TDS FAQ regarding Property Sale in India under Section 194-IA

1. What is Withholding tax?

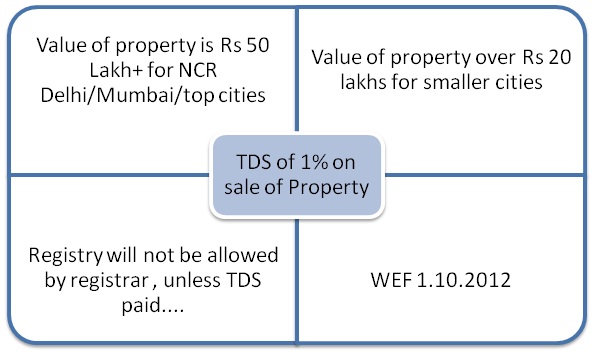

According to the new provision, 1% TDS has to be deducted on the purchasing price by the buyer of the property when a transaction is related to immovable property (except agricultural land). This is only applicable if the selling price of the property is equal to or exceeds INR 50 Lakhs in metro cities and INR 20 Lakhs in smaller cities. This deduction of tax by the buyer also known as tax retention to pay it to the government is known as “withholding tax”

2. Why this tax is being introduced?

The main reason of introducing TDS by the buyer of the property is that often the PAN number is not quoted by the seller or the buyer of the property. Thus, the majority of the transactions are not being reported. Thus, in order to find the real estate transaction in the most accurate way the Finance Minister launched the new TDS provision from current Fiscal year 2013-14. It was introduced as section 194-IA and is restricted to ongoing TDS provision under the Income Tax Act, 1961. It is applicable all across India from 1st June 2013.

3. What is Tax liability u/s 194-IA?

TDS is deducted at 1% of the selling price of the immovable property that exceeds value of INR 50 Lakhs in metro cities and INR 20 Lakhs in smaller cities. 20 percent TDS is deductible provided if the seller refuses to share his PAN information or does not possess a PAN card at all.

4. Which assets are covered u/s 194-IA?

The TDS is applicable to all immovable assets including land, building, all residential venues, all commercial venues, all assets that include land or building, etc. except the land that falls under category of agricultural land.

5. Who is liable to pay? Whose tax will be deducted?

The buyer of the property is liable to pay the TDS within

The deduction will be deducted from the seller for selling of his asset. It had to be paid separately to the government by the buyer.

6. Is it applicable if partial payment has been made before 1st June 2013?

For calculating the limit of Rs. 50 Lacs, the partial payment made before 1st June 2013 must be considered.

For example

An asset is being purchased in Delhi and is valued at INR 80 Lacs. A part payment for this purchase INR 40 Lacs was made before 1st June 2013

The payment made after 1st June 2013 is INR 40 Lakhs, that is less than INR 50 Lakhs –the prescribed limit.

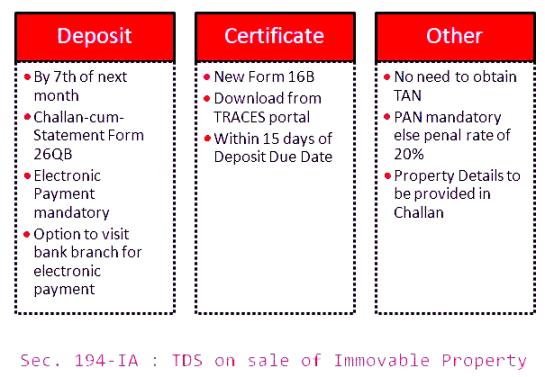

TDS on entire value of INR 80 Lakhs must be deducted from the payment of rest 40 Lacs as and when such payments are made. This TDS must be deposited online at https://www.tin-nsdl.com with in 15 days of the transaction.

7. What does the valuation of property for TDS calculations constitute of?

The value of the property must include the entire incidental payments, which a seller is required to do viz. legal fees, contributing towards shares, parking space, and maintenance of flat.

However, the stamp duty fees as well as registration and transfer fees to be paid by the seller are not subject to TDS.

8. How does the buyer deposit TDS with the government?

The deductee can deposit the TDS at https://www.tin-nsdl.com

Entire procedure to deposit TDS has been explained here.

The purchaser can make an payment in a bank’s physical branch as well. As mentioned earlier the seller will get Credit for TDS, which is necessary to be mentioned in the form.

9. What is the TDS implication in case of a property loan?

In case the buyer takes as loan to buy the property, up to the loan amount, the bank or the financial institution will make payment directly to the seller, without routing the payment through the purchaser, who is the borrower. The loan-granting institute will make deductions and will deposit the same in government account. The buyer of the property must obtain the certificates from the loan-granting institute and keep them secured for any future references.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income