Gain on Sale of Bogus Penny Shares is Subjected to be Held

The penny shares are low value shares and Investment in such shares involves huge risk, and such shares are usually subject to lot of manipulation in prices.

However, investing in the penny stock is not always considered to be invalid, as the department of income tax has started to investigate alleged investment in shares with consent of the companies listed in the stock exchange to resolve the negative issues. In this regard, to provide more coherent outcome, the income tax department can also investigate under the rules of u/s 133(6) of the Income Tax Act. One of the key sources for collecting the information is SEBI (Securities Exchange Board of India) with regards to capital market manipulation.

ITAT Mumbai Held Gains from Selling Penny Shares

An assessee, Mumbai based owner of a fast food center had obtained invalid capital by purchasing and selling shares of a Kolkata based company M/s Shiv Om investment and Consultancy Ltd. After the examination of the case, it was confirmed that 4000 penny shares had been purchased by the assessee from M/s Shiv Om investment and Consultancy Ltd by paying Rs 4,080 and sold 2500 penny shares on 27th January of 2006. On 16th of May 2006, he also sold 1000 penny shares in return of Rs 6,89,750 from which the tax was not deducted. The Revenue department thus re-opened the issue of notice as per u/s 148 of the Income Tax Act on 7th of April 2008 and provided a notice to the assessee.

The assessment conducted by the revenue department during the period of 2005-2006 revealed that the scrip value of shares increased by 49 times as compared to its purchase price within a short period. The Revenue department issued notice to the assessee seeking all the details of payment and to provide justification why this transaction may not be held as bogus one

Held By ITAT

It was apparent that the penny shares purchased by the assessee were transacted in cash in the off market. The purchase of these shares was held as fraudulent by the Revenue department, as it involved manipulation of the price by the broker. The payments made by the assessee were also considered to be invalid and the Revenue department accepted the contentions of the assessee regarding the sales of 1500 penny shares.

Become a Pro at Managing Your Finances with Separate Savings and Salary Account

Become a Pro at Managing Your Finances with Separate Savings and Salary Account  All About Intra-day Trading Startegies

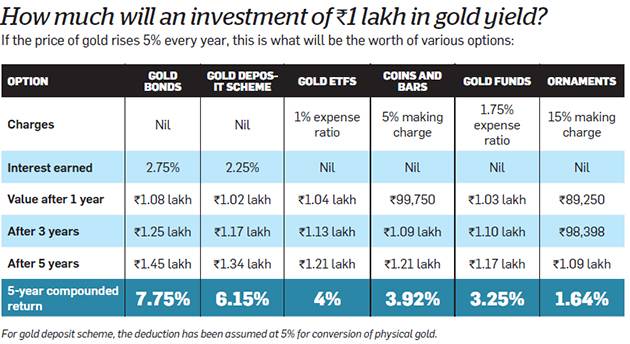

All About Intra-day Trading Startegies  Investing in Gold Bond- safer option than investing in Gold and yields better return

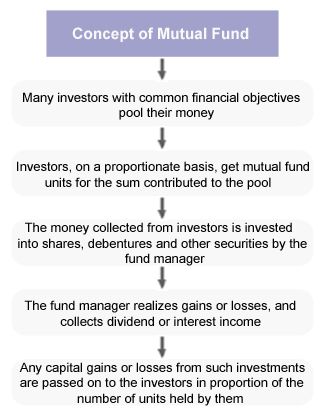

Investing in Gold Bond- safer option than investing in Gold and yields better return  All about Mutual Funds Investments

All about Mutual Funds Investments  If you think investing in mutual funds or SIP is simple, think again

If you think investing in mutual funds or SIP is simple, think again  Investment Strategy in a Volatile Market

Investment Strategy in a Volatile Market  Major Changes Expected in Direct Tax Code 2025 and why these matter

Major Changes Expected in Direct Tax Code 2025 and why these matter  Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?

Can an assessee pay House Rent to his parents and claim relief? Would there be any legal complications?  Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA

Boost Your Business & Reduce Taxes: A Guide to Maximizing Benefits Under Section 80JJAA  What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return

What is remedy to taxpayer if the Tax deductor fails to deposit the TDS or fails to file TDS Return