All about Wealth Tax Return

Every person as well as Hindu Undivided Family and Companies having net wealth more than the maximum amount not chargeable to wealth tax has to file the Wealth Tax Return.

Every person as well as Hindu Undivided Family and Companies having net wealth more than the maximum amount not chargeable to wealth tax has to file the Wealth Tax Return.

Currently the maximum limit of net wealth which is not chargeable to tax as per the Wealth Tax Act, 1957 is Rs. 15, 00,000/- lakhs.

Assets for which one has to pay wealth tax:

1. Structures or land except one house property or land and one additional land measuring 500 square meters or less than that;

2. Cars, boats and aircraft;

3. Gold and other expensive jewellery;

4. Furniture, utensils or articles made of gold, silver or any other precious metal;

5. Urban land;

6. Cash amounting to more than Rs. 50,000/-

Assets for which one does not have to pay wealth tax:

Productive assets are not liable to Wealth tax. Thus shares, Mutual Funds, etc are exempt from wealth tax.

Assets of a minor:

Assets of a minor child are to be clubbed with the net wealth of his or her parent. However no clubbing is done for the assets belonging to a minor suffering from any disability as per section 80U of the Income Tax Act.

The clubbing provisions do not apply for any asset acquired by the minor child from his or her own income by applying his or her skills or knowledge.

What is Net Wealth?

Net wealth is the total value calculated as per the W.T. Act, 1957, of all assets of the assessee held till the valuation date after deducting the total debts of the assessee which have been taken in connection with the assets liable to wealth tax.

What is the rate of Wealth Tax?

The rate of Wealth Tax is 1% of the amount which is excess of Rs. 15 Lakhs.

Wealth Tax Return:

The Wealth Tax return is to be filed as per Form BA. One has to declare the value of an asset during an assessment year as on the date of valuation i.e. 31st March of every year. The assessee has to sign on all the documents attached.

Due date of filing wealth tax return:

The due date for filing wealth tax return is same as that of filing an income tax return. For individuals and HUFs the due date is 31st July of the subsequent financial year for which one files the return.

Valuation of an asset:

Value of an asset except cash is to be determined as per rules of Schedule III. The details of calculation of the value of the assets are to be attached with the return. In case any rule of this schedule provides that a document supporting the valuation is to be attached, the same must be attached with the return.

Statement of Taxes:

The amount of Wealth tax which is payable on the net wealth has to be stated. The tax has to be calculated as per the rates of Part I of Schedule I. the interest chargeable for late filing, if any has to be indicated. The net tax payable or refund has to be stated.

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

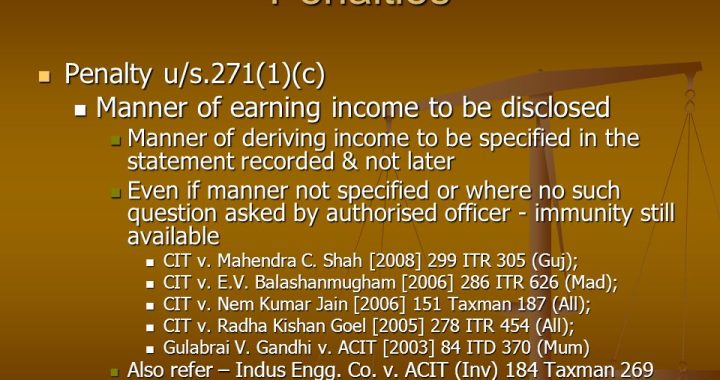

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?