Change in the Rates of TDS for FY 2017-18 and the applicable areas

Rates of TDS as applicable for FY 2017-18

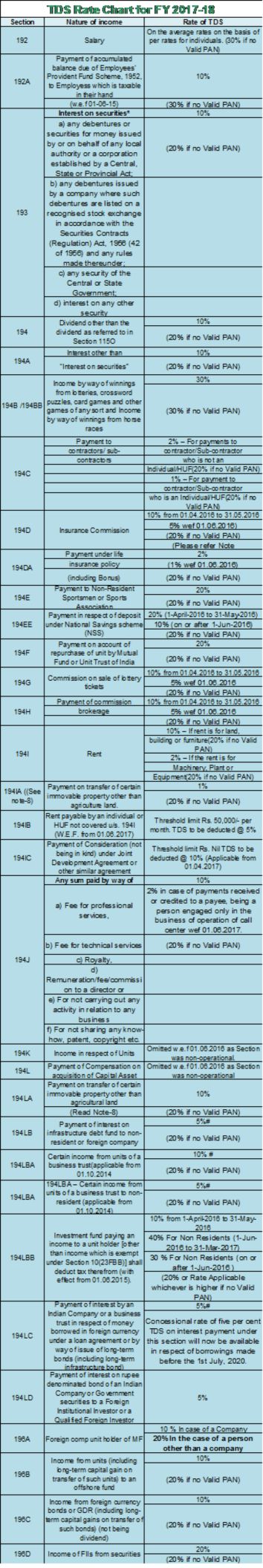

TDS means Tax Deducted at Source and this is one of the modes by which taxes are collected. This chart features the tax deduction rates for the Assessment Year 2018-19 relevant to financial year 2017-18. This budget has amended certain rates of TDS on various items, Please see chart below for Rates of TDS for FY 2017-18

TDS or Tax Deducted at Source is a process of collecting income tax at the source by the Government of India. Any employer has the liability to deduct tax at source while making the annual payment to an employee. The employers deduct this tax only at the time of paying salary and the employees are bound to go through this to avoid severe penalty by Income Tax Department. TDS deduction rate on salary ranges from 10% to 30% and applicable to employees working under the age of 60.

Rates of TDS for FY 2017-18

Please see Chart below for rates of TDS for FY 2017-18

| TDS Rate Chart for FY 2017-18 | ||

| Section | Nature of income | Rate of TDS |

| 192 | Salary | On the average rates on the basis of per rates for individuals. (30% if no Valid PAN) |

| 192A | Payment of accumulated balance due of Employees’ Provident Fund Scheme, 1952, to Employess which is taxable in their hand | 10% |

| (w.e.f 01-06-15) | (30% if no Valid PAN) | |

| 193 | Interest on securities* | 10% |

| a) any debentures or securities for money issued by or on behalf of any local authority or a corporation established by a Central, State or Provincial Act; | (20% if no Valid PAN) | |

| b) any debentures issued by a company where such debentures are listed on a recognised stock exchange in accordance with the Securities Contracts (Regulation) Act, 1956 (42 of 1956) and any rules made thereunder; | ||

| c) any security of the Central or State Government; | ||

| d) interest on any other security | ||

| 194 | Dividend other than the dividend as referred to in Section 115O | 10% |

| (20% if no Valid PAN) | ||

| 194A | Interest other than | 10% |

| “Interest on securities” | (20% if no Valid PAN) | |

| 194B /194BB | Income by way of winnings from lotteries, crossword puzzles, card games and other games of any sort and Income by way of winnings from horse races | 30% |

| (30% if no Valid PAN) | ||

| 194C | Payment to | 2% – For payments to |

| contractors/ sub- | contractor/Sub-contractor | |

| contractors | who is not an | |

| Individual/HUF(20% if no Valid PAN) | ||

| 1% – For payment to | ||

| contractor/Sub-contractor | ||

| who is an Individual/HUF(20% if no Valid PAN) | ||

| 194D | Insurance Commission | 10% from 01.04.2016 to 31.05.2016 |

| 5% wef 01.06.2016) | ||

| (20% if no Valid PAN) | ||

| (Please refer Note | ||

| 194DA | Payment under life | 2% |

| insurance policy | (1% wef 01.06.2016) | |

| (including Bonus) | (20% if no Valid PAN) | |

| 194E | Payment to Non-Resident Sportsmen or Sports Association | 20% |

| (20% if no Valid PAN) | ||

| 194EE | Payment in respect of deposit under National Savings scheme (NSS) | 20% (1-April-2016 to 31-May-2016) |

| 10% (on or after 1-Jun-2016) | ||

| (20% if no Valid PAN) | ||

| 194F | Payment on account of repurchase of unit by Mutual Fund or Unit Trust of India | 20% |

| (20% if no Valid PAN) | ||

| 194G | Commission on sale of lottery tickets | 10% from 01.04.2016 to 31.05.2016 |

| 5% wef 01.06.2016 | ||

| (20% if no Valid PAN) | ||

| 194H | Payment of commission | 10% from 01.04.2016 to 31.05.2016 |

| brokerage | 5% wef 01.06.2016 | |

| (20% if no Valid PAN) | ||

| 194I | Rent | 10% – If rent is for land, |

| building or furniture(20% if no Valid PAN) | ||

| 2% – If the rent is for | ||

| Machinery, Plant or | ||

| Equipment(20% if no Valid PAN) | ||

| 194IA ((See note-8) | Payment on transfer of certain immovable property other than agriculture land. | 1% |

