Flipkart India Private Limited vs. ACIT (Karnataka High Court) The applicant raised the contentions in support of the petition for stay of demand: The Issue:... Read More

Sourav

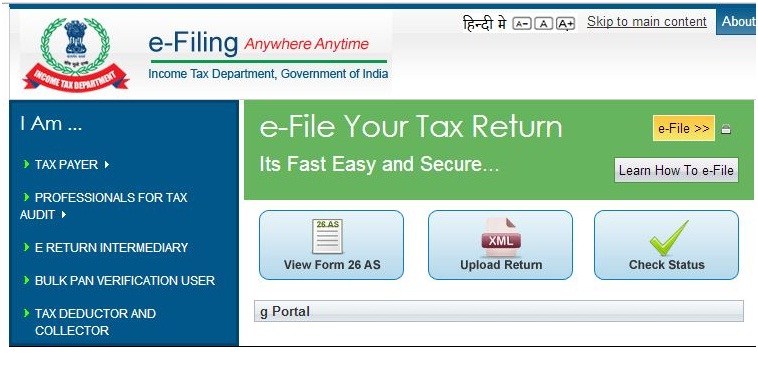

The Central Board of Direct Taxes has made an announcement vide press release dated 30.12.2015 with respect to the Procedure for electronic filing of appeal... Read More

Assessee allowed to claim exemption u/s 54F for multiple flats if located at same address In the Case of CIT Vs Shri Gumanmal Jain (Madras High Court),... Read More

Assessee not indebted for providing the facility for conducting the survey if not asked for

3 min read

Assessee not indebted for providing the facility for conducting the survey if not asked for

3 min read

Income Tax Appellate Tribunal Amritsar Bench in a thought-provoking decision of Smt. Kailash Devi ITA 347/ASR/ 2015 manifested on 05-04-2016 on conducting the survey and... Read More

CBDT circular on Taxability of compensation received on compulsory acquisition of Agricultural land

4 min read

CBDT circular on Taxability of compensation received on compulsory acquisition of Agricultural land

4 min read

With the help of Circular No. 36/2016, The Ministry of Finance has cleared all the doubts and clarified that receipt of compensation in case of compulsory acquisition... Read More

The Income Tax department has given a signal for strong action against those who undertake Benami transactions. Those who undertake Benami Transactions would be chargeable... Read More

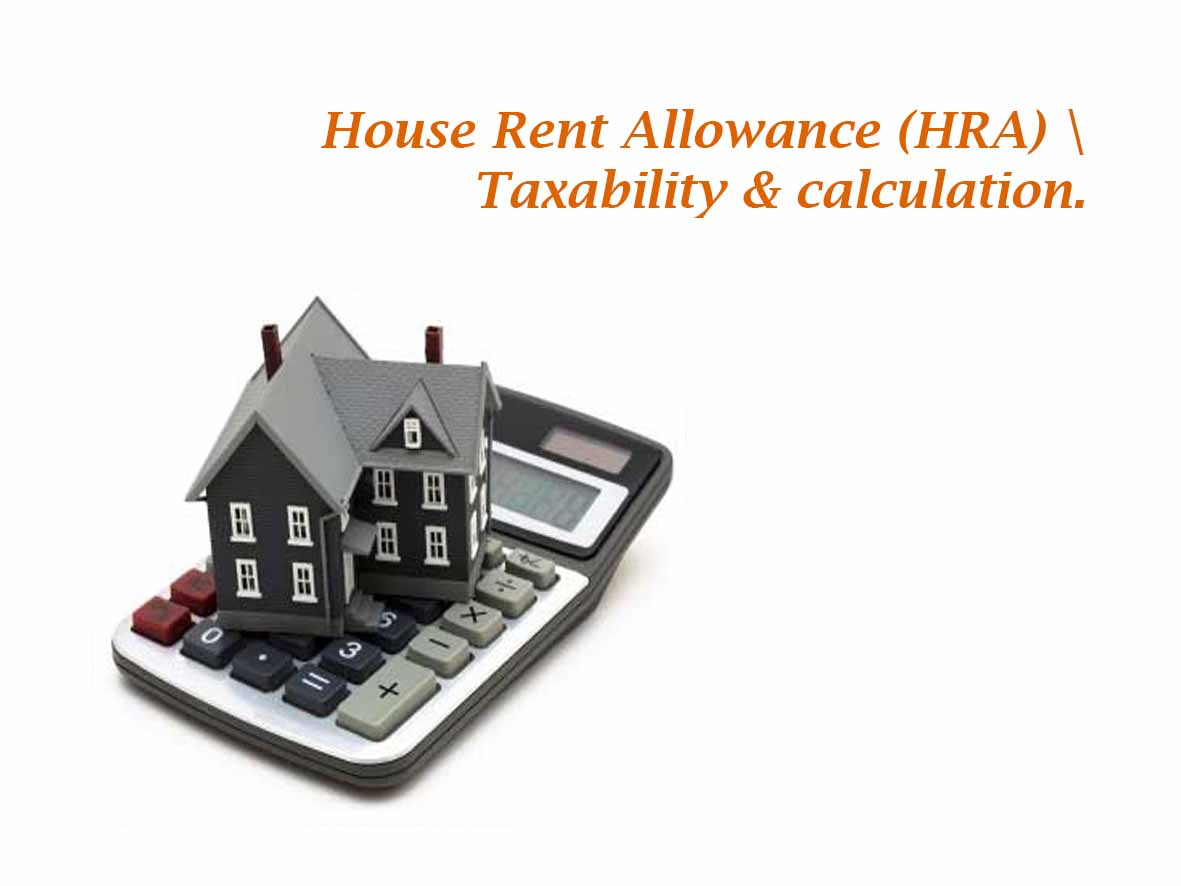

House Rent Allowance (HRA) is a general component of salary structure and allowed as allowance. Though House Rent Allowance is a part of the salary,... Read More

