Do I Need An Attorney Oklahoma Probate Process?

What Can An Experienced Tulsa Probate Attorney Do For You?

The word probate is used for court-supervised administration. This is for the descendant’s estate. The role of the court is to supervise the process of probate, and a personal representative Is appointed for the inventory of the property of the descendant, resolving files against the estate, determination of potential heirs, distribution of the property according to the will, or maybe by court’s order. This also includes finishing all the duties assigned by the court inside the administration of the descendant’s estate.

How Can An Tulsa Probate Attorney Who is Highly Experienced Help You?

For any family members or personal representatives of the descendants, having a highly experienced Tulsa Probate Attorney can make it significantly easier and far less stressful process of probate in Oklahoma. Some of the probate attorney aspects are tough for a personal representative to deal with, like taking objections regarding the claims of the creditors that are incorrect or not founded or transferring a title to the real estate, and many more.

Also, there may be objections or controversies in some estates on the subject of probate litigation if more heirs are contesting or taking up objection on how the estate is being managed by the personal representative objecting to the validity of the will. In every difficult situation, you may have to clear the mess in less time and increase your chances of winning and reduce a massive burden from your head. You will need a robust and specifically and highly experienced Tulsa probate attorney.

Oklahoma Probate Process: A Brief Overview

In Oklahoma, the probate process’s primary purpose is to pay the descendant’s debts and help in the distribution of assets with the testament and last will to the right person. In case the descendant dies without writing his/her will, then the intestate laws of Oklahoma take over the probate process. In such cases, the property and the debt are handled with the procedures set up in the statutes. For every case, a personal representative is appointed. This personal representative is charged with reviewing claims filed with the estate, identifying potential heirs, and making an inventory of the estate’s property.

In case a descendant has died with debts, creditors are allowed to file claims with the probate as to know why the debt is owed and how much Is the amount of the debt owed. These debts may or may not be approved by the personal representative. In case the debts are approved by the personal representative from the assets in the estate, provided enough assets are available to cover the debt. In case the debt is not approved by the personal representative, the creditor has the right to lift the objection and take the matter to court, which will decide and resolve the objection.

After the payment of any pending estate taxes or debts have been completed, the personal representative is responsible for distributing the assets available to the heirs depending upon the will or in case of absence of the will through Oklahoma intestate laws. Later, a final accounting is presented to the probate court for final approval. This will show all the assets that entered the estate and how every estate was distributed or paid to the creditors, heirs, and all the administrative expenses.

The complete probate process can take up around six to twelve months in general. On the other hand, some complex cases may take a few years. Although using any highly experienced probate attorney can work as a catalyst and high speed up the process, avoid you going through a ton of the paperwork, and make it a lot less stressful for you, especially when your case involves conflicts and other complexities.

To Sum Up

To conclude, in case of a descendant’s death, the value of the properties and estate must go to the rightful people. To assure this, a personal representative takes care of the complete system and works on it. Some cases are simple that can be completed in a mere time of six to twelve months, while in case of conflicts between heirs, involvement of debts, or unpaid taxes, having no wills may take up more time. If you want to avoid a lot of stressful paperwork and want the work to be done faster, all you need is a highly experienced attorney, that will help you through it in no time.

Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter  Steps to Take After a Personal Injury: A Comprehensive Guide

Steps to Take After a Personal Injury: A Comprehensive Guide  ITAT Held AO Cannot Examine Issues in Scrutiny Assessment Except for those Selected for Limited Scrutiny as per the CBDT Circular

ITAT Held AO Cannot Examine Issues in Scrutiny Assessment Except for those Selected for Limited Scrutiny as per the CBDT Circular  Introducing and predicting the future of DOT

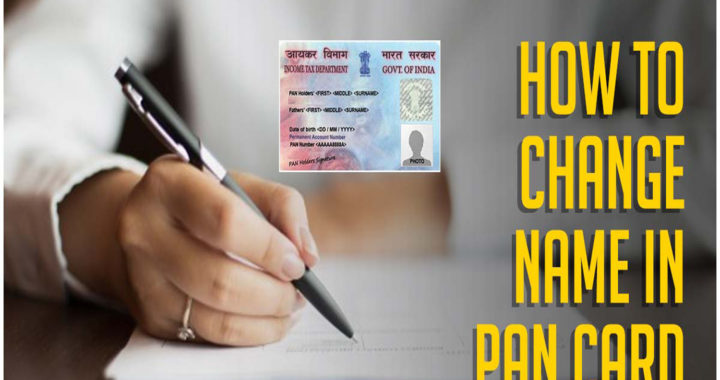

Introducing and predicting the future of DOT  Process to Correct the PAN Card Online

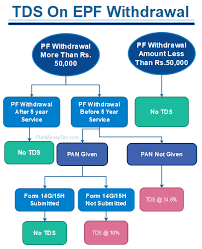

Process to Correct the PAN Card Online  No TDS on withdrawals of EPF till covid-19 persists

No TDS on withdrawals of EPF till covid-19 persists  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?