All about Choosing between New Tax Regime and Old Tax Regime- Which regime is good for you

Choosing between old and new regime of income tax

The New Regime and Old Regime of income tax in India represent two different tax structures that individual taxpayers can choose from. Let’s delve into each regime in detail:

Old Regime of Income Tax:

The Old Regime refers to the traditional income tax structure that was in place before the introduction of the New Regime in the Union Budget for the fiscal year 2020-2021. Under the Old Regime, taxpayers are eligible for various tax deductions, exemptions, and allowances.

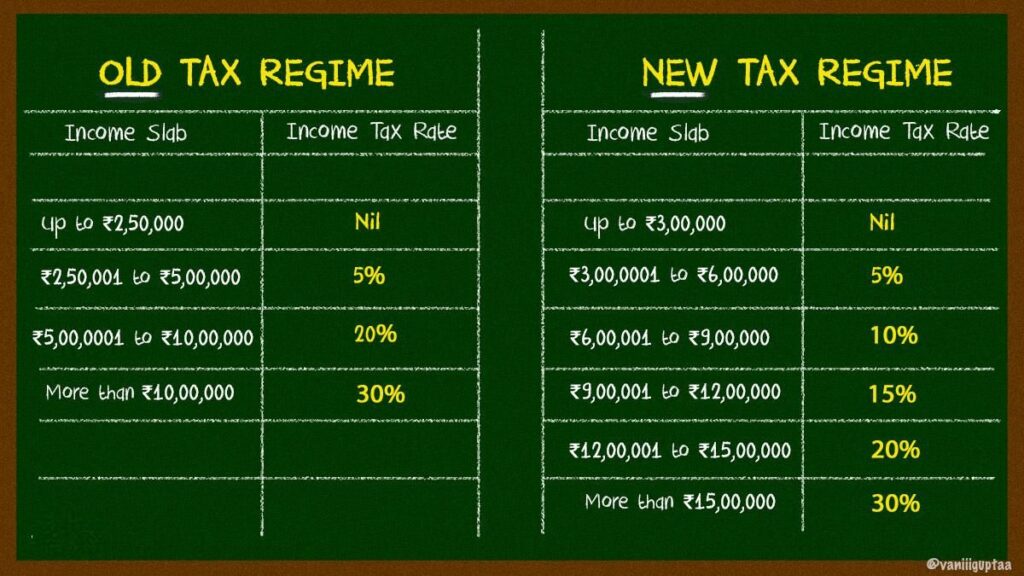

a) Tax Slabs:

The Old Regime consists of different tax slabs based on income levels. The tax slabs under the Old Regime, as updated in Budget 2023 are as follows: (the tax slabs below are for normal assessee, for Senior Citizen Upto 3 Lakhs in No Tax and for Super Senior Citizen this limit is Rs 5 Lakhs)

Up to INR 2.5 lakh: No tax

INR 2.5 lakh to INR 5 lakh: 5% tax

INR 5 lakh to INR 10 lakh: 20% tax

Above INR 10 lakh: 30% tax

b) Deductions and Exemptions:

Taxpayers under the Old Regime can avail themselves of various deductions and exemptions available under the Income Tax Act. Some of the commonly claimed deductions include those for investments in Provident Fund (PF), Public Provident Fund (PPF), National Savings Certificates (NSC), life insurance premiums, medical insurance premiums, housing loan interest, and so on. Additionally, individuals can claim deductions for expenses like tuition fees for children, medical expenses of dependent family members, and donations to specified charitable organizations.

New Regime of Income Tax:

The New Regime was introduced in the Union Budget for the fiscal year 2020-2021 as an alternative to the Old Regime. It aims to simplify the tax structure by removing various deductions and exemptions and offering lower tax rates. Under the New Regime, taxpayers are not allowed to claim most of the deductions and exemptions available under the Old Regime.

a) Tax Slabs under New Regime of Income Tax:

The tax slabs under the New Regime, as amended vide Budget year 2023, are as follows :

Up to INR 3 lakh: No tax

INR 3 lakh to INR 6 lakh: 5% tax

INR 6 lakh to INR 9 lakh: 10% tax

INR 9 lakh to INR 12 lakh: 15% tax

INR 12 lakh to INR 15 lakh: 20% tax

Above INR 15 lakh: 30% tax

b) Removal of Deductions and Exemptions:

Under the New Regime, most deductions and exemptions are not available. Taxpayers cannot claim deductions for investments in PF, PPF, NSC, life insurance premiums, medical insurance premiums, housing loan interest, etc. Additionally, deductions for expenses such as tuition fees, medical expenses, and donations are not allowed. However, effective Budget 2023, Standard Deducton from salary income is allwed as on lines on Old Regime, limited to Rs 50,000/-

It’s important to note that taxpayers have the option to choose between the Old Regime and the New Regime each financial year. They can evaluate their financial situations, income sources, and potential tax savings to determine which regime is more beneficial for them. It’s advisable to consult with a tax professional or financial advisor to make an informed decision based on individual circumstances.