The Finance Bill, 2017 has something new to propose and to insert a new section 269ST in the Indian IT Act, 1961 w.e.f 1st April... Read More

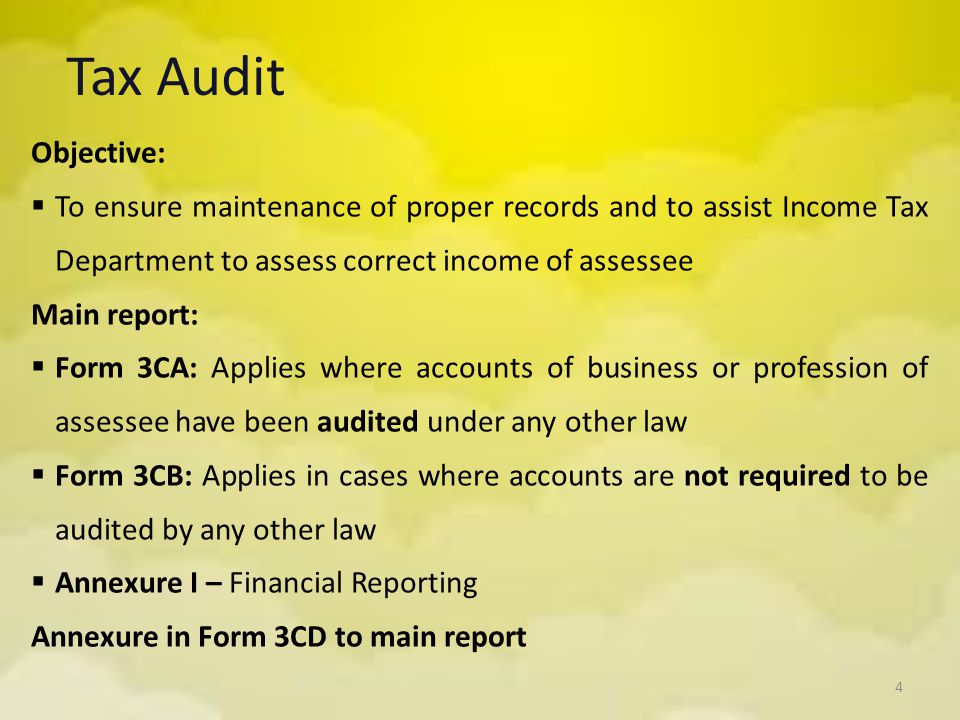

Amendments to Provisions of Tax Audit and provisions with respect to maintenance books of account

4 min read

Amendments to Provisions of Tax Audit and provisions with respect to maintenance books of account

4 min read

A person is liable to get his books and accounts audited U/s 44AB (Tax Audit) by a practicing Chartered Accountant, if in the previous financial... Read More

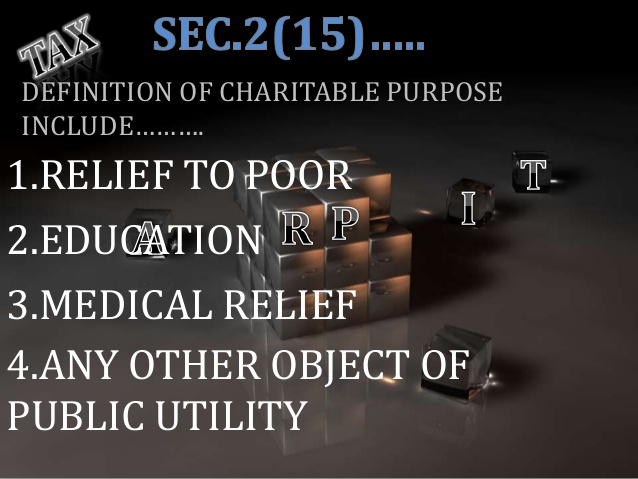

There were many amendments in Budget 2017 were made and proposed by Finance Minister regarding Taxation of Charitable Trust. First Amendment governing taxation of Charitable... Read More

Flipkart India Private Limited vs. ACIT : The department cannot demand payment of tax dues but have to grant complete stay if the assessment is “unreasonably high pitched”

Flipkart India Private Limited vs. ACIT : The department cannot demand payment of tax dues but have to grant complete stay if the assessment is “unreasonably high pitched”  Procedure for electronic filing of appeal before the CIT(Appeals)

Procedure for electronic filing of appeal before the CIT(Appeals)  Exemption under Section 54F allowed for multiple flats if located at same address

Exemption under Section 54F allowed for multiple flats if located at same address  Violators to face strict action for Benami transactions warns IT Department

Violators to face strict action for Benami transactions warns IT Department  Taxability of House Rent Allowance and deductions available under 88 GG for rent paid

Taxability of House Rent Allowance and deductions available under 88 GG for rent paid  Overview of the Various Restrictions and Analysis of Section 269ST of Income Tax Act

Overview of the Various Restrictions and Analysis of Section 269ST of Income Tax Act  Recent Amendments for Taxation of Charitable Trust introduced in the Union Budget 2017

Recent Amendments for Taxation of Charitable Trust introduced in the Union Budget 2017  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?