Restructuring your Salary in Tax Efficient Manner can increase your carry home Salary by upto 10%

Overview of E Way Bill (Electronic Way Bill) under GST Regime

Importance of getting salary rationalized cannot be over emphasized. With times, as salary levels have risen and the Income tax exemption limits still at ridiculously low levels of Rs 2.50 lacs unless one is a senior citizen, the focus on getting salary designed on Tax-efficient manner

Though over last 10 years, the scope of tax planning from Salary Head has come down quite substantially due to many exemptions either not available, or Cap imposed on them, yet there are few areas left where an individual can get his salary restructured to make it tax efficient and minimize tax outgo

Employers too understand this aspect and after negotiating the salary package, they leave it to the prospective employee to tailor his package with in the norms.

It may be noted, there is no single package that fits all. Depending on one’s needs and some other factors, the salary structure could be different for each assessee.

Major Components of Salary

Broadly, the salary can be divided into 4 major components-

- Basic Salary

- Allowances/ Reimbursements

- Perquisites

- Contributions to funds/ Retirements benefits

Now, depending on one’s requirements and financial factors, the package can be planned. Some of the factors that decide the designing of the package are-

What factors decide Salary Structuring?

- Requirement of immediate cash every month in form of salary

- Whether you have your own house; or living in rented accommodation Or does your wife owns the house; if so, is she working?

- Do you need to travel a lot while performing your Job duties

- What is your age? Have you already completed 5 years subscription to PF? How far away is your retirement? Do you need some pension after retirement?

- Are you a passive investor? Would you like lumpsum funds after retirement or would prefer annuity?

- Do you live in any of the Metro City or Other City?

Now some thoughts on how to design the tax efficient salary-

- BASIC SALARY – Fixing The Basic Salary- Basic Salary is fully taxable. However, most of the tax free components as Mediclaim limits, PF, Superannuation, House Rent Allowance are factor of the Basic Salary. The cap on Tax Free PF contribution by employer is 12% of the Basic Salary. Similarly, the HRA is exempt upto maximum (depending on other factors too) of 50% of the Basic Salary if you are living in any Metro City as Mumbai, Delhi, Bangalore etc and 40% of the salary if living in other cities. Similarly the contribution to superannuation funds with approved fund manager is also factor of the basic salary

- Allowances– Now a days most of the allowances are taxable. However, some of the tax free allowances are Medical Reimbursement (Upto Rs 1250 per month), Local Conveyance(Rs 1600 per month); Meal Coupans upto Rs 1300 per month; Diwali Gift Coupans upto Rs 5000 per year; House Rent Allowance –upto 40% or 50% of the basic as discussed above and subject to submission of the requisite information to your office

- Perquisites– You can also ask employer to get you some perquisites as Medical insurance for self and family. Normally such coverages while providing better facilities (such as coverages from day one; pre-existing diseases also covered) are also much cheaper when taken through employer. You can ask your employer to get such cover for company as a group

4. Retirement Benefits/ Contributions to funds- You can ask employer to provide upto 12% of the Basic salary as contribution to PF, You can also get your Car leased with company and get rentals for such hiring(If your wife or other family members owns the Car, you can get the same leased to at appropriate rates;) You can also hire a driver through your employer or get reimbursement of salary of driver. This would be so, if you are using driver for moving around for official purposes

While we have tried to make this very simple for a layman to understand, yet we are also attaching an excel sheet which would be simple to use. Just enter few inputs and you can get suggestion on designing the salary. We would welcome your suggestions to make it this calculator further simple and better

In case you need any help in designing of the salary, you can also hire any of our tax professionals as experts, who would be helping you design the tax efficient salary

[embeddoc url=”https://www.itrtoday.com/wp-content/uploads/2016/09/Tax-Planning-Salary.xlsx” download=”all” viewer=”microsoft”]

How Budget 2020 Made the Dividend Option of Mutual Funds Tax Inefficient?

How Budget 2020 Made the Dividend Option of Mutual Funds Tax Inefficient?  HUF- a tax planning tool to save Income tax

HUF- a tax planning tool to save Income tax  Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives

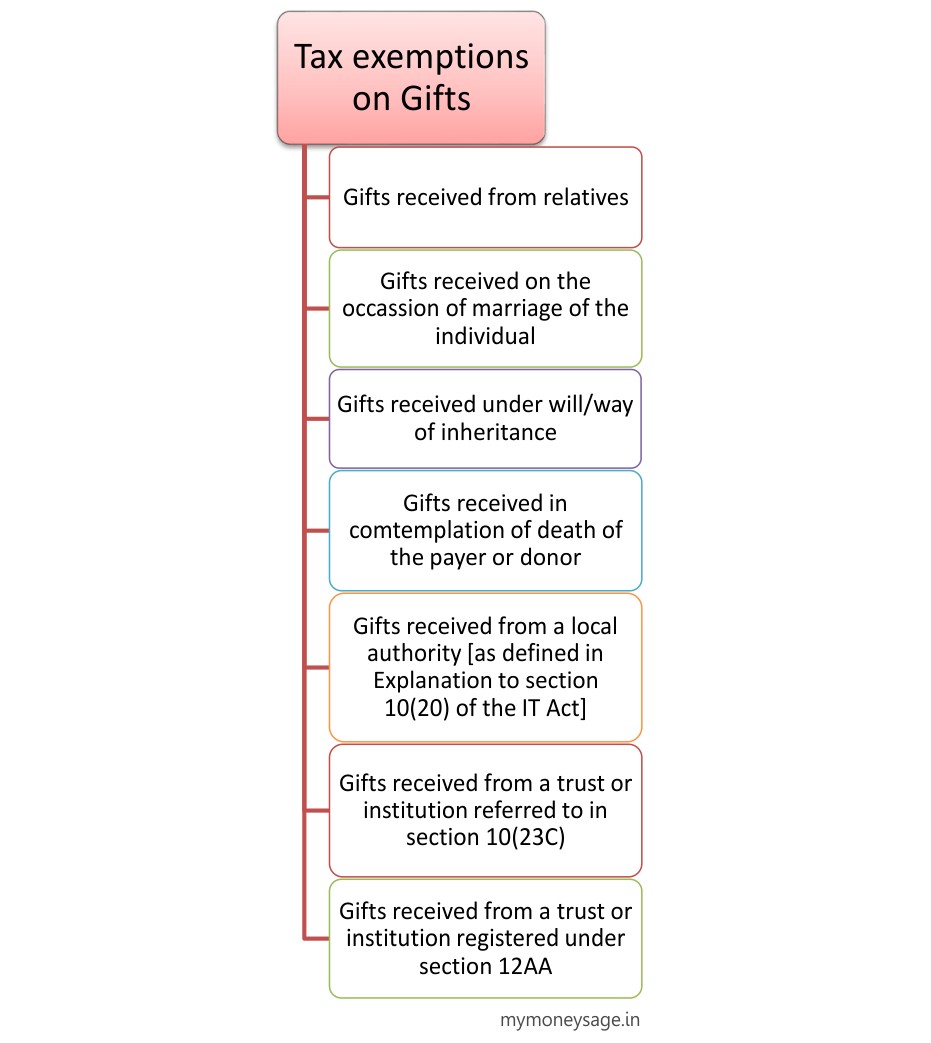

Reality of the tax-saving lucrative plans offered by the wealth Managers and the Bank Executives  Do I owe a tax for the gift I receive? Get to Know the Rules of Taxability of Gift in India

Do I owe a tax for the gift I receive? Get to Know the Rules of Taxability of Gift in India  ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?