How Budget 2020 Made the Dividend Option of Mutual Funds Tax Inefficient?

Dividend Distribution Tax on dividends declared by mutual funds has been abolished in Budget 2020.

Dividend Distribution Tax on dividends declared by mutual funds has been abolished in Budget 2020. Alternatively, it made dividends at their slab rate taxable in investors ‘ pockets.

Investment decisions should be made from a wealth-building perspective. There is an option for reinvesting dividends, but it is tax-inefficient as people tend to spend their earnings of dividends, instead of reinvesting them.

For example, someone in the slab rate of 30 per cent would pay a tax at that rate while someone in the slab of 20 per cent would pay tax on dividends from the mutual fund (equity and debt). It will begin from the 2020–21 fiscal year.

Dividend Distribution Tax or DDT

The dividend taxation is a radically different situation from what happens right now. In the present system, equity fund dividends are facing 11.65 per cent DDT, and debt fund dividends are facing 29.12 per cent DDT (which includes cess and surcharge).

The profit shall be tax-free in the investor’s pockets until DDT is deducted. Therefore, the new tax law increases the tax burden on investors in higher tax brackets while raising it to low-tax brackets for individuals.

Dividend Policy

The dividend policy defines a dividend payment that directly passes the dividend to shareholders. It consists of reinvestment of dividends in which the dividend declared is reinvested in the scheme of the mutual fund.

The Morningstar data points out that approximately 3 lakh crores out of the total Asset Under Management(AUM) of open-ended mutual funds of some 23.29 lakh crores are invested in the dividend option which is nearly 12 per cent of the total AUM.

For mutual funds, the percentage is much higher for open-ended hybrid funds at a whopping 35 per cent of the total number. This is because hybrid funds were actively sold via dividends following Demonetization on the grounds of ‘ daily revenue.

Profits from the mutual funds depend on the fund’s output in question. These can be paid out only from the mutual fund’s realized earnings. Therefore they can not be relied on in any way for a steady income.

When stocks got sluggish in 2019, investors became disillusioned with the hybrid funds being offered on that basis.

Role of Tax Brackets for an Investor

The investor group has seen unremitting outflows.”Anyone with a tax bracket above 10 per cent who can wait for at least one year should not invest in the equity funds dividend plans. Even those who can’t wait one year should stop dividend plans if they fall over 15 per cent in a tax bracket, “says IIFL Wealth’s Gaurav Awasthi.

In India, the long-term capital gains tax (LTCG) that applies to fund gains kept for more than one year is 10 per cent (above a tax-free capital gains allowance of some 1 lakh per year).

Short-term capital gains tax (STCG) in India is 15 per cent in funds held for shorter periods. However, investors in higher tax brackets are better off taking their returns as capital gains rather than slab-taxed dividends.

Role of Tax Brackets in Debt Funds

Gaurav Awasthi of IIFL claims, “To debt funds, the same claim applies to people who can wait three years and who are above 20 per cent in a tax bracket.”

Debt mutual funds face a 20 per cent (after indexing) long-term capital gains tax if kept for more than three years.

Budget 2020 also introduced a 10 per cent Target Deducted Tax (TDS) on dividends from the mutual fund. Experts have pointed out that this option creates a cost of compliance for investors.

“The TDS provision will also bring reconciliation and additional compliance for investors,” says Suresh Sadagopan, founder of Ladder 7.

How to Make the Right Investment Decisions?

Investment decisions should be made from a wealth-building perspective. There is an option for reinvesting dividends, but it is tax-inefficient as people tend to spend their earnings, instead of reinvesting them.

The dividend reinvestment option exists, but as dividends are now entirely taxable, it is hugely taxed and is inefficient compared with the development choice. Investors may receive a regular amount by Systematic Withdrawal Plans (SWPs) from mutual funds, and they do not need dividends.

When you consider the tax perspective, investors should avoid the dividend option of mutual funds for the above reasons in all but the lowest tax brackets (zero tax or 5 per cent).

Even those in lower brackets may see their income increase over time and be forced into higher tax brackets as a result. Those who are already in the mutual funds’ dividend option need to check with their financial advisers.

