How to use E-Nivaran Facility of Income Tax?

Many people face many problems regarding e-filing, refund, and rectification issues, and wish to complain regarding the same to the IT department. But, thinking that the procedure is too complicated and tedious, most of them do not file any complaint about the same.

As a solution to this problem, the IT department has developed an “E-Nivaran” process on its E-filing doorway. This facility can be availed by anyone, whether or not they are registered.

What is E-Nivaran facility of Income Tax?

It is a paperless method of booking complaints, uploading essential and required documents, getting the grievance processed, and tracking the same redressal. The user can register a complaint against any of the following-

- Assessing Officers

- E-Filing Portal

- TRACES

- Centralized Processing Centre (CPC)

- Directorate of Income Tax

- NSDL

- UTI

- SBI-Refund Bankers

There are various categories and sub-categories for grievances on the portal. The user can choose the correct category and file the complaint along with the required personal information.

The complainant can also upload the documents supporting his complaint. If the complaint does not fall under any of the categories mentioned therein, the user can complain about in a particular text field, wherein all the details of the complaint can be mentioned.

The process to submit the grievance-

-

If the user is not registered at the e-filing portal:

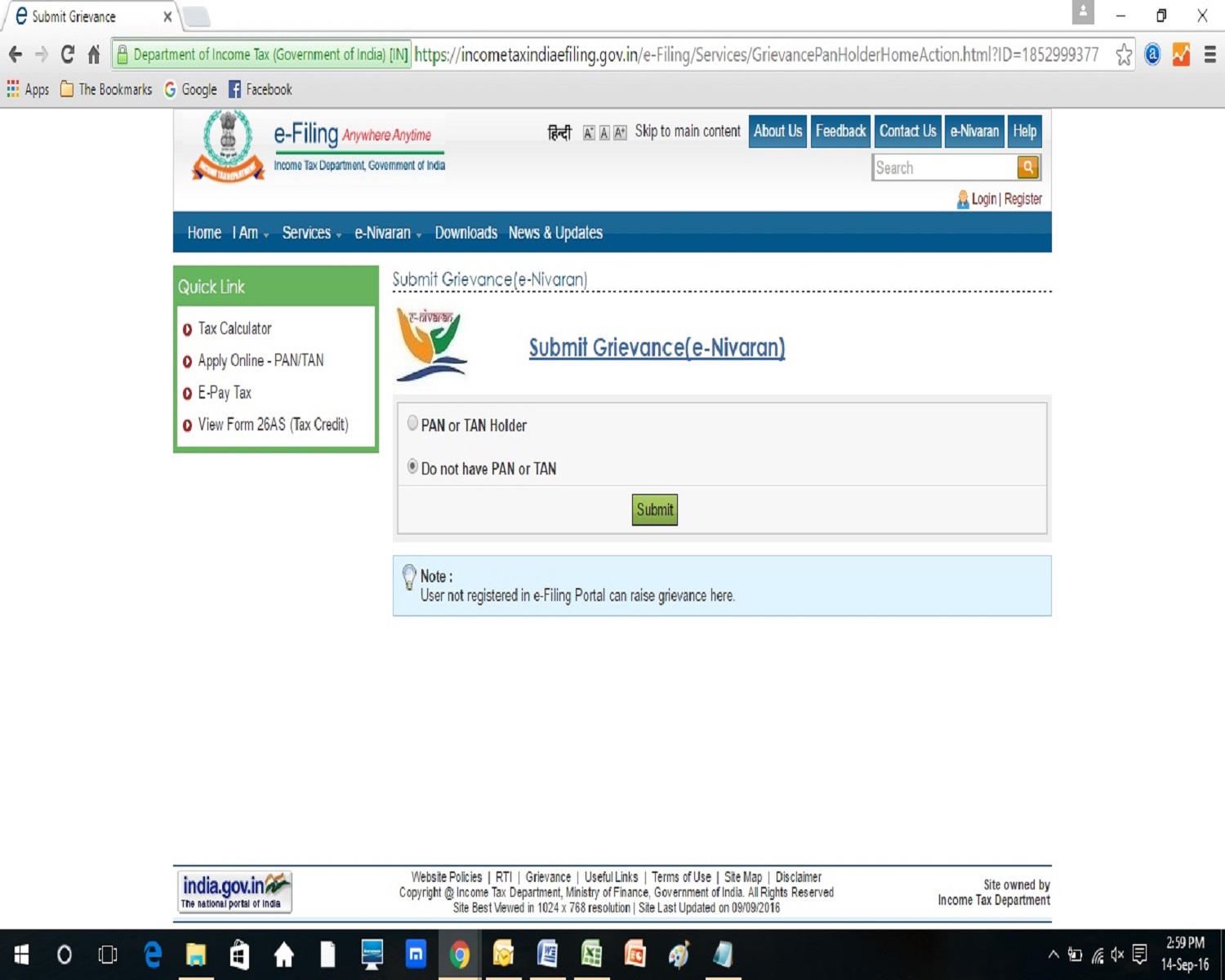

The user shall visit the e-filing portal- www.incometaxindiaefiling.gov.in and click the ‘e-Nirvana’ menu which is at the top right side of the page. After that, the user proceeds by clicking the ‘Submit Grievance’ option. After that, the user can click on ‘Do not have PAN or TAN’ and then click the submit button.

From there, the user can go to the ‘Grievance’ tab and complain. After registering the complaint, the user can Preview and also edit his grievance before submitting it.The user will receive a six-digit OTP pin on the email id and the mobile number submitted while raising the request. The user shall then click the ‘Validate’ button.

-

If the user is registered:

If the user is registered and has a PAN or TAN number, after clicking on the ‘Submit Grievance’ button, the user shall ‘Agree’ the Grievance Disclaimer.

The user is expected to read all the instructions very carefully and then fill in the ‘e-Nirvana’ form the ‘Grievance’ tab and then click the ‘Preview and Submit’ option to register the complaint.

A few examples of the options available under the e-Nirvana are as follows:

Complaints related to CPC:

- E-filing status shows ‘ITR-V’ received, but no acknowledgment from CPC.

- Received the ITR_V from CPC, but the status does not show up.

- The ITR-V is posted and signed for more than 15 days, but no ack is received from the CPC.

- Even though a correction is filed u/s 139(9), received a notice from CPC.

- Unable to upload the correction.

- No outstanding demand as per AO, but received a notice u/s 245 from the CPC.

- TDS/TCS credits appear but are not allowed.

- The difference in the computed income and entered income.

- Demand paid, but CPC sends demand again.

- The account shows a refund payable, but the amount is not received.

- A refund reissue request was raised, but no refund was made.

- The legal heir verified by the AO, but CPC made no refund.

- Refund Status shows that it is paid at TIN-NSDL, but no payment is received.

- Others.

Grievances related to the e-filing:

- Defective return.

- Query related to compliance

- Difficulty opening ITR-V, filing ITR returns, raising a request for rectification, revising the return, updating the profile, and downloading the XML and other receipts.

- Others.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income