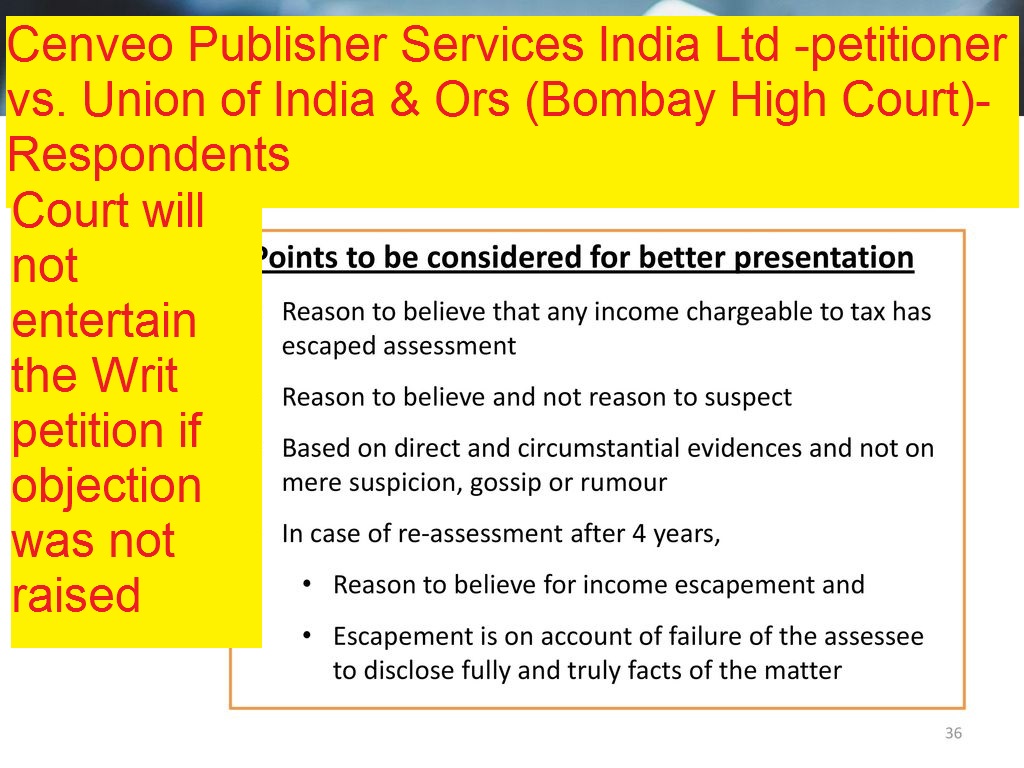

Cenveo Publisher Services India Ltd -petitioner vs. Union of India and Ors (Bombay High Court)-Respondents

Sec 147: Reopening of assessment: Delay in filing objections by the assessee to the reasons given by AO and leaves him with little time to dispose of the objections and pass the assessment order before it gets time-barred, destroys the formula which says the AO should not pass the assessment order for 4 weeks (Asian Paints 296 ITR 90 (Bom). A writ petition to challenge such reopening will not be entertained. Let’s discuss the Case of Cenveo Publisher Services India Ltd -petitioner vs. Union of India & Ors (Bombay High Court).

Cenveo Publisher Services India Ltd -petitioner vs. Union of India & Ors (Bombay High Court)-

1) In the given case the bench of B.P.COLABAWALLA, J and AKIL KURESHI, J. refused to entertain the case as the petitioner has not followed the procedure set out by the Supreme Court in GKN Driveshafts (India)Ltd. (supra) Case. The petitioner created a situation wherein the Assessing Officer is left with a short time to dispose of the objections and complete the assessment. This element was not mentioned in the judgment cited by the counsel for the petitioner.

2) Background of the case: Here the petitioner is a registered company under the Companies Act. The Petitioner had filed the return of income declaring the total income of Rs.1.65 crores (rounded off) for the Assessment Year 2011-12. Subsequently, the Petitioner after revising the return declares the revised income of Rs.2.64 Crores (rounded off). The return of the petitioner was taken in scrutiny by the Assessing Officer. He passed the order under Section 143(3) of the Income Tax Act, 1961 (“theAct” for short) on 3.3.2015 accepting the Petitioner’s revised income.

3) The AO issued the impugned notice to reopen such assessment citing the reasons for issuing such notice. In response, the Petitioner filed the return in April 2018 stating that the revised return may be treated as the return. The Petitioner also asked from AO to give reasons for reopening such assessment in the communication. On 14.09.2018 the reasons were given to the petitioner by AO.

4) The Petitioner filed a Writ Petition No. 3534 of 2018 challenging the notice of reopening the assessment. At the request of the petitioner, it was taken up for hearing by the court on 13.12.2018. The court noticed that the petitioner had approached the court without raising objections before the AO. This was apparently in breach of the mechanism devised by the Supreme Court in the case of GKN Driveshafts (India) Ltd. Vs. Income Tax Officer reported in 259 ITR 19 (SC).

5) Thereupon on 14.12.2018, the Petitioner raised the objections before the AO. The Assessing Officer answered such objections on 28.12.2018. Since the last date for framing the assessment was fast approaching, and the assessment would get time-barred on 31st December 2018, the Assessing Officer passed the order of assessment on 28.12.2018.

6) In such circumstances, the Petitioner has once again approached the Court challenging very notice of reopening of the assessment and also including the challenge to the order of reassessment as consequential to the main challenge to reopening of the assessment.

7) The LC for the petitioner contended that the notice for reopening of the assessment is based on the reasons which are not sustainable. He added that the impugned notice had been issued beyond the period of 4 years from the end of the Assessment Year without there being any failure from the assessee to disclose all the material facts. Such being the facts the Petitioner should not be relegated to the alternative remedy. He further added that the AO took a considerably long time in citing the reasons for reopening the assessment. It is, therefore, that the Petitioner could not challenge the notice earlier. The Petitioner should not be punished for the delay on the part of the Assessing Officer in supplying the reasons.

8) Going through the facts in the present case the court is not inclined to entertain this petition and would relegate the petition to the statutory remedy. This is because of the following reasons.

- Filing writ petition in the court without raising any objections before AO is a clear breach of the procedure laid down by Supreme Court in the case of GKN Driveshafts (supra). Allowing the assessee to do so without any explanation at all would dismantle such mechanism.

- Raising objections promptly after withdrawing the petition would not in any manner dilute the fact that it was on the ground of the petitioner’s conduct that the Assessing Officer was left with little time to dispose of his objections and after that complete the assessment before it becomes time-barred.

- Writ petition should not be entertained when an alternative statutory remedy is available. (Commissioner of Income Tax Vs. Chhabil Dass Agarwal reported in 357 ITR 357)

9) In the given circumstances, this petition is not entertained, leaving it open to the petitioner to challenge the assessment order before the Appellate Authority. All contentions of the Petitioner are kept open.