Do I owe a tax for the gift I receive? Get to Know the Rules of Taxability of Gift in India

Taxability of Gift received in various scenarios in India

Having the knowledge of all the incomes or assets that are taxable is no easy feat. If any such asset escapes your mind or maybe you are unaware that the asset is taxable, then you can be in a lot of trouble. One such asset is “gifts”. To delve more into the situation of gift tax act in India, let us consider these scenarios first.

Taxability of Gift under Income Tax Act- Consider these scenarios

- It is not uncommon, but maybe your friend borrowed some money from you and is now paying back by transferring into your bank account.

- You want to borrow some money from your friend or relative or parents or any such individual, and have the money transferred to your bank account

- You received a gift of money for your wedding or birthday or any such occasion and you got that money deposited to your bank account

These are some very common scenarios that you may experience. Now, you have to know whether the amount deposited is taxable or not. For you may not know it but the government levies a tax on gifts as well. So, what are the rules of gift tax act? You may find the information given below to be quite helpful.

Rules of Taxability of Gift Received

-

Any amount up to Rs. 50,000, is not taxable

The most important information that you as a taxpayer must know, no tax will be levied on monetary gifts of up to Rs. 50,000 per year. However, if the gift crosses the amount of Rs. 50,000 then you will have to pay gift tax on the total amount and not just the additional sum.

-

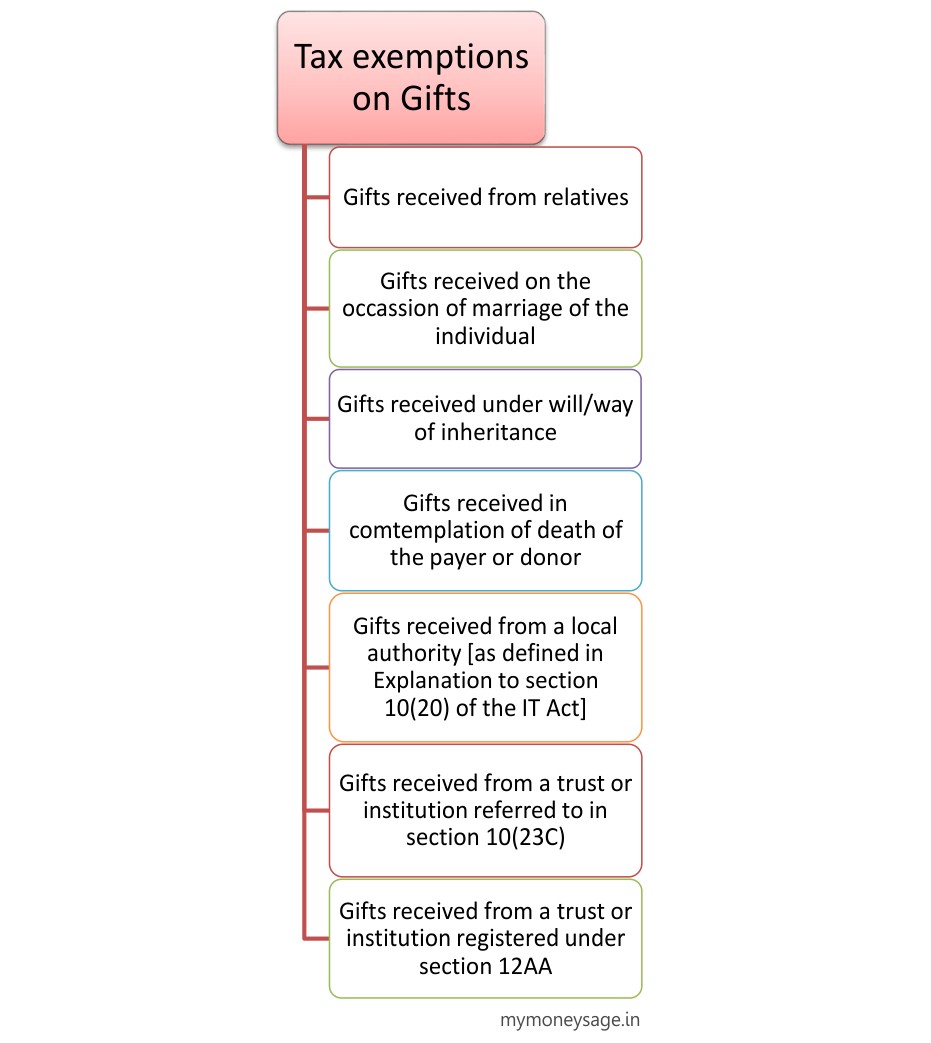

Gifts from relatives are exempted

Any gift that you have received from specified relatives as money in cash, cheque or such, is completely tax-free. The government has issued a list of relations who can be construed as your relatives. They are:

- Your spouse

- Your brother or sister

- Spouses of your brother or sister

- Maternal and paternal uncles and aunts

- Any of your lineal ascendants or descendants

- Any lineal ascendants or descendants of your spouse

- Spouse of the persons who have been referred above.

-

Wedding gifts are not taxable

Any amount of money that you may receive as a wedding gift will not be taxed. So, even if you receive a sum of Rs. 1 crore in your wedding as a gift, it is tax-free.However Please consider that u/s 269 ST , marriage is one occasion and a person

receives amount of Rs.3,00,000/- in Cash , penalty is levied of 100% if amount received.

-

Will and inherited money is tax-free

If you receive any amount of money through a will or as inheritance, then no gift tax can be levied on the sum you have received.

-

Gift tax on movable/immovable properties

There are two aspects

- If the property is gifted without any consideration then the stamp duty value will be taken if it exceeds Rs. 50,000.

- If the property is gifted for consideration, then the actual value of the property will be taken.

Be careful

Even you are aware of the rules and exemptions, be careful when you take a hefty sum of money and let them deposited into your account no matter how short the period is.

How Budget 2020 Made the Dividend Option of Mutual Funds Tax Inefficient?

How Budget 2020 Made the Dividend Option of Mutual Funds Tax Inefficient?  HUF- a tax planning tool to save Income tax

HUF- a tax planning tool to save Income tax  Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives

Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives  Restructuring your Salary in Tax Efficient Manner can increase your carry home Salary by upto 10%

Restructuring your Salary in Tax Efficient Manner can increase your carry home Salary by upto 10%  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?