Investment Strategy in a Volatile Market

Volatile market

Volatility refers to the fluctuations in the performance of the market. Here the prices of the stocks rise or fall sharply within a very short period of time.

Volatility in the market

Volatility is impacted greatly not only by the changes in the national economic policy but also by the international economic policy. A national factor can be “delayed monsoon” whereas an international factor can be a war between two nations.

These fluctuations ignite fear in the minds of investor leaving them with the feeling of insecurity. This is the time when you as investor need to stay put and plans your moves to ensure a complete and secured utilization of your hard earned money.

Getting panic

Whenever there is a great deal of fluctuation, the first reaction coming from investors is “panic”. But those who do so end up losing more and more. So the best strategy is to have a control on the nerves. Waiting for right opportunity and then making a decision is the most advisable thing. One can always observe “crisis” in a volatile market as an “opportunity”.

Some of the Investment strategies have been mentioned below-

Plan your strategy

You must have a definite strategy for making investments. You must consider the time horizon for which you are going to make the investment. Look at your income, savings and expenditure and then decide upon the amount to invest. Your recurring expenditure should not be put on hold for investing in the market. There are some spurting expenditures too.

Set a goal

Deciding upon a target in terms of time and returns both is quite required. If you want to earn a certain amount of money over a given period of time then your investment should be proportional to the same. More investments would yield you better returns over a longer period of time. If you want to enjoy benefits in a short period then you may have to choose a little riskier stock which in all probability will give good returns in a short time period.

Diversification

Putting your money into different sectors is a good idea. All sectors might not perform the same at all times. So, Ensure that your investment is made in small caps, mid-caps and large caps so that the entire money is not drowned in one go in case of a sudden crisis in the market. However, investing in large caps is always recommended for long term benefits.

Evaluate

Before making any investment you must evaluate your own situations and the market mood as well. Judge the timing of making an investment. Wait for an opportune moment to put you money into the market. This will make you grow your money bigger and larger.

A smart investment strategy can save you from any kind of disaster and ensure multifold growth of your money. So a better analysis of the market having a good control on the nerves may turn out to be the key to combat a volatile market.

Become a Pro at Managing Your Finances with Separate Savings and Salary Account

Become a Pro at Managing Your Finances with Separate Savings and Salary Account  All About Intra-day Trading Startegies

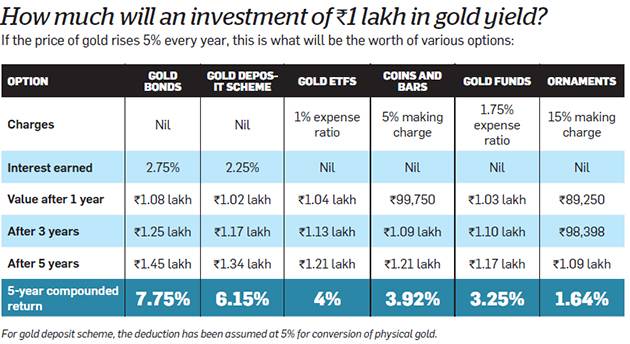

All About Intra-day Trading Startegies  Investing in Gold Bond- safer option than investing in Gold and yields better return

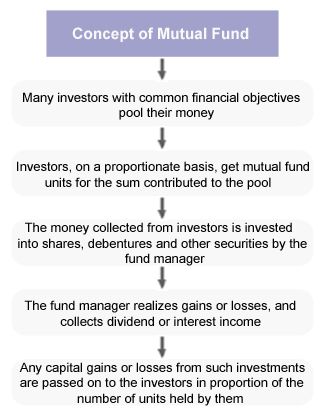

Investing in Gold Bond- safer option than investing in Gold and yields better return  All about Mutual Funds Investments

All about Mutual Funds Investments  Gain on Sale of Bogus Penny Shares is Subjected to be Held

Gain on Sale of Bogus Penny Shares is Subjected to be Held  If you think investing in mutual funds or SIP is simple, think again

If you think investing in mutual funds or SIP is simple, think again  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?