Tabular comparison of Old Regime of Income Tax and New Regime of Income Tax

Aspect |

Old Regime |

New Regime |

| Tax Slabs | Multiple tax slabs based on income | Multiple tax slabs based on income |

| Deductions and Exemptions | Taxpayers can claim various deductions and exemptions available under the Income Tax Act. | Most deductions and exemptions are not available. |

| Tax Rates | Up to INR 2.5 lakh: No tax | Up to INR 3 lakh: No tax |

| INR 2.5 lakh to INR 5 lakh: 5% tax | INR 3 lakh to INR 6 lakh: 5% tax | |

| INR 5 lakh to INR 10 lakh: 20% tax | INR 6 lakh to INR 9 lakh: 10% tax | |

| Above INR 10 lakh: 30% tax | INR 9 lakh to INR 12 lakh: 15% tax | |

| INR 12 lakh to INR 15 lakh: 20% tax | ||

| Above INR 15 lakh: 30% tax | ||

| Available Deductions | Various deductions available, such as investment in PF, PPF, NSC, life insurance premiums, medical insurance premiums, housing loan interest, etc. | Most deductions and exemptions are not available. |

| Other Allowances | Standard deduction | Standard deduction |

| House Rent Allowance (HRA) | House Rent Allowance (HRA) | |

| Leave Travel Allowance (LTA) | Leave Travel Allowance (LTA) | |

| Medical Allowance | Medical Allowance | |

| Conveyance Allowance | Conveyance Allowance |

Please note that this table provides a general overview, and the specific details and rules may be subject to change.

Which regime, New or Old, of Income Tax Should be chosen by assessee having Income from Salary

When deciding between the New Regime and the Old Regime of income tax in India, individuals earning income from salary should consider several factors before making a choice. Let’s explore these factors in detail to help assess which regime may be more suitable:

Tax Rates:

One crucial aspect to consider is the tax rates applicable under each regime. The New Regime offers lower tax rates at certain income brackets compared to the Old Regime. By comparing your salary income with the tax slabs in both regimes, you can determine which regime may result in lower tax liability.

Deductions and Exemptions:

The Old Regime allows for various deductions and exemptions, such as investments in Provident Fund (PF), Public Provident Fund (PPF), National Savings Certificates (NSC), and deductions for housing loan interest, medical insurance premiums, and more. Assess whether you qualify for and benefit from these deductions and exemptions under the Old Regime. If you have significant eligible deductions and exemptions, the Old Regime might be more advantageous for you.

Simplicity and Convenience:

The New Regime aims to simplify the tax structure by eliminating most deductions and exemptions. If you find the process of claiming and keeping track of deductions and exemptions cumbersome or if you do not have many eligible deductions, the New Regime might be more convenient for you.

Future Financial Goals:

Consider your long-term financial goals. If you have specific financial objectives, such as buying a house, saving for retirement, or planning for your child’s education, the deductions and exemptions available under the Old Regime may help you save more taxes and accumulate funds for these goals. On the other hand, if your financial goals are more short-term or immediate, the New Regime may offer simplicity and a potentially lower tax burden.

Income Sources:

Evaluate whether you have income from sources other than salary, such as rental income, capital gains, or business income. The tax treatment of these additional income sources may differ under the two regimes. If you have substantial income from such sources, feel free top consulat us to help you choose the Right Tax Regime that saves you the Income Tax.

Individual Circumstances:

Consider your personal circumstances, including your age, family composition, and health. These factors can influence the deductions and exemptions you can claim under the Old Regime. For instance, if you have dependent family members with specific medical needs, deductions available in the Old Regime for medical expenses might be beneficial.

Ultimately, the choice between the New Regime and the Old Regime depends on your individual situation, financial goals, and tax liability. It’s recommended to evaluate the impact under both regimes, seek professional advice if needed, and make an informed decision based on what aligns best with your financial objectives and circumstances.

Once I choose regime of Income Tax in any assessment year Can i change the same next year

Yes, you have the flexibility to switch between the New Regime and the Old Regime of income tax in India from one assessment year to another. The choice of regime is not permanent and can be changed on a yearly basis. Here are some important points to consider regarding switching between regimes:

The choice between the New Regime and the Old Regime is available on a yearly basis. Before filing your income tax return for a particular assessment year, you can assess your financial situation and choose the regime that is more beneficial for you for that specific year.

Intimation to Employer:

If you are a salaried individual, you need to inform your employer of the regime you have chosen at the beginning of the financial year. This will enable them to deduct taxes from your salary based on the selected regime.

Impact on Deductions:

When you switch from the Old Regime to the New Regime, you will not be eligible to claim most of the deductions and exemptions available under the Old Regime for that particular assessment year. Similarly, if you switch from the New Regime to the Old Regime, you can claim deductions and exemptions available under the Old Regime.

Careful Assessment:

It is essential to carefully evaluate the impact of switching regimes each year. Consider factors such as your income sources, eligible deductions, exemptions, and tax liability under both regimes before making a decision. You may want to consult with a tax professional or financial advisor to understand the potential benefits and implications of switching regimes.

Timeframe for Switching:

The switch in regimes needs to be made before filing the income tax return for the relevant assessment year. Once you file your return, the choice of regime for that year becomes final and cannot be altered.

Remember to stay updated with the latest tax regulations and feel free to consulat us to make an informed decision based on your specific circumstances and financial goals.

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income