The benefits of lower capital gains taxes in the growth plan must be balanced with the cost of redeeming their current dividend-option mutual fund investments. These may include exit load and capital gains tax because a dividend-to-growth transition is considered a taxable redemption.

HUF- a tax planning tool to save Income tax

HUF- a tax planning tool to save Income tax  Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives

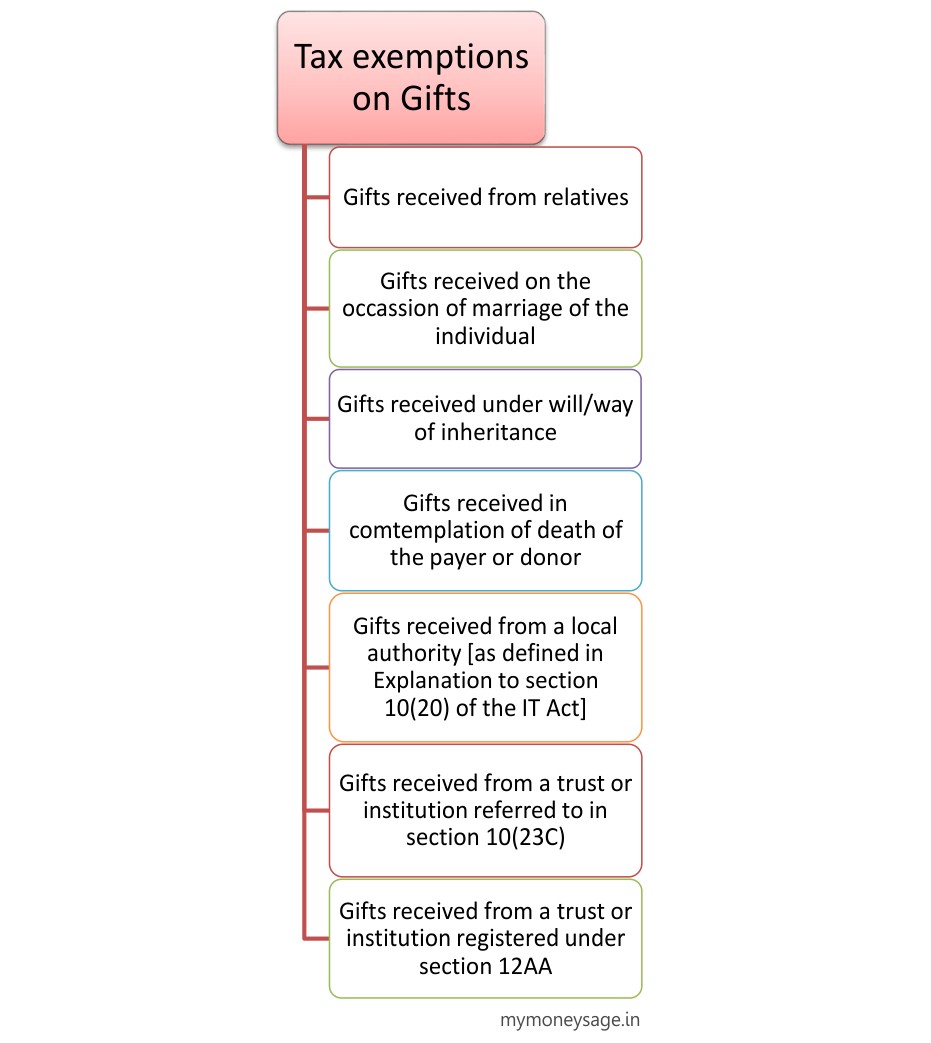

Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives  Do I owe a tax for the gift I receive? Get to Know the Rules of Taxability of Gift in India

Do I owe a tax for the gift I receive? Get to Know the Rules of Taxability of Gift in India  Restructuring your Salary in Tax Efficient Manner can increase your carry home Salary by upto 10%

Restructuring your Salary in Tax Efficient Manner can increase your carry home Salary by upto 10%  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?