How Much You Can Earn As A Cost and Works Accountant?

How much can you earn as Cost and Works Accountant

With the number of corporations emerging these days, the market is on the hunt for the right candidate for each and every role, and one such hunt is on for the Cost and Works Accountant. The CWA or Cost and Works Accountant course is the most sought after career path these days. Let’s take a look at the benefits and important details regarding the role.

Cost and Work Accountant role

The Cost and Works Accountant is responsible for strategic management decisions regarding the financial expenses of the firm. He is also responsible for cutting down the cost of operations for the corporation and thereby increasing profits. Some of the important roles that a Cost and Works Accountant plays are collection, assimilation, collation, and analysis of monetary information for the company.

The Cost and Works Accountancy is a particularly new discipline but nevertheless here to stay owing to its designated importance for the company. The Cost and Works Accountant’s judgement and experience plays an important role in shaping the future of the organization as he also weighs in on managerial decisions.

Cost and Works Accountant (CWA) Eligibility

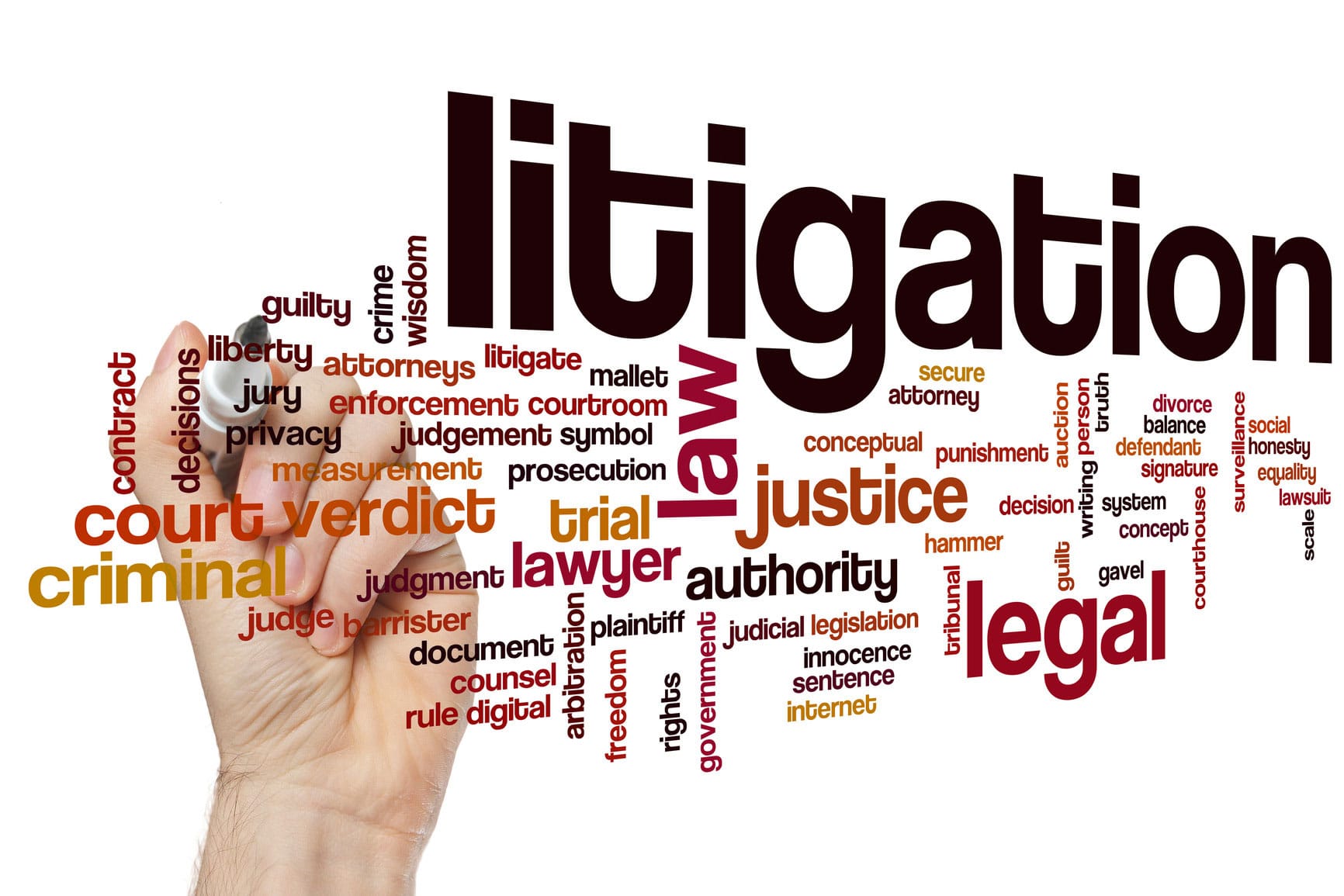

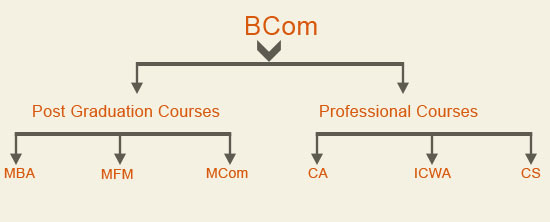

The CWA course is available for all students, whether you’re a commerce student, or you hail from the field of science. In order to enroll yourself for the foundation course, the minimum eligibility criteria is 10+2 from a state government recognized board. At the time of application, the student must also have completed 17 years of age to be eligible. Students who have already completed their graduation may directly opt for the intermediate course.

The course duration for the intermediate course is 18 months, and requires one to be of 18 years or older at the time of application. Only once you’ve completed the intermediate course, you are eligible to apply for the final course, which also ranges for 18 months. At the moment 35 Indian Universities approve the course provided by ICWAI.

Scope of CWA

The scope for CWA lies both in public as well as private sectors. A vast majority of the job availability for CWAs is in the United Kingdom, and a bit in Europe and other common-wealth countries. The United States does not require as many CWAs at the moment, but the certification is surely popular and catching up in other countries as well.

Cost and Works Accountants are employed as senior members in the organization, their roles may comprise Chief Accountant, Finance Director, Financial Controller, Senior Marketing Manager and so on. They are required in various fields such as insurance, banking, business organizations, government bodies, research, teaching, and many more.

Expected Salary as Cost and Works Accountant

Pursuing the education to become a Cost and Works Accountant is the smart way of possessing a senior position in a business organization, however, landing that position requires practical knowledge and experience. While a fresher may receive Rs. 25,000 to Rs. 30,000, increasing your experience can get you a salary worth Rs. 50,000 a month and more as your experience grows.

In conclusion, there are a number of opportunities available in India and abroad for this new career path, and will surely benefit the ones who work smart and hard.

Related Read- Career Options After Qualifying as a CA

Bankruptcy Lawyer in Pittsburgh

Bankruptcy Lawyer in Pittsburgh  3 Ways to Get Help With Your Legal Case

3 Ways to Get Help With Your Legal Case  Guide to preparing for CA Final Exams – Part 2

Guide to preparing for CA Final Exams – Part 2  Guide to preparing for CA Final Exams – Part 1

Guide to preparing for CA Final Exams – Part 1  MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?

MBA and ICWA- Both has its own significance. Which one is good for career- MBA or ICWA?  Your ultimate guide for CA campus interviews

Your ultimate guide for CA campus interviews  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?