Best 10 Tax Saving Tips For An Entrepreneur

Paying Income Tax, though seems hard, is an inevitable part of any business and each businessman or entrepreneur must know the various legitimate ways of reducing the tax to be paid. Who doesn’t want to know the tax saving tips? There is no escapism from the duty of paying tax, which is a source of income for the government, but surely there are some tips that can be used in India to reduce the tax burden which is as follows.

Best Tax Saving Tips For An Entrepreneur

Showing business convenience expenditure:

There are several expenses which are incurred for business purposes; all such expenses can be included in the business convenience expenditure. Some of them include expenses for phone, vehicle, charges paid to the driver, parking charges, etc. When business is carried from the house itself, even electricity expenses and internet expenses related to the same can be shown in this category.

When a business is a new entity, any cost incurred in the setting up also falls in this category and is deducted u/s 35D of the IT Act.

Any depreciation on the capital assets can also be deducted as an expenditure.

Expenditure on business trips:

Money spent on tours and trips related to business shall be considered as expenses related to it. Therefore any expense made for staying in a hotel and for traveling can be filed in the company’s account and can be shown as a deduction.

Premium paid on health indemnity:

U/S 80D of the IT Act, the entrepreneur can show up to Rs 25,000 for any premium paid for medical insurance for a tax deduction. This will include premium paid for dependent parents, spouses, and children. But if the business is an alternative source of income for the person, apart from a job, where his medical expenses are taken care of then he can’t show the same as a deduction in his business.

The hiring of family members as employees:

When the family members join the business as employees, any salary paid to them can be shown as a deduction from the company’s account, and this would eventually reduce the total tax, as salary can be reduced from the assessable income.

TDS should be done:

Many transactions fall under the IT Act that requires the buyer to deduct the tax at source while making reimbursement to the seller. If this is not taken care of, then such expenditure shall be considered unacceptable and will in turn increase the tax burden.

Investing the excess in Marketing:

Money spent on marketing is a tax-deductible income. So spending on advertisement and campaigning can be shown as an expense to reduce the tax load.

No cash transactions to be made:

If the daily payment exceeds Rs. 20,000 in cash, then such dealings will be considered as nullified by the IT dept. so the better way is to make a bank transaction if daily payments are above the said limit.

Special Depreciation for manufacturing entity:

Entrepreneurs who are involved in the business of manufacturing can claim an additional depreciation apart from the standard depreciation. This will fall u/s 35AD. Such depreciation is considered on equipment in the year when they are put to usage. This is only available in the first year of the business.

Save the Donation amount:

Entrepreneurs can make donations to the registered charity accounts, and avail 100% tax relief. And the donation should not be in kind, for, getting the tax benefit.

Interest on house loan:

Any interest paid for a house loan can be deducted if the pan card is linked to the start-up. A total of Rs. 1,50,000 can be claimed as deduction every year, u/s 80C of the IT Act.

Every saving is equivalent to earning, so the entrepreneurs need to take care of the above-said points and save on tax liability.

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

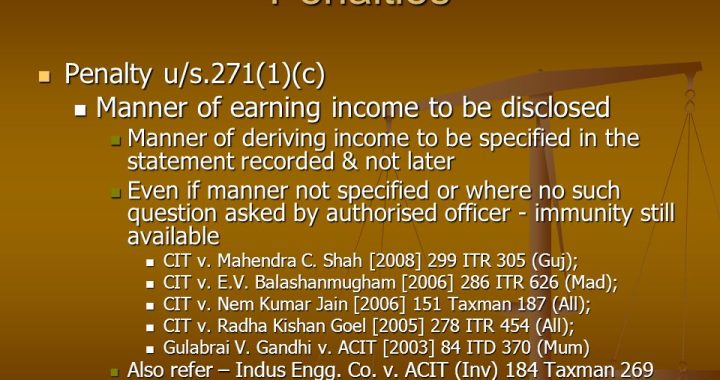

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure