How to handle outstanding Income Tax demand?

outstanding income tax demanad

Income tax demand could arise due to several simple reasons. For instance, at the time of filing return, you might have wrongly fed the information or the income tax department might not have reflected for the prior assessment years.

The government has introduced enhanced functionality in the Income Tax e-portal which is now user-friendly; they offer improved features that assist taxpayers in rectifying their mistakes.

Steps for responding to the tax demand

Step 1: Get your login and password ready and login into www.incometaxindiaefiling.gov.in along with your PAN number or date of birth.

Step 2: Hit on the ‘e-file’ button and then go to ‘Respond to Outstanding Tax Demand’. A dialogue box will appear showing the below details.

- Assessment Year

- Section Code

- Demand Notification Number

- Date on which demand is raised

- Outstanding Demand amount

- Uploaded by

- Rectification rights

- Response – Submit and View

Step 3: Now, hit on the ‘Submit’ for the respective assessment year. Select one of the choices as mentioned hereunder:

- Demand is correct

- Demand is partially correct

- Disagree with demand

- If you choose the option “Demand is Correct” then you have to oblige with the demand letter.

- If you choose the other options i.e “Demand is partially correct” or “Disagree with demand” you are required to provide necessary explanations along with evidence to support the same.

- The assessed needs to provide additional information for the option selected by him. These information includes:

- Demand paid: Date of payment, BSR code, Account, serial number.

- Demand already reduced by rectification/Revision/Appeal: You are required to upload the rectification order that has passed by the Assessing Officer and give information with respect to the date of order, the pending demand amount after rectification, etc.

- Rectification / Revised Return filed at CPC: In case you have filed the rectification for demand amount, you need to provide acknowledgement number of rectification application which you have filed online. Whereas if you have filed a revised return, you are required to present the acknowledgement number of the e-filed revised return.

- Rectification filed with AO: In case you have filed rectification manually to the A.O, you are required to provide the date of filing application.

- On successful submission of the response, a unique transaction id would be issued which can be used for future reference.

- Other points to note

- If demand is seen to be uploaded by the A.O then the right of rectification rests with the Assessing Officer and would be required to contact the jurisdictional A.O for the rectification.

- For the tax demand where there is “No Submit response option” available, such demand is confirmed already by the A.O. You are required to get in touch with your Jurisdictional A.O for rectification if required.

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

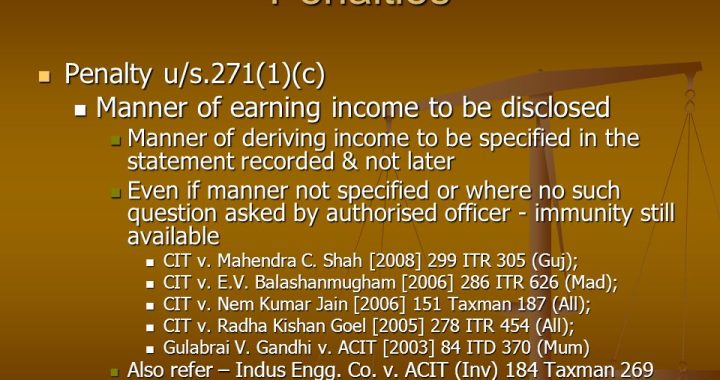

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?