Indian Income Tax Calculators: Find out “What Will Indian Income Tax Department Take Away From You”

Every year in the last week of February, a new National budget is presented. The finance minister along with all the national expenses also informs Indians about how much income tax do they have to pay to the Indian Income Tax department in order to keep the nation’s treasury funded.

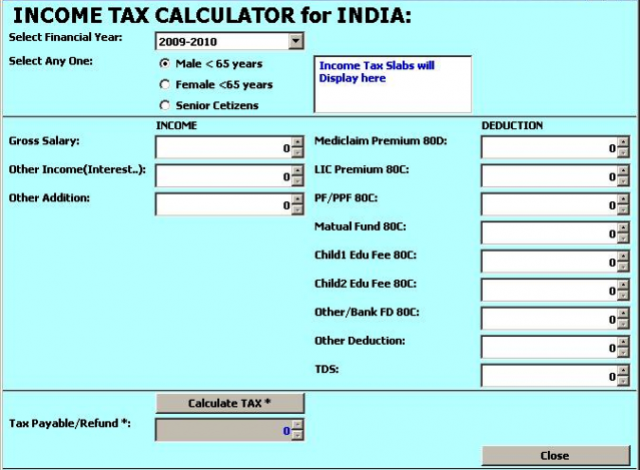

Calculating Indian Income tax is a complex process. To facilitate the Company laws of India we need services of a Charted Accountant at our premises. Here is an attempt to easy the process and provide the expert tax calculation to you online.

As the Indian government keeps making amendments and add-ons to the Indian Tax Laws, we have come up with various tax calculators to assist and guide you.

The benefits of using our online Tax Calculators are that

- When you use online tax calculators, you can ensure that you do not miss up on any aspect of income disclosure. Perfect filling is a big relief when you get income tax assessment notice. Since you file perfect income details you have nothing to worry about.

- You have input minimum efforts and you get perfect calculations.

- There is a step by step guide for each and every aspect of tax calculations along with tax savings.

- You save a lot of effort, save time and save money as well. Find out how much you can save even if you are a salaried employee or just a housewife/homemaker.

- Get to know about benefits for Senior citizens for Tax calculations and how you can benefit from it right away through online tax calculator.

- You can avail our special feature and get a Financial Advisors and Charterd Accountat services online itself.

- Get the knack of all Acts, rules and regulations and tax savings along with Investments for NRIs too.

We have step by step guide for Individuals, sole proprietor ship firms, Partnership firms, Private Limited companies, Public Limited companies, HUF, Domestic Companies and even for Cooperative Societies. Calculate Indian income tax in no time by simply following the steps and get rid of your tax issues immediately.

If you still need help, our professional Charted Accountant services for Indian Income Tax Calculations can be availed right from here at https://www.itrtoday.com itself.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income