What would be Consequences of not Replying to Queries by Income Tax Department India

What would be Consequences of not Replying to Queries by Income Tax Department India

Not replying to queries from the Income Tax Department in India can have various consequences, as the department has the authority to enforce compliance with tax laws. Here are some potential consequences:

Penalties and fines:

The Income Tax Department has the power to impose penalties and fines for non-compliance. If you fail to respond to queries or provide the required information, you may be liable to pay penalties, which can range from a certain percentage of the tax amount to a fixed amount for each day of non-compliance.

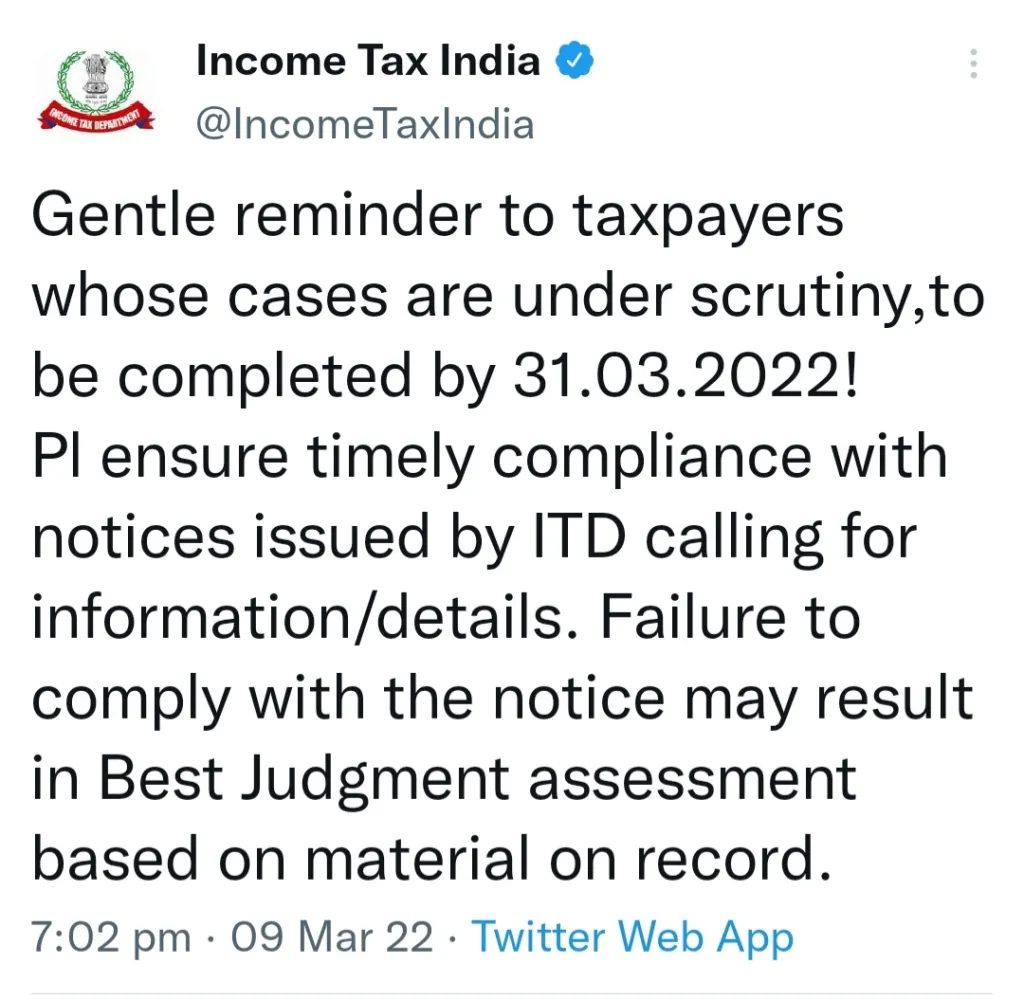

Assessment based on available information:

If you do not provide the requested information, the Income Tax Department can proceed with the assessment based on the available information. This means they can make an estimation of your income or profits, and determine the tax liability accordingly. This estimation may not be in your favor and could result in a higher tax assessment.

Tax evasion investigations:

Non-compliance or non-response to queries may trigger further investigations by the Income Tax Department to determine if there are any potential instances of tax evasion. This could lead to a more extensive scrutiny of your financial records, transactions, and assets, and if tax evasion is found, it may result in legal consequences, including criminal prosecution.

Loss of deductions and exemptions:

If you fail to respond to queries regarding certain deductions or exemptions claimed in your tax return, the Income Tax Department may disallow those claims, resulting in a higher tax liability. This could lead to additional tax payments and potential interest charges.

Legal proceedings:

Non-compliance with the queries and notices from the Income Tax Department may result in legal proceedings. The department can initiate legal actions against you, including prosecution under the Income Tax Act. This can lead to penalties, fines, and even imprisonment, depending on the severity of the non-compliance.

Reopening of assessments:

If you do not respond to queries, the Income Tax Department may reopen your tax assessments for previous years. The department has the power to reassess your income and tax liability for up to six years from the end of the relevant assessment year. This can result in a higher tax demand if the department finds discrepancies or unreported income during the reassessment.

Default assessment:

In case of non-compliance or non-response, the Income Tax Department can proceed with a default assessment. In this scenario, the department will estimate your income and tax liability based on available information, such as third-party data, previous tax returns, and other relevant sources. The assessed income and tax may not accurately reflect your actual financial situation, potentially leading to an inflated tax liability.

Attachment of assets:

If you fail to respond to queries or non-compliance persists, the Income Tax Department has the authority to take enforcement actions. They can initiate proceedings to attach your assets, such as bank accounts, properties, or other valuable possessions, to recover the outstanding tax dues. The attachment of assets can significantly disrupt your financial situation and may require legal intervention to resolve.

Blacklisting and adverse consequences:

Non-compliance with queries from the Income Tax Department may result in your name flagged by the department. This can have adverse consequences, including difficulties in obtaining loans or credit, restrictions on foreign travel, and potential damage to your reputation. This can also subject you to heightened scrutiny in subsequent tax assessments.

Compounding of offenses:

If non-compliance is found to be deliberate or willful, the Income Tax Department can initiate criminal proceedings against you. In such cases, you may be charged with offenses under the Income Tax Act, which can lead to penalties, fines, and even imprisonment. Compounding of offenses refers to the process of settling such cases by paying a compounding fee. However, this option may not be available for all types of offenses and depends on the discretion of the department.

It is important to understand that the consequences of non-compliance can vary depending on the specific circumstances and the actions taken by the Income Tax Department.

It is advisable to respond to queries from the Income Tax Department in a timely manner and provide the requested information to avoid potential complications and consequences.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income