If you think investing in mutual funds or SIP is simple, think again

Investing in Mutual funds

Ask any individual working in a decent organisation about his investment options. Very intuitively one gets choices like the stock market (restricted to the trading of stock certificates), systematic investment plan (SIP) or mutual funds and gold jewellery (strictly restricted to ornaments). But how much these investment instruments lead you to your financial goals is a million dollar question. And we haven’t yet spoken about govt. bonds, options, futures and many more instruments of which an average Indian individual is not even aware of existence.

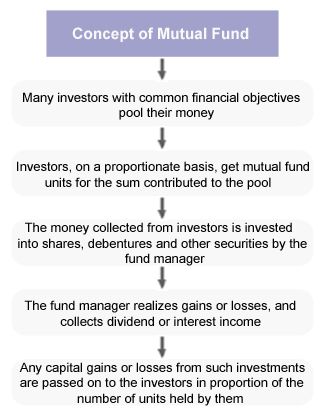

Understanding Mutual Funds

Most popular investment methods are Mutual Funds managed through systematic investment plans (SIP). Mutual Fund helps to achieve goals like buying flat, car or child’s education, marriage savings etc. Usually, mutual funds are managed by fund managers and professional financial advisors.

Thanks to google, it is easy to search for best performing Mutual Funds. But how simple it can be to invest? Well, it is easier said than done. Mutual fund ratings are dynamic and based on the performance of the fund over time. Hence, a fund which is highly rated today, may not necessarily maintain its rating a year later. While a highly rated fund is a better first step for shortlisting a scheme for investing, it does not guarantee better returns eternally. The success of mutual fund depends on upon (i) the ability of the manager to time market trends and to pick stocks that increase in value, (ii) his incentive for risk-taking, (iii) the explicit and implicit fund fees and cost, (vi) the trading performance of the funds, (vii) the governance structures of the fund, and finally, (vii) regulation.

One other issue with fund managers is mutual funds charge operating and management fees which pay for the fund’s management expenses (usually around 1.0 percent to 1.5 percent annually for aggressively managed funds). Additionally, some of the mutual funds charge redemption fees and exorbitant sales commissions. Few of the funds purchase and sell shares frequently which lead to higher transaction costs. Some of these overheads are charged on a constant basis, nothing like stock investments, where the commission is paid only when you buy and sell.

The Bottom Line

Looking at the historical returns for a fund which has consistently outperformed is also not a solution. To give an example, SBI IT Fund was once considered at outperforming mutual funds sometime back. Until recently i.e. mid- the year 2015 this mutual fund has given excellent returns but it in the past one year it has shown fluctuating results, where an average financially literate investor might confuse himself with the determination of choosing the fund in its portfolio. Same is the case with many mutual funds since there exists seasonality over the years where the funds might outperform or underperform.

Become a Pro at Managing Your Finances with Separate Savings and Salary Account

Become a Pro at Managing Your Finances with Separate Savings and Salary Account  All About Intra-day Trading Startegies

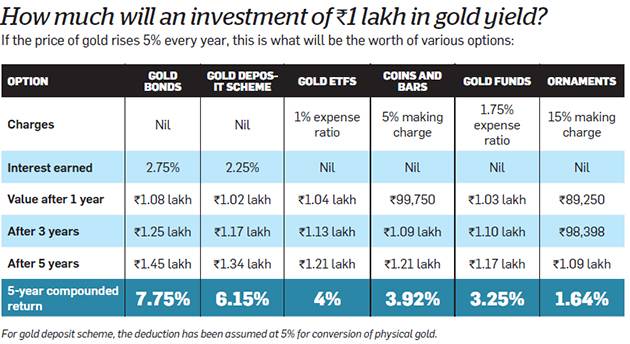

All About Intra-day Trading Startegies  Investing in Gold Bond- safer option than investing in Gold and yields better return

Investing in Gold Bond- safer option than investing in Gold and yields better return  All about Mutual Funds Investments

All about Mutual Funds Investments  Gain on Sale of Bogus Penny Shares is Subjected to be Held

Gain on Sale of Bogus Penny Shares is Subjected to be Held  Investment Strategy in a Volatile Market

Investment Strategy in a Volatile Market  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?