How to avoid income tax audit

Most of the people paying Tax are afraid of an IRS audit / income tax audit. Recent statistics have revealed that 150,000 taxpayers have been successful in avoiding an IRS audit/ income tax audit. The Most of the people paying Tax are afraid of an IRS audit / income tax audit. Recent statistics have revealed that 150,000 taxpayers have been successful in avoiding an IRS audit/ income tax audit. The IRS has postponed the proposed line-by-line income tax audit included in the Taxpayer Compliance Measurement Program (TCMP). However, this does not affect its standard tax auditing program. The IRS has picked people on a computer analysis basis to determine the tax returns are most likely to be in error.If the IRS tends to audit you, you hardly have an option to stop that. While audits are rare, you may, however, reduce the ill effects of it.

Here are some tips for avoiding an IRS audit. If you are already facing an IRS audit, you may pass out of it with a minimum loss.

The percentage of people involved in an audit is extremely small. The number of people involved in an IRS audit has increased slowly since 2008.

If you are involved in an audit of the IRS this year, you are not alone. About 1.5 percent of all taxpayers are audited. The IRS audits are very few in number. Most people are chosen for audit as either their tax deductions appear to be very high compared to the person’s income, or tax items that contain errors. Sometimes the tax items requiring evidence or an explanation, or is included in the IRS’ list containing hot tax issues.

Though the IRS audit targets go on changing there are some strategies which can help.

1. Avoid erroneous data – One of the most common defects responsible for audit is erroneous data entry. This can easily be prevented. One should follow the advice of double-check on the filed return. People often are too careless about their taxes which should be avoided.

2. Be honest – It is a common sense that telling the truth in your tax return is a must to reduce the possibility of an audit. Hiding some of your income may attract attention of the Department.

3. Go for e-filing – Filing returns electronically often reduce errors as it decreases the odds of an audit. In the year 1986, the IRS received an electronically filed tax return. By 1990, taxpayers throughout in India who expected a refund could file their return electronically.

4. Self-defense – You must take all the tax deductions to which you are entitled on your tax return. Do not be afraid of the potential of an IRS tax audit. Apply your common sense and weigh the risk you are utilizing many tax deductions on your tax return with the reward that you receive in terms of tax savings.

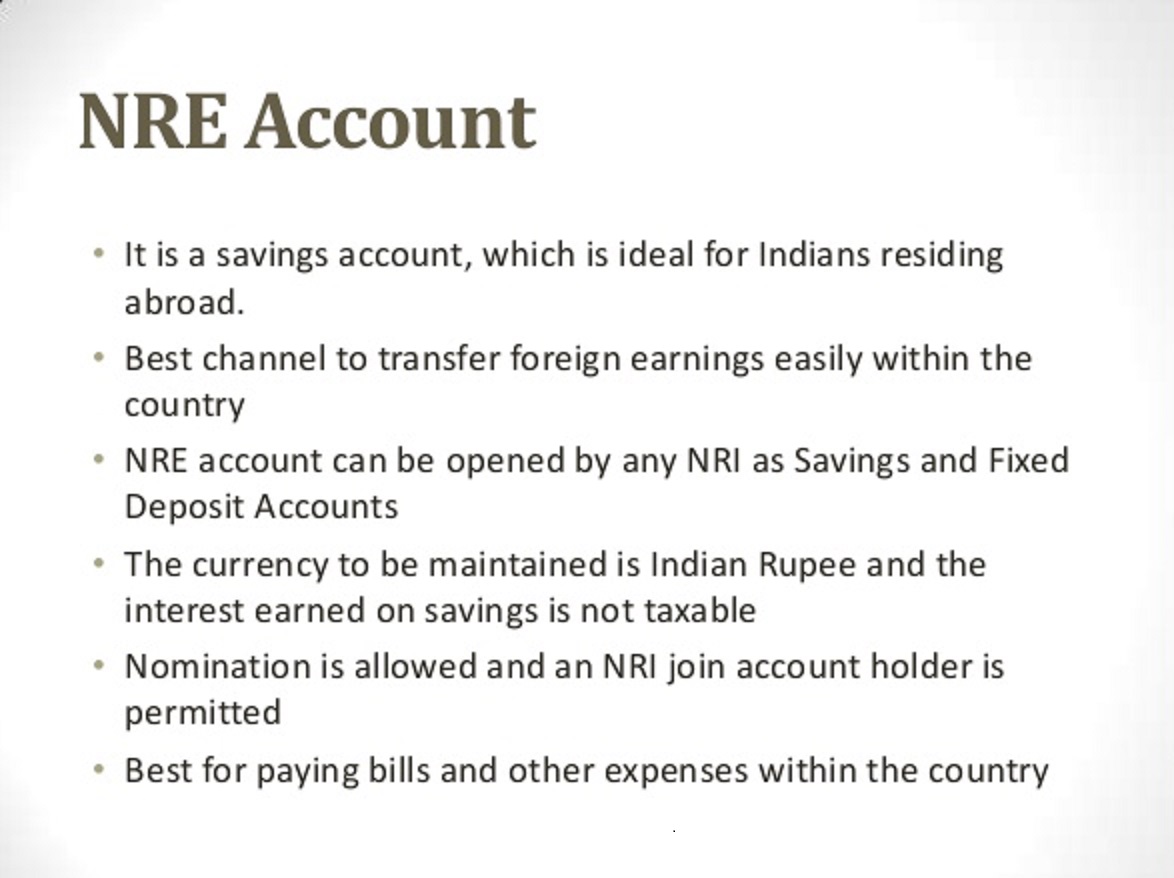

Tax Liability of an NRE account

Tax Liability of an NRE account  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?