HUF- a tax planning tool to save Income tax

HUF- a tax planning tool to save Income tax

No one wants to shed their hard earned money in the form of taxes, but unfortunately, there is no escape to that. The income tax Act provides that all income shall for the purpose of charge of income tax. Let’s further see how HUF- a tax planning tool to save tax?

HUF- a tax planning tool to save tax-Computation of Total Income is classified under the heads:

- a) Salaries;

- b) Income from house property;

- c) Profits and gains from business and profession;

- d) Capital gains and

- e) Income from other sources.

In spite of the categorization for showing their income people find an illegal way to save their taxes.

Why Salaried Class pay More Taxes?

Salaried class people often pay more taxes as compare to the people who are engaged in other jobs. As per the data shared by the CBDT, the number of new income-tax filers increased nearly a crore in 2017-18, taking the total income tax returns filed to 6.84 crores, up 26% from 5.43 crore in the previous year.

It is due to the constant efforts made by the income tax department that there is an increase in filing of returns. IT Department continuous follow-up with potential non-filers through email, SMS, statutory notices, outreach programmes, etc. as well as through structural changes made in law and the government’s emphasis on the widening of tax net has resulted in this outcome.

Even though there is no escape to pay tax, IT department from time to time come up with certain Acts, tools or provisions to make sure people can save their tax. HUF (Hindu Undivided Family) is one of the most effective and legal ways to save the tax.

HUF and its Formation

The term HUF stands for Hindu Undivided family. HUF can be formed immediately upon the marriage of an Individual. After marriage, the HUF will comprise of two members- the individual and his spouse. Subsequently, on the birth of any child, he or she will also become a member of the HUF. HUF can be formed by any individual who is born Hindu, Sikh, Jain or Buddhist, provided he is married. The lineal descendants of Karta, their spouses, and children, automatically become members of his family.

HUF cannot be formed alone but by a family. Assets of the HUF consist of any ancestral property, a gift, a will, or property purchased from the sale of joint family property.

Once HUF is formed, it needs to be formally registered in its name. It should have a legal deed which contains all the details of the HUF members and the business carried by them.

Tax saving under HUF:

The main reason behind forming the HUF is to get the extra PAN card legally. HUF has its own PAN card and is taxed separately. All the members of the HUF, as well as the HUF itself, can claim the deduction under section 80C. Mr.Taranpreet Singh, who is a Partner of TASS Advisors LLP told Zee Business Online that HUF could be created to tax a family, not an individual.

HUF can take a life Insurance Policies in the name of its members to claim deduction under Sec 80C. If the members of the family are contributing towards the functioning of the family business, then HUF can also pay salary to its members. The expenditure on salary can be deducted from the income of HUF. Mr. Singh further added that Common income belonging to a family should be subject to tax under the hands of HUF and therefore, can be adopted as a tax planning tool to minimize overall tax impact for a joint family.

The family uses HUF as a means to build assets.

How Budget 2020 Made the Dividend Option of Mutual Funds Tax Inefficient?

How Budget 2020 Made the Dividend Option of Mutual Funds Tax Inefficient?  Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives

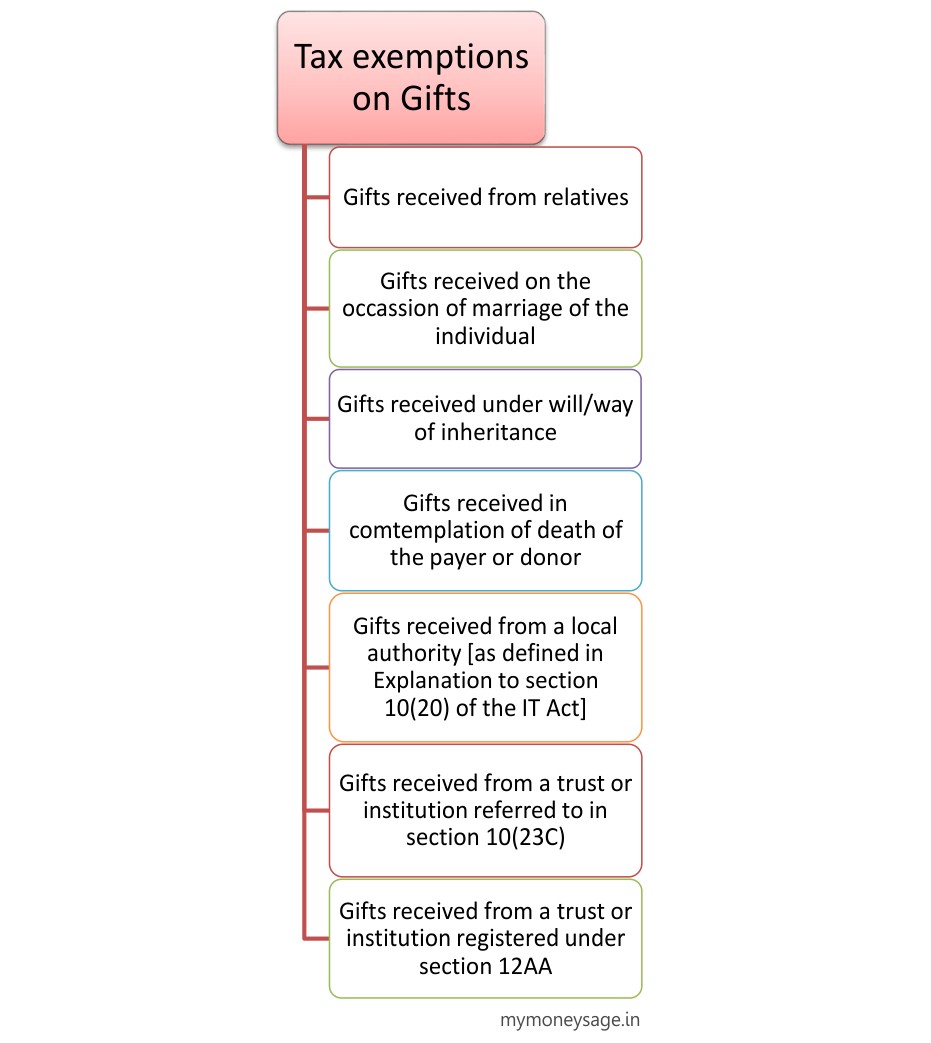

Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives  Do I owe a tax for the gift I receive? Get to Know the Rules of Taxability of Gift in India

Do I owe a tax for the gift I receive? Get to Know the Rules of Taxability of Gift in India  Restructuring your Salary in Tax Efficient Manner can increase your carry home Salary by upto 10%

Restructuring your Salary in Tax Efficient Manner can increase your carry home Salary by upto 10%  Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?  Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA

Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA  What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return

What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return