CBDT extends the time for filling tax audit report

The Central Board of Direct Taxes has extended the deadline for filing tax audit report as per section 44AB of the Income Tax Act,1961, from 30th September,2014 to 30th November,11.2014 vide notification passed on 20th August, 2014.

The Central Board of Direct Taxes has extended the deadline for filing tax audit report as per section 44AB of the Income Tax Act,1961, from 30th September,2014 to 30th November,11.2014 vide notification passed on 20th August, 2014.

The Central Board of Direct Taxes, New Delhi, while exercising its power conferred by section 119 of the Income Tax Act has extended the due date for furnishing the report of audit as per section 44AB of the Income Tax Act for the Assessment Year 2014-15 for assessees who are not required to file report under section 92E of the Income Tax Act from 30.9. 2014 to 30.11. 2014.

It has been further stated that the tax audit report filed as per section 44AB of the Act within 1.4.2014 to 24.7. 2014 in the pre-revised forms shall be considered as valid tax audit report filed under section 44AB of the Act.

Accounting professionals seeking clarity on the deadline:

Some accounting professionals of India have asked for clarity from legal point of view from the Central Board of Direct Taxes regarding extending of deadline for furnishing tax audit report. They have asked the authorities to substantiate the recent directive.

The income tax practitioners in India have expressed their views that the extension is of little value as the tax audit report has to be completed before the completion of the income tax return and the deadline for filing the income tax return remains the same which is 30.9.2014. No clarification has been provided by the Government or the Department regarding the reason behind such extension. For the said reason doubts are appearing in the minds of many tax professionals that the extension of time will practically provide no administrative relief to the common public.

In a seminar organized by the Indore branch of Institute of Chartered Accountants of India, a speaker said that the New Tax Audit report will challenge the Chartered Accountants and they should deal it very carefully. He also said that Tax Department requires that information from the Chartered Accountants which shall be utilized in security assessment. He said that at present Tax Audit reports cannot be prepared by the office assistants as the required information has now become very complicated and dealing with those complications is not an easy job.

It was also stated that the responsibility should be carried out very carefully by the Chartered Accountants and if any incorrect information enters the Tax Audit Reports, it will create complications for the assessee. They have to examine every transactions keeping in mind the TDS provisions and should report them in tax Audit reports very carefully.

Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

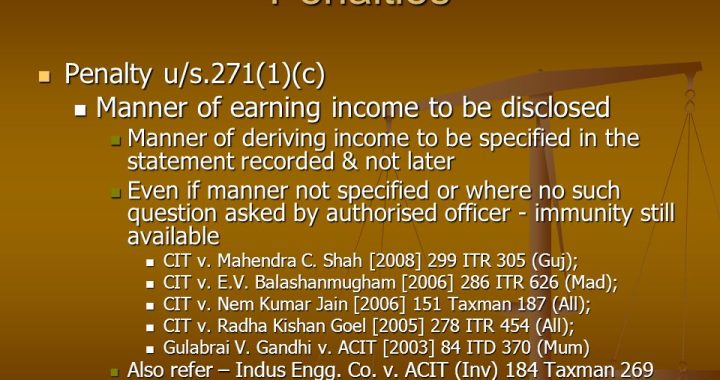

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?  Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA

Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA