Bought a wrong Insurance policy? Check out the remedies available

What are steps to cancel a wrong LIC Policy

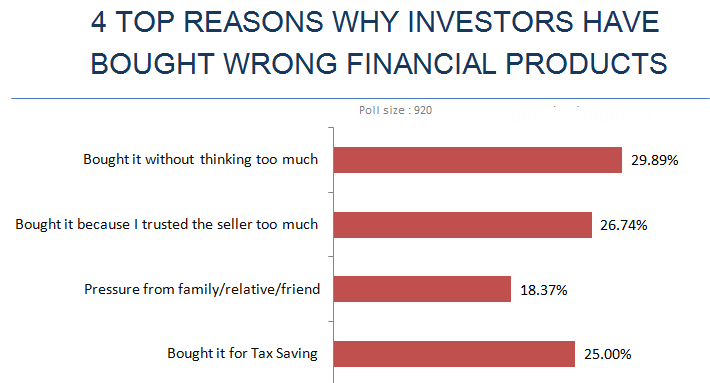

Usually, in India, people buy insurance policies on trust only. It could be a friend, agent, reputed banker or an insurance company. Whatsoever be the case, in most of the cases customer subscribes the insurance policy without understanding its terms and conditions.

The policyholder finds out all such clauses after he receives the policy document from the insurance company. In case you have subscribed to an insurance policy under duress or without having a complete understanding all the clause of the policy, you still have the following remedies at your disposal.

If you are not convinced about the policy you bought, you can still exit from policy- Don’t stay with policy against your free will

Cancellation of the Policy

A recently subscribed insurance policy could be cancelled if the consumer is not pleased with it. IRDA (Insurance Regulatory and Development Authority) provides a provision where the unhappy consumer could return his insurance policy and can get the refund. However, the consumer has a small window of hope known as the free-look period in which he should inspect the policy comprehensively and choose to continue with it or not.

The consumer-friendly option offers the consumer a period of 15 days from the day of receipt of the insurance policy to choose to accept the insurance policy or cancel the same. In case the insurance policy is cancelled in the look-free period, the consumer can get the refund of the preliminary premium on cancellation of the insurance.

This free-look period safeguards a consumer if he thinks that the subscribed insurance policy is not the right one. The free-look facility period offers a policyholder a stress-free exit option from an inapt policy, but he should act quickly.

For surrendering the policy, you need to give a written request or fill-up a form which would be provided by the insurance company. You need to finish this step and get the receipt of the same. Don’t trust the insurance agent ever again for cancelling the policy. In most of the cases, the insurance agent won’t submit your policy documents within the free look period and would wait till the free look period is over.

Complete refund or partial refund?

According to Insurance Regulatory and Development Authority, the company might withhold some amount, if the policyholder cancels his policy within the free look period.

How and to whom to make a complaint

If you are not satisfied with the response of the insurance company, you are entitled to file a complaint. Insurance companies are required to circulate a formal complaint process which you could follow. This lets you contact the right person and also tells you how long will it take for a response. Most of the companies issue it over their website. In case this doesn’t help you can contact the financial ombudsman. It is a free service that assists in resolving disagreements between the financial services company and the consumers. However, for using this service you need to wait 8 weeks from the day of filing the complaint to the company.

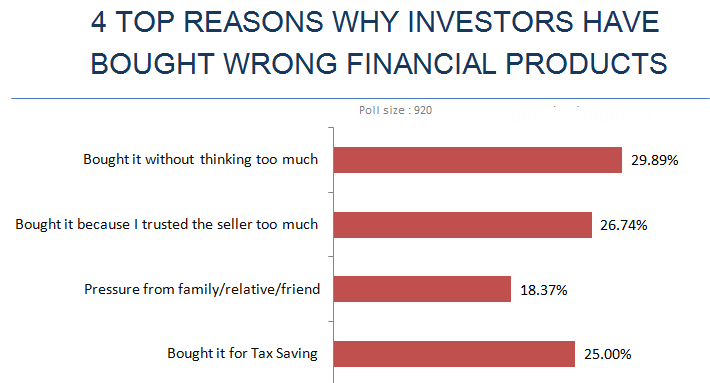

Life Insurance Policy Payouts – Are they Taxable or Not?

Life Insurance Policy Payouts – Are they Taxable or Not?  Insurance is a Practical Business Investment

Insurance is a Practical Business Investment  5 fantastic benefits of selling your life insurance

5 fantastic benefits of selling your life insurance  Money Back Rules for Lapsed LIC Insurance Policies. What if Insurance Policy has elapsed?

Money Back Rules for Lapsed LIC Insurance Policies. What if Insurance Policy has elapsed?  Term Insurance, Accidental Death and Dismemberment or Term Insurance- Which Insurance is Best for you

Term Insurance, Accidental Death and Dismemberment or Term Insurance- Which Insurance is Best for you  Life Insurance Policies – Are they really bliss?

Life Insurance Policies – Are they really bliss?  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?