A Quick Walk Through of Accounting Standard 4 (AS4)- Contingencies and Events after Balance Sheet Date

Accounting Standard 4- Contingencies and Events after Balance Sheet Date

Accounting Standard 4- Contingencies and Events After Balance Sheet Date

The Accounting Standard 4 (AS 4) deals with the treatment of

- Contingencies and

- Events occurring after balance sheet date

In the Financial Statement applicable for the accounting period commencing on and after April 1st, 2017 after considering Companies (Accounting Standard) Amendment Rules 2016.

Contingencies

Following nature of contingencies are excluded from the scope of AS 4 and covered under other Accounting Standards:

- Liabilities of life insurance and general insurance enterprises arising from the policies issued

- Obligation under retirement benefit plan

- Commitment arising from long term lease contract

As per AS 4, Contingency is a condition or situation, the ultimate outcome of which, gain or loss, will be determined only on the occurrence or non-occurrence or one or more uncertain future events.

- The term “contingencies” in AS 4 is restricted to conditions and situations whose financial effect is determined by future events which may occur or not, that existed on balance sheet date

- Many times estimates are made to determine amount to be stated in financial statement for both certain and uncertain events. Only the estimated made for uncertain events are considered to be contingencies. Some examples of estimates made for certain events – estimation of useful life for determination of depreciation, eventual expiry of useful life of an asset is not uncertain thus it does not make depreciation a contingency

- Any uncertainty relating to future events can be expressed by range of outcomes which further can be presented in quantifiable probabilities. In most of the cases, there is no relevant information available to support the probabilities

- It is the management of the enterprise that determine the outcomes and financial effects of contingency. The judgement is generally based on the information available up to the date on which financial statements are approved and also supplemented by the experience of the similar transaction

As per Accounting Standard 4, a contingency shall be provided as at Balance Sheet Date for reasonable estimate of the loss probable based on future event after taking into account any related probable recovery

Accounting treatment of contingent loss under AS 4

- If the contingency is most likely to result in loss to the enterprise then it is prudent to provide for such loss in financial statements

- If there is no sufficient evidence to estimate the amount of loss, then disclosure of its existence and its nature is to be made

- If there is matching counter-claim or claim against third party for a potential loss then it may be avoided or reduced. Then amount of provision shall be determined after taking into account, the probable recovery of claim provided, no significant uncertainty exists towards its measurability and collectability

- Even though the possibility of loss is very remote, obligations like existence and amount of guarantee, discounted bills and exchanges are generally disclosed in financial statements by way of notes

- No provisions for contingencies are made for general or unspecified business risk

Summary

Amount of contingency shall be provided if:

It is probable that future event will confirm that after taking into account any related probable recovery, an asset has been impaired or a liability has been incurred as at the balance sheet date,

And;

A reasonable estimate of the amount of the resulting loss can be made.

Accounting treatment of contingent gains under AS 4

Contingent gains are not to be recognised in financial statements since their recognition may result in recognition of revenue which we may never realise (it is also against principle of prudence)

Determination of the amount at which contingencies are included in financial statements

- Amount of contingency is based on the information available at the date on which financial statements are approved

- Even events occurred after balance sheet date that indicate that an asset may be impaired, or that a liability may have existed, at the balance sheet date are, therefore, taken into account for identifying contingencies and their amount

- If each contingency can be separately identified, the special circumstances of each situation considered in determination of amount of such contingency for example, a substantial legal claim against the enterprise. If the uncertainties which created contingency in respect of an individual transaction are common to a large number of similar transactions then amount of contingency need not be determined individually e.g. warranties for the product

Events occurring after balance sheet date

- Events which occur between the date of balance sheet and date on which financial statement are approved may require adjustment to assets and liabilities, if the additional information materially effecting the determination of amount relating to the condition existing on balance sheet date e.g. an adjustment may be made for a loss on trade receivable account which is confirmed by the insolvency of a customer which occurs after the balance sheet date.

- Adjustments to assets and liabilities are not appropriate for events occurring after balance sheet date, if such events do not relate to conditions existing at the date of the balance sheet e.g. decline in the market value of the investment between the balance sheet date and the date on which financial statements are approved.

- Events occurring after balance sheet date which do not affect the amount stated in financial statements are not required to be disclosed normally but if they are of such significance that it enables the users of financial statement to make proper evaluation and decision then the approving authority may require disclosure.

- Some events occur after balance sheets but are reflected in the financial statement due to statutory requirements or because of special nature e.g. if an entity declares dividends to the shareholders after the balance sheet date, the entity should not recognize those dividends as a liability at the balance sheet date. Such dividends are disclosed in the notes.

