Facts under which the Penalty may be void under Income Tax Act section 274

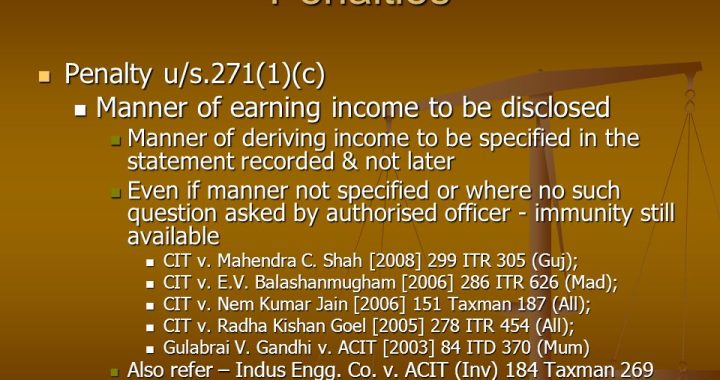

Section 271 (1)(c) is a penalty notice under section 274 in which the irrelevant portion is not stroke out and which does not also specify whether this penalty is for “the concealment” or for “the furnishing in-accurate particulars”.

On the question whether the proper satisfaction has been arrived at by the Assessing Officer for starting proceedings under section 271(1)(c), the assessment order nowhere indicates or spells out that the Assessing Officer was having the view that surely the assessee was guilty in cases of concealing the particulars of his income or furnishing in-accurate particulars of his income.

If the contentions of the assessee are accepted by the Assessing Officer and the offer of undeclared income in the income tax return without indicating (directly or indirectly) that particulars of income has been concealed the by the assessee or he has furnished inaccurate particulars of income, it is very hard to say that satisfaction for initiating the proceedings is discernible as per the order of the assessment.

In the case, the assessee having good faith offers income tax before any true detection by the Assessing Officer, such voluntary offer will be taken as the advantage of by the Assessing Officer to start the proceedings of penalty against the assessee and without specifying any reasons why the proceedings of penalty are initiated under section 271 (1)c of the IT Act. According to the section 271 (1)c of the income tax Act, the satisfaction for initiation of proceedings of penalty is not really discernible from the assessment order.

The mere facts that the assessee had to be agreed to pay income tax and did not really challenge the order of assessment does not mean that assessee conduct is mala fide. Following are the principles that can be applied:

- Penalty u/s 271(l)(c) of IT Act is a civil liability.

- Mens rea is really not a necessary element in order to impose penalty for breach of the civil liabilities or obligations.

- Wilful concealment cannot be considered as a necessary ingredient for good civil liability.

- Only in case when no explanations are offered or the explanations are offered is found to be incorrect or when the assessee has failed to prove that these explanations offered are not bonafide, then in this case an order to impose penalty could be passed.

- The imposition of such penalty u/s 271(l)(c) is not automatic.

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure