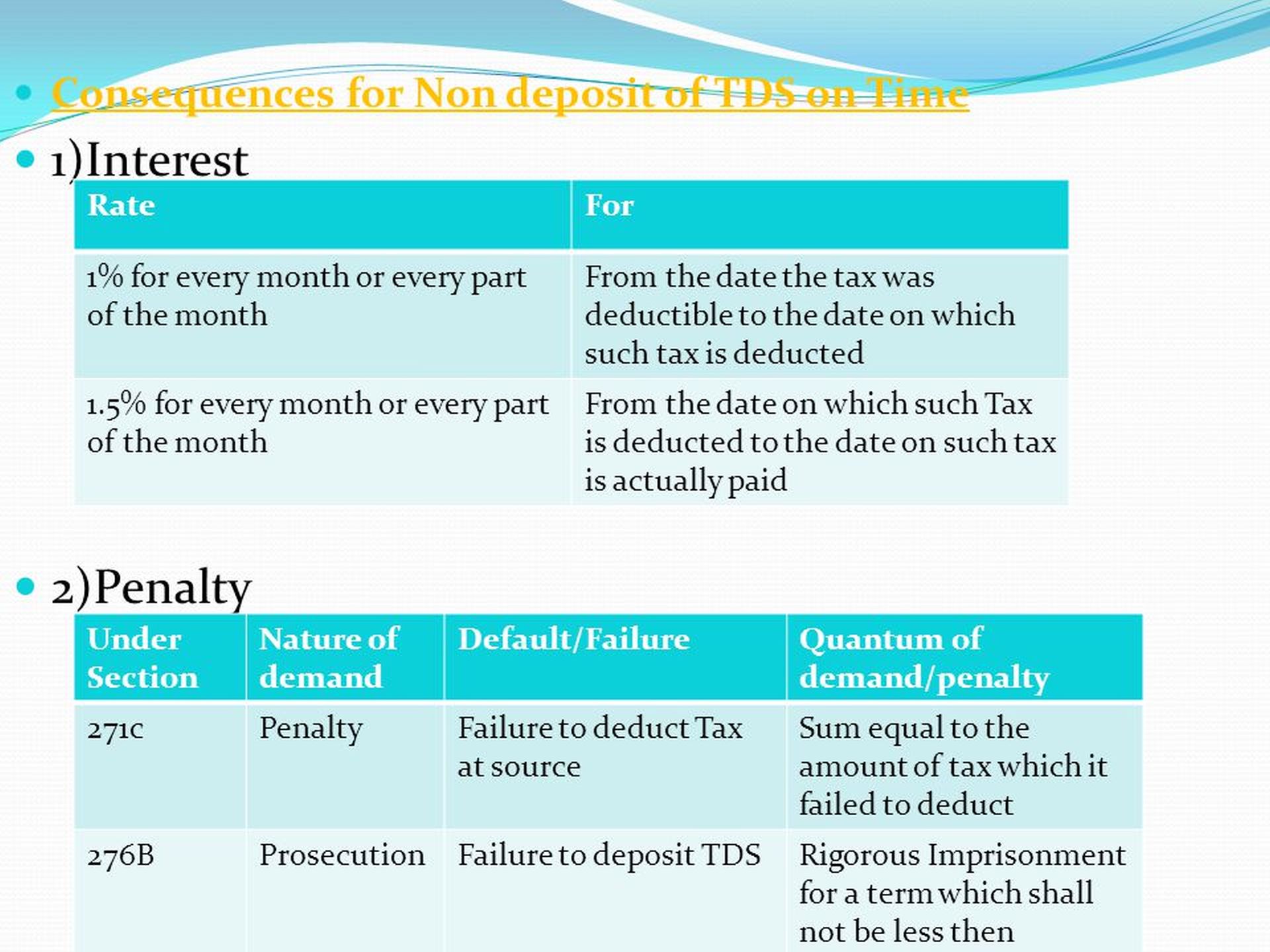

- Levy of interest: If the taxpayer fails to provide the timely deposition of TDS, he/she as per the Section 201 will be deemed as an assessee-in-default in respect to any such tax and is liable for penal action under Section 201(1A). An interest of 15 will be charged each month from the month it was supposed to be deposited to the month it was deposited. If the TDS was deducted but not deposited then an interest of 1.5% will be deducted every month from the month it was supposed to be deposited to the month it was deposited.

- Levy of penalty: Under Section 271C a penalty of an amount equal to the TDS not deposited can be levied on the taxpayer. However, the total amount of penalty cannot increase the amount of tax in arrears.

- Prosecution: Section 276B gives the power to prosecute any taxpayer who fails to deposit TDS with the rigorous punishment of 3 months to 7 years along with fine.

This is particularly worrying when the deductor fails to deposit the TDS and the taxpayer is completely unaware of it. The consequences of non-deposit the TDS by the deductor falls completely on the shoulders of the taxpayer. Moreover, the deductor shows that he/she has deposited the TDS but it may not be the case and the taxpayer doesn’t even know about it.

What to do- How to escape penalty for non deduction or non deposit of TDS in time?

The CBDT has released some new rules for the Assessing Officers to take into account when a case of non-deposit of TDS arises from the above-stated case. So, now if the TDS has been deducted, but not deposited then you must,

- Maintain all the proofs of your TDS deduction, such as pay slips, Form 16 and 16A.

- Write to the Assessing Officer, clarifying the whole situation in details.

- Raise a rectification request if you have received any kind of a demand from the department.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income