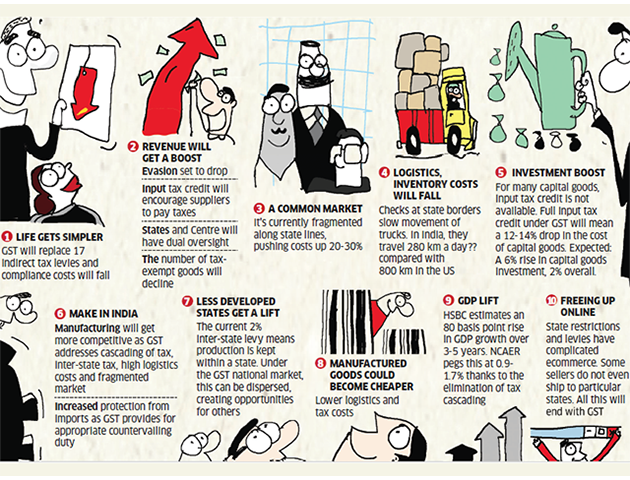

We are passing through the tax regime where complete indirect tax system will switch over to the Goods and Service Tax (GST) which includes four... Read More

Sourav

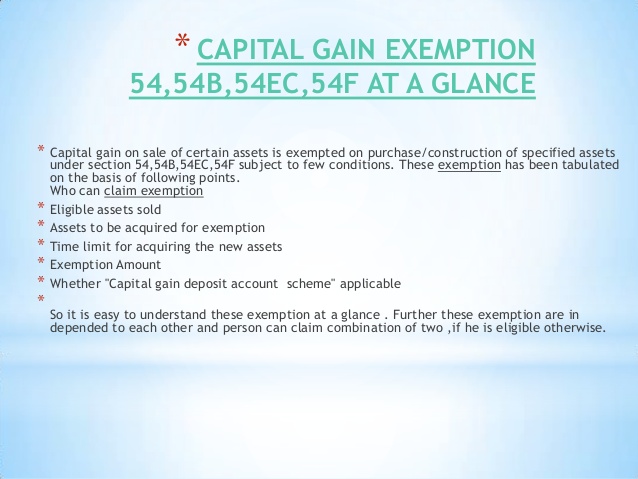

A trust which is solely for the benefit on an individual could claim deduction under section 54F

3 min read

A trust which is solely for the benefit on an individual could claim deduction under section 54F

3 min read

The Issue arose before the ITAT is that whether the assessee trust, which is only for the benefit of an individual, will be eligible to... Read More

Could you save yourself from the hands of income tax by transferring money to your spouse’s account?

4 min read

Could you save yourself from the hands of income tax by transferring money to your spouse’s account?

Have you ever transferred money to spouse’s account in order to meet her personal requirements and expenses? If this thing happens very often, then you... Read More

Tapas Paul Vs ACIT (ITAT Kolkata) Facts of the case Assessing Officer has disallowed the payment made to the labourers by the assessee on the... Read More

In the transition phase of General sales tax to Value added Tax and the initiatives of E-Governance, like Goods and Service Tax (GST), many states have made several efforts,... Read More