| (20% if no Valid PAN) | ||

| 194IB | Rent payable by an individual or HUF not covered u/s. 194I (W.E.F. from 01.06.2017) | Threshold limit Rs. 50,000/- per month. TDS to be deducted @ 5% |

| 194IC | Payment of Consideration (not being in kind) under Joint Development Agreement or other similar agreement | Threshold limit Rs. Nil TDS to be deducted @ 10% (Applicable from 01.04.2017) |

| 194J | Any sum paid by way of | 10% |

| a) Fee for professional services, | 2% in case of payments received or credited to a payee, being a person engaged only in the business of operation of call center wef 01.06.2017. | |

| b) Fee for technical services | (20% if no Valid PAN) | |

| c) Royalty, | ||

| d) Remuneration/fee/commission to a director or | ||

| e) For not carrying out any activity in relation to any business | ||

| f) For not sharing any know-how, patent, copyright etc. | ||

| 194K | Income in respect of Units | Omitted w.e.f 01.06.2016 as Section was non-operational. |

| 194L | Payment of Compensation on acquisition of Capital Asset | Omitted w.e.f 01.06.2016 as Section was non-operational |

| 194LA | Payment on transfer of certain immovable property other than agricultural land | 10% |

| (Read Note-8) | (20% if no Valid PAN) | |

| 194LB | Payment of interest on infrastructure debt fund to non-resident or foreign company | 5%# |

| (20% if no Valid PAN) | ||

| 194LBA | Certain income from units of a business trust(applicable from 01.10.2014 | 10% # |

| (20% if no Valid PAN) | ||

| 194LBA | 194LBA – Certain income from units of a business trust to non-resident (applicable from 01.10.2014) | 5%# |

| (20% if no Valid PAN) | ||

| 194LBB | Investment fund paying an income to a unit holder [other than income which is exempt under Section 10(23FBB)] shall deduct tax therefrom (with effect from 01.06.2015). | 10% from 1-April-2016 to 31-May-2016 |

| 40% For Non Residents (1-Jun-2016 to 31-Mar-2017) | ||

| 30 % For Non Residents (on or after 1-Jun-2016 ) | ||

| (20% or Rate Applicable whichever is higher if no Valid PAN) | ||

| 194LC | Payment of interest by an Indian Company or a business trust in respect of money borrowed in foreign currency under a loan agreement or by way of issue of long-term bonds (including long-term infrastructure bond) | 5%# |

| Concessional rate of five per cent TDS on interest payment under this section will now be available in respect of borrowings made before the 1st July, 2020. | ||

| 194LD | Payment of interest on rupee denominated bond of an Indian Company or Government securities to a Foreign Institutional Investor or a Qualified Foreign Investor | 5% |

| 196A | Foreign comp unit holder of MF | 10 % In case of a Company |

| 20% In the case of a person other than a company | ||

| 196B | Income from units (including long-term capital gain on transfer of such units) to an offshore fund | 10% |

| (20% if no Valid PAN) | ||

| 196C | Income from foreign currency bonds or GDR (including long-term capital gains on transfer of such bonds) (not being dividend) | 10% |

| (20% if no Valid PAN) | ||

| 196D | Income of FIIs from securities | 20% |

| (20% if no Valid PAN) | ||

Important facts to remember about TDS applicable Fy 17-18

If you want to get rid of penalty, TDS is the utmost important aspect of your earnings. TDS is calculated on the basis of a threshold limit and it will be deducted from your future income or payments after the maximum level of income are analyzed.

TDS is actually deducted as per the rule and regulation of Indian Income Tax Act, 1961. TDS is controlled by the Central Board for Direct Taxes and this is an indispensable part of the Indian Revenue Service Department.

Beside the interest income earned on bank deposits, TDS is levied also on various other incomes and expenditures. To avoid penalty from salary income, rent payment or even lotteries, going through the TDS deduction process is always safer.

The list of payments on which TDS deduction is applicable

Employment Provident Fund – TDS is levied on the premature withdrawal of the PF. But there has been a proposal made to increase the threshold limit from Rs 30,000 to Rs 50,000 for the purpose of TDS deduction.

Horse Race Winning Money – Here TDS will be deducted on Rs 10,000 of earning which previously was Rs 5,000.

Payment of Insurance Commission – The threshold limit for TDS deduction has been decreased from Rs 20,000 to Rs 15,000.

Brokerage – In this case, threshold limit will be Rs 15,000.

Payments to contractors – A proposal has been made to increase the TDS threshold limit from Rs 75,000 to Rs 1 Lakh.

Payment of NSS deposits – The existing TDS rate is 20% but it has been proposed to decrease it to 10%.

Commission on lottery tickets sale – The TDS rate has been decreased from the existing 10% to 5%.

Payment in respect of life insurance policy – In this case, the TDS rate has been decreased from 2% to 1%.

Certain Misconceptions about deduction of TDS

As it is very necessary to go through the TDS process, at the same time people undergo certain misconceptions regarding TDS deduction. The biggest misconception exists amongst the honest tax payers. They think that since they receive their salary or any other payment after the deduction of Tax at Source, hence they are not required to file their income tax return as they assume that their tax liability has been discharged.

Some other misconceptions state that if there is no TDS as such, and then the investments are free. This is actually a major misconception. This is also a wrong notion that if an employer has deducted TDS, you are free from filing income tax return.

Hence, it is very important to clarify all the misconception regarding TDS and accomplishing this process makes you an honest tax payer which is mandatory as per government rules and regulations. Abiding by them makes you a responsible citizen.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income