ITAT Held AO Cannot Examine Issues in Scrutiny Assessment Except for those Selected for Limited Scrutiny as per the CBDT Circular

Recently, the Income Tax Appellate Tribunal (ITAT) has asserted that the Assessing Officer (AO) cannot travel for any reason except for the selection of scrutiny for limited scrutiny, according to the Central Board of Direct Tax (CBDT) circular. It was held in the case of the assessee, Duckwoo Autoind Pvt. Ltd. After the said company filed the return of income, the AO conducted the scrutiny assessment via CASS as per the limited scrutiny assessment, which is issued by the notice under section 143(2) of the Act 1961.

However, the Principal Commissioner of Income Tax (PCIT) issued a notice under section 263 of the Act 1961 and found the incurred expenses of the assessee should not be permitted. PCIT also noted that the AO accepted these expenses without proper inquiry, marking the scrutiny assessment faulty as per the interest of the Revenue. PCIT dictated the AO to reframe the scrutiny assessment to which the AO presented an appeal before ITAT.

M. Abhishek, who counsels the assessee, states that the AO had assessed two issues and produced his scrutiny assessment accordingly. However, now PCIT is bringing forward a new issue where the depreciation, pre-operative expenses, expenses relatable to administrative processes, and employee benefits, which come to one crore rupees, need to be disallowed. In that case, Mr. S. Maruthu Pandian suggested that PCIT cannot ask for a reframing of the assessment for a limited scrutiny assessment. Considering both parties, the division bench of ITAT that includes Mahavir Singh (Vice President) and Manjunatha (Accountant Member) has accepted the appeal by the assessee and stated that the AO is not to examine other issues except for the selected ones in the limited scrutiny assessment.

Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter  Steps to Take After a Personal Injury: A Comprehensive Guide

Steps to Take After a Personal Injury: A Comprehensive Guide  Do I Need An Attorney Oklahoma Probate Process?

Do I Need An Attorney Oklahoma Probate Process?  Introducing and predicting the future of DOT

Introducing and predicting the future of DOT  Process to Correct the PAN Card Online

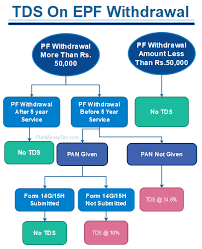

Process to Correct the PAN Card Online  No TDS on withdrawals of EPF till covid-19 persists

No TDS on withdrawals of EPF till covid-19 persists  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?