- If the events occurring after the balance sheet indicate that the entity ceases to be a going concern then it is an indicator to consider whether or not fundamental assumption of going concern is to be used for the preparation of financial statements.

Disclosure

- Disclosure requirements are applied on those contingencies or events which affects the financial position materially.

- If a contingent loss is not provided then at least its nature and its estimate as well as the financial effect is to be disclosed by the notes, unless the possibility of the loss is remote. In case where no reliable estimate can be made, then facts must be disclosed.

- If disclosure of events occurring after the balance sheet date is to be made in report of approving authority then the information given comprises nature of events and estimate of their financial effects or statement that such estimate cannot be made.

Bankruptcy Lawyer in Pittsburgh

Bankruptcy Lawyer in Pittsburgh  3 Ways to Get Help With Your Legal Case

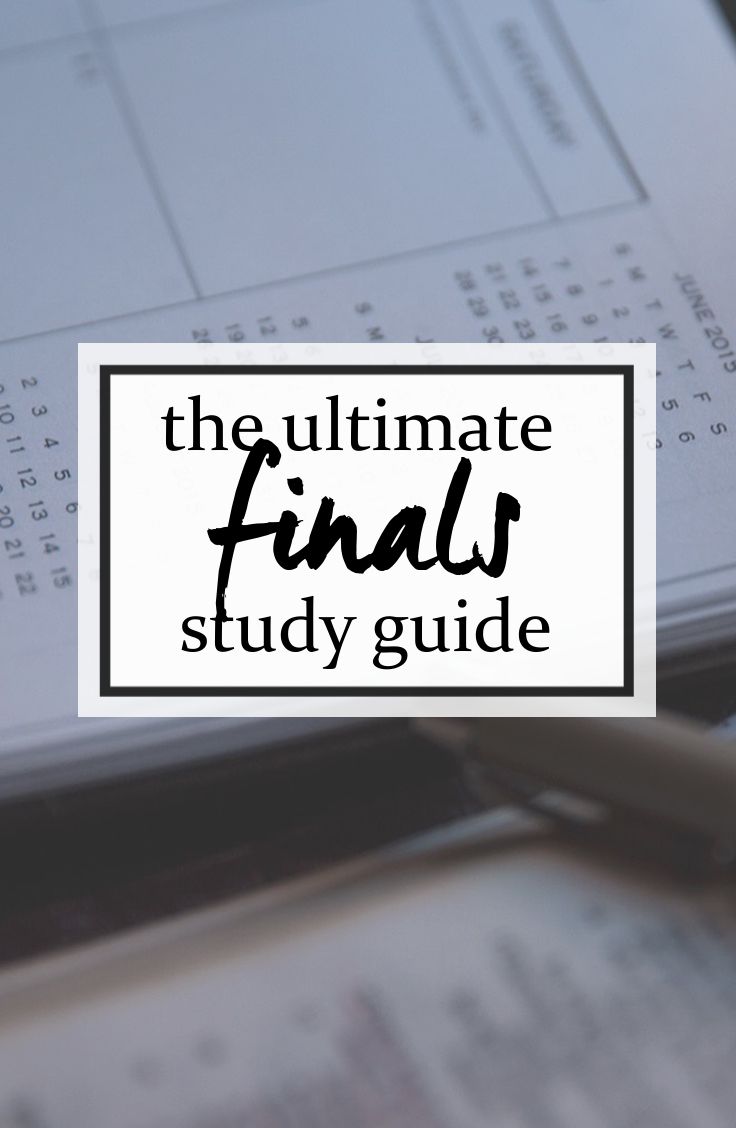

3 Ways to Get Help With Your Legal Case  Guide to preparing for CA Final Exams – Part 2

Guide to preparing for CA Final Exams – Part 2  Guide to preparing for CA Final Exams – Part 1

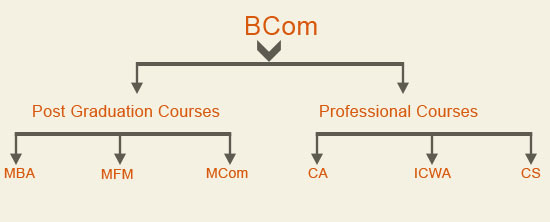

Guide to preparing for CA Final Exams – Part 1  MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?

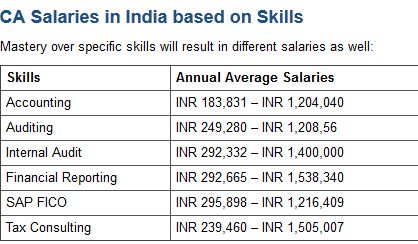

MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?  How Much You Can Earn As A Cost and Works Accountant?

How Much You Can Earn As A Cost and Works Accountant?  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?