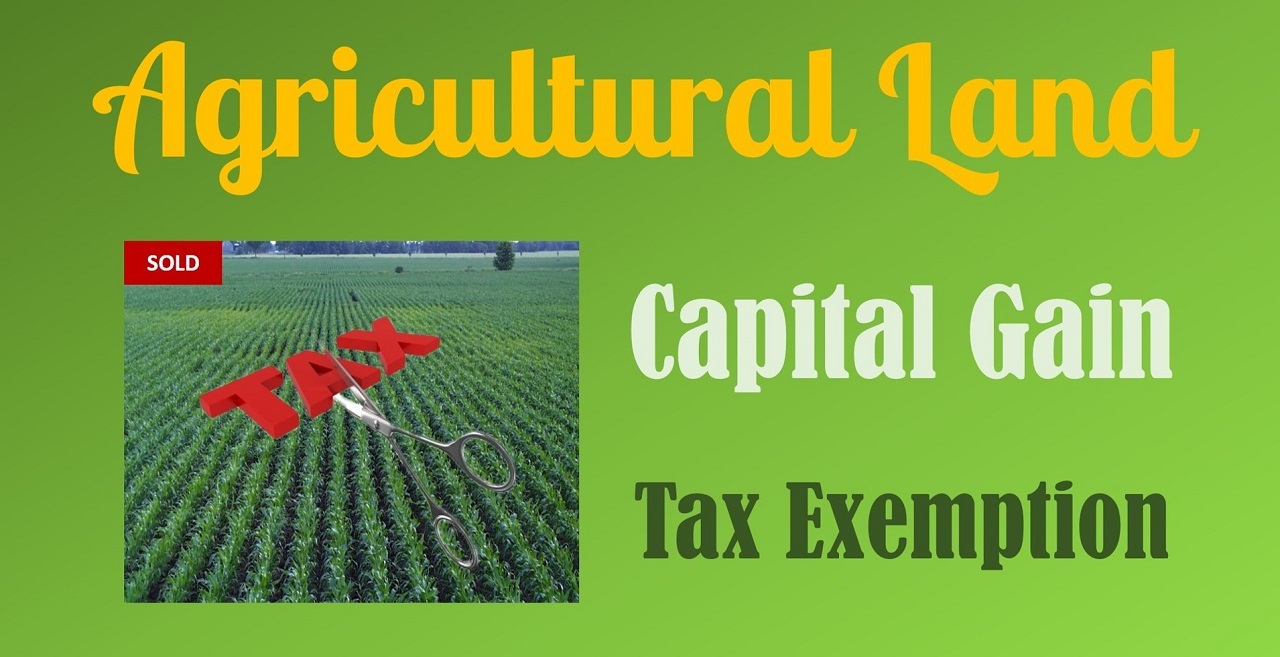

Whether the Receipt of unaccounted Income on sale of agricultural land can be brought in taxation ambit as unaccounted income? The Matter was discussed in following case... Read More

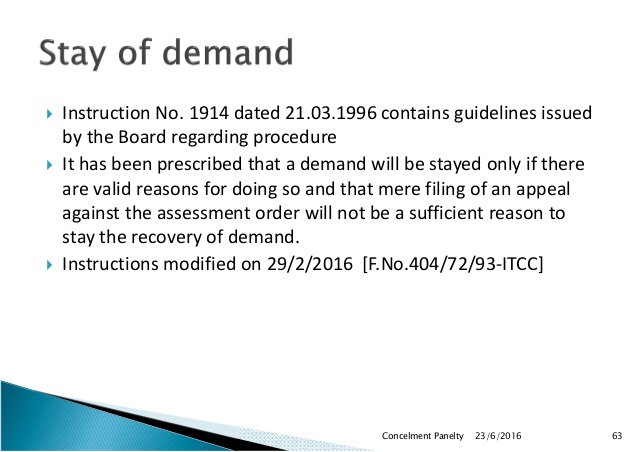

Stay of Demand of Income Tax does not require and Pre-deposit of Tax by Assessee as has been held in following case where the Assessing... Read More

NRIs or Non-Resident Indians are the Persons of Indian origin or citizens of India who qualify for NRI status for the relevant assessment year. Let’s... Read More

Overview of Job Work under the GST regime

4 min read

Overview of Job Work under the GST regime

4 min read

Job work means any process or any treatment undertaken by a person as per the specification of another registered taxable person (Raw material supplier) on... Read More

The provisions contained in the section 147 of the Income Tax Act authorizes the Assessing Officer for reassessment by reopening the case wherever there is... Read More

Some important points to be considered under Goods and Service Tax

Some important points to be considered under Goods and Service Tax  TDS u/s 194C is not required to be deducted when paying wages to laborers working under assessee’s direct supervision

TDS u/s 194C is not required to be deducted when paying wages to laborers working under assessee’s direct supervision  Overview of E Way Bill (Electronic Way Bill) under GST Regime

Overview of E Way Bill (Electronic Way Bill) under GST Regime  Receipt of Unaccounted Income due to sale of Agricultural Land is not taxable

Receipt of Unaccounted Income due to sale of Agricultural Land is not taxable  Stay of Demand of Income Tax by the Assessing Officer does not require an assessee to make a pre-deposit

Stay of Demand of Income Tax by the Assessing Officer does not require an assessee to make a pre-deposit  A deep dive into the Taxation of Non-Resident Indians Income

A deep dive into the Taxation of Non-Resident Indians Income  Mere low income cannot constitute understatement of income by an Assessing Officer

Mere low income cannot constitute understatement of income by an Assessing Officer  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?