A summary on section 263 of the Income Tax Act

Section 263 of the Income Tax Act deals with the powers given to the Commissioner of Income tax to ask for and check the records of a proceeding as per the provisions of the Act and to revise any order if it is erroneous and detrimental to the interests of the Department.

Section 263 of the Income Tax Act deals with the powers given to the Commissioner of Income tax to ask for and check the records of a proceeding as per the provisions of the Act and to revise any order if it is erroneous and detrimental to the interests of the Department.

The said power has a broad scope and is obviously subjected to restrictions in order to restrain any arbitrary use. Section 263 of the present Act is similar to section 33B of the Income Tax Act, 1922 and has been there in the statute since a long time with some changes. The law contained in section 263 has been laid down by the Courts in many judicial decisions.

Essentials of Section 263:

The Commissioner has the power of revision as per Section 263 in cases if the following two conditions are satisfied.

1. The order should be erroneous – The first essential condition for invoking section 263 of the Act is that the impugned order should be wrong. Section 263 cannot be invoked if the impugned order is prejudicial to the interest of the revenue but it is not wrong.

2. The order should be prejudicial to the interest of the revenue – The second essential condition for invoking section 263 of the Act is that the impugned order should be prejudicial to the interest of the Department. However any loss of revenue due to passing of an order by the Assessing Officer cannot be considered as prejudicial to the interest of the department.

Scope of Section 263:

The Assessing Officer cannot make a fresh assessment when section 263 is invoked. Revision under section 263 is not re-assessment. The whole assessment is not opened before the Assessing Officer in such kind of revision.

The error as stated in Section 263 does not depend upon possibility or speculation. There should be a mistake either relating to fact or relating to law.

Kinds of orders which can be revised:

Section 263 is not limited to orders relating to assessment only. It also applies to orders where proceedings are dropped and/or filed.

An assessment order passed by Assessing Officer regarding income escaping assessment under section143(3) can be examined by the Commissioner by virtue of his powers under section 263.

Any communication by the Assessing Officer disposing of an application determining the tax liability for TDS as per the provisions of section 195(2) is considered to be an order for section 263 as it was held in the case of Board of Control for Cricket in India v. DIT [2005] 96 ITD 263 (Mum.)

Is an assessee entitled to raise a new claim in an application under section 263?

An assessee cannot raise a new claim in assessment proceedings in an application made under section 263 as it was held in the case of ACIT v. ITW India (P) Ltd. [2010] 40 SOT 348 (Hyd.)

Notice under section 263:

It is an obligation to send notice mentioning in which manner the impugned order is prejudicial to the interests of the Revenue. The show-cause notice should state the grounds and the order under Section 263 should not be contrary to such grounds of revision. Before exercising powers relating to revision, the assessee must be given an opportunity of hearing.

Whether revision is allowed against void orders?

The Commissioner under section 263 has no jurisdiction to revise a void order. This was held in the case of ITO v. Garg Enterprises [2005] 142 Taxman 42 (Mag.) (Chd.) that the Commissioner cannot exercise his power of revision under section 263 against an order which was considered as void.

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

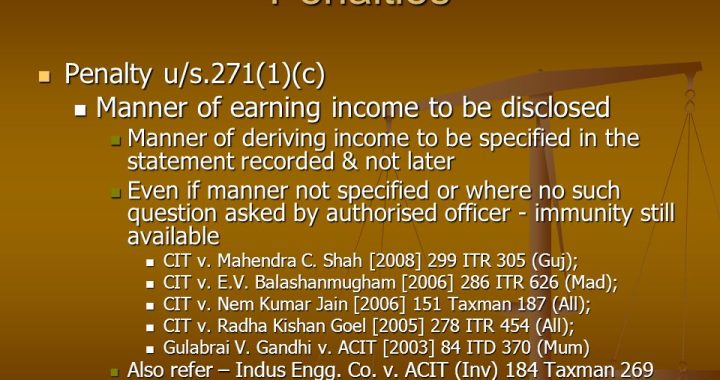

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income  Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure

Bombay High Court Upholds Section 271(1)(c) Penalty for Deliberate Non-Disclosure  Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act

Reporting of Foreign Assets by Indian Taxpayers under Section 139(1) of the Income Tax Act  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?