All about EOU Scheme – Import Export Procedure and Availing Input Credit Part 3

In continuation to our detailed article on the EOU Scheme, here comes another one regarding the Import/Export Procedure under the same.

Import/Export Procedure under EOU Scheme

An EOU can procure goods from DTA without payment of Central Excise Duty by following the procedure laid down under Circular nos. 851/9/2007-CX dated 03.05.2007 and 859/17/2007-CX dated 13.11.2007. Superintendent, Central Excise in-charge of EOU is required to issue Certificate in Form CT-3 annexed with the aforesaid circular dated 03.05.2007 as Annexure-A.

Goods purchased from DTA are required to be brought directly from the manufacturer/warehouse into the EOU’s premises under ARE-3. On the arrival of goods at the premises of the user of the industry i.e. the EOU shall verify the number/quantity/weigh/description/value/duty etc. with the content mentioned in the ARE-3 and invoice of the goods and account for the goods in the records maintained.The Certificate of warehousing form ARE-3 is required to be submitted by the EOU within a period of 90 days as follows:

- Application regarding arrival of goods in the form ARE-3 in three copies shall be sent to Superintendent in charge of the EOU.

- The superintendent shall depute the bond office for physical verification of good within 24 hours of reciept of information.

- After verification of sech goods, Superintendent in charge of EOu shall countersign on all copies of ARE-3 on the basis of report of bond officer

a. Original copy of ARE-3 shall be sent to the Superintendent in charge of Consignor

b. Duplicate copy of ARE-3 shall be sent to the Consignor

c. Triplicate copy of ARE-3 shall be sent to the EOU for the records

Issuance of Pre-Authenticated CT-3 Books

In order to avoid separate authentication every time, the EOUs are issued pre-authentication CT-3 booklet form, against which they are allowed to procure capital goods, raw materials, consumables etc.

Availment of Cenvat Credit

With effect from 06.09.2004, EOUs can procure goods on payment of duty and take credit of duty paid in respect to DTA sales, in case, the unit is unable to take credit, it can also claim refund of CENVAT credit in terms of CENVAT Credit Rules, 2004.

Import by EOU/EHTP/STP Units

An EOU is allowed to import all types of goods except prohibited goods without payment of duty for the purpose of manufacture/ production of export product for export. Notification no. 52/2003-Cus. Dated 31.03.2003 allows EOU to procure these goods from private bonded warehouses and from international exhibitions held in India without payment of duty.

If EOU is intending to import goods without payment of duty then they are required to obtain procurement certificate from Jurisdictional Range Officer/Superintendent of Customs in the format as provided in the CBEC Circular No. 14/98-Customs dated 10.03.1998.

EOU can have clearance of imported goods and private bonded warehouse without payment of import duty by submitting the procurement certificate within 90 days of its issue to the Assistant Commissioner of Custom in-charge of the port.

Import Consignment of EOU is not subject to detailed examination at the port of import. The import consignment is fully examined at the premises of the EOU.

For Clearance of goods from the port of import, following documents are required to be submitted by the EOU:

- Into-Bond Bill of Entry (in quadruplicate),

- Invoice, Packing list,

- Certificate of Origin,

- Procurement certificate issued by Jurisdictional Central Excise,

- Attested copy of legal undertaking,

- Attested copy of Private Bonded Warehouse License,

- Copy of the green card and valid

Steps

- The Into Bond Bill of Entry is assessed at the import port. The good moves under the cover of into Bond Bill Entry

- Original Copy is retained with the custom station of import and three copies of bill of entry accompanies the consignment

- The officer-in-charge of the EOU examines the report on the duplicate and triplicate copies and return the duplicate copy to the Assistant Commissioner of customs station of import

In case of any discrepancies found in goods during the examination, the same shall be brought to the notice of the Customs Station of import for the purpose of updating.

Note: The Software units are allowed to import software through data communication link, internet etc. and file Bill of Entry within 24 hours (Circular No. 58/2000-Cus. dated 10.7.2000).

Period of Utilization

| Raw materials, spares, consumables imported | EOU is required to use them within a period of 3 years from the date of such importation or such extended period as may be allowed by Assistant Commissioner or Deputy Commissioner incharge of the unit |

| Capital goods | They are required to be installed in the approved premises within 1 year from the date of importation, this time period may be extended by the Jurisdictional Assistant Commissioner or Deputy Commissioner of Excise/Customs |

(Ref:- Circular No. 30/99-Customs, dated 25.05.1999)

Export by EOU/EHTP/STP Units

- For Export, EOUs are required to take consignment to the port of export under the cover of form ARE-1.

- Application of form ARE-1 shall be in quadruplicate and presented in advance of removal of goods to the jurisdiction Range officer with other documents.

- Jurisdictional Central Excise Officer verifies the packages and seal it, endorses all the copies and return duplicate and triplicate copies to the unit.

- The Customs Officer at the port verifies the copies and make endorsement on the ARE-1 copies and return the original and quintuplicate copies to the exporter.

Documents required to be attached with the shipping bill

- R. form (in duplicate),

- Invoice & packing list,

- A declaration by the unit confirming correctness of export information including contract with foreign buyer etc,

- Insurance cover for duty involved.

Self-Certification of Export Cargo

Vide Circular No. 12/2005-Customs, dated 04.03.2005, CBEC has prescribed the guidelines for removal of goods from the factory premises of EOU/EHTP/STP for the purpose of export on the basis of self-certification.

Export through Courier

Export by EOU through courier can take effect only through authorised couriers, rules are laid down under Courier Export/Import Regulation, 1988.

Export through Post

EOU can export trade samples, products or warranty repairs through Foreign Post Office (FPO).

Export through Electronic Mode

EOUs engaged in export of software services are allowed to export goods through data communication links. Instead of Shipping bill and GR form, they are required to use SOFTEX form.

Bankruptcy Lawyer in Pittsburgh

Bankruptcy Lawyer in Pittsburgh  3 Ways to Get Help With Your Legal Case

3 Ways to Get Help With Your Legal Case  Guide to preparing for CA Final Exams – Part 2

Guide to preparing for CA Final Exams – Part 2  Guide to preparing for CA Final Exams – Part 1

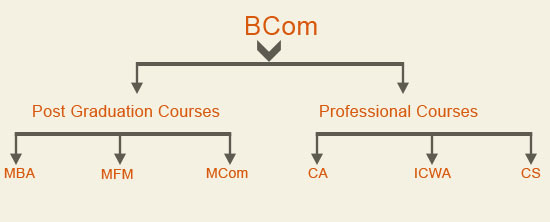

Guide to preparing for CA Final Exams – Part 1  MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?

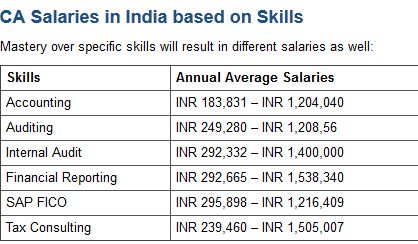

MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?  How Much You Can Earn As A Cost and Works Accountant?

How Much You Can Earn As A Cost and Works Accountant?  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?