Which is the Best return form for you to File Income Tax return?

Which is the Best return form for you to File Income Tax return

It has been proposed to exempt senior individuals from submitting income tax returns if their only source of annual income is pension and interest income. Section 194P was recently added to oblige banks to withhold tax from elderly citizens over 75 who receive a pension and interest income from the bank.

-

What exactly is ITR (Income Tax Return)?

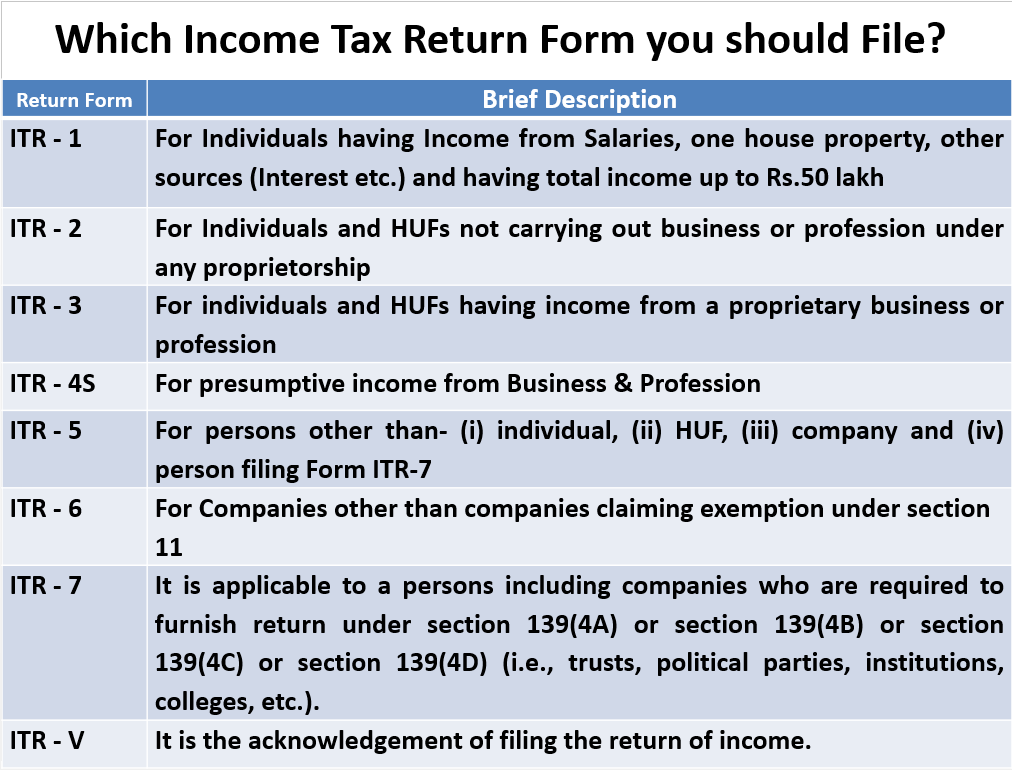

The Income Tax Return (ITR) is a document on which a taxpayer submits information to the IRS regarding his earnings and the taxes he owes. So far, the department has issued notifications for ITR 1, 2, 3, 4, 5, 6, and 7.

Every taxpayer should file his ITR on or before the deadline. The applicability of ITR forms varies based on the taxpayer’s sources of income, the amount of revenue generated, and the type to which the taxpayer belongs, such as individuals, HUFs, corporations, etc.

-

What are the benefits of filing an ITR (income Tax Return)?

If any of the following circumstances apply to you, filing an income tax return (ITR) in India is required:

- If your gross annual income (GAI) exceeds the bare exemption ceiling, see the table below.

- If you have multiple sources of income, such as a residence, a rental property, or capital gains, etc.

- If you want to request a refund from the Department of Revenue.

- If you earned or invested in foreign assets throughout the fiscal year.

- If you want to apply for a visa or a loan, follow these steps.

- If the taxpayer is a corporation or a partnership, regardless of profit or loss.

Types of ITR and how to select the one that suits you

There are seven types of ITR forms

ITR-1- For Salaried persons, having interest income and Rental Income from a single property and having overall income less than Rs 50 Lakhs

Citizens who fall into one of the following groups must fill out this form:

- Income comes from a pension or a salary.

- Income is generated from a single-family residence. Exclusion is permissible, however, if you carried the losses forward from the prior year.

- If agriculture generates a total income of not more than Rs.5,000.

- A maximum of Rs.50 lakh in total income can be created.

- Income from other sources, such as winning horse races, the lottery, and so on.

ITR-2- for individuals having Income from Capital Gains as well, besides, Salary, Interest and Rental Income

Individuals and Hindu Undivided Families (HUFs) who fall into the following categories must utilize the ITR-2 form:

- The individual’s income must be higher than Rs.50 lakh.

- A pension or a salary might be used to supplement income.

- Income derived from a residential property.

- Winnings from lotteries or horse races produce income.

- If the person is the Director of a Corporation.

- The individual’s agricultural revenue exceeds Rs.5,000.

- Profits from capital gains have been generated.

- If you invested in unlisted equity shares throughout the financial year.

- Foreign income and foreign assets provide revenue.

ITR-3

Individuals and HUFs who earn a living through a profession or a sole proprietorship must use this form. The ITR-3 form is available to the individuals listed below:

- People who make a living through their job or company.

- If there were any investments in unlisted equity shares at any point during the financial year.

- If the person is a partner in a company.

- If the person is a board member of a corporation.

- If your income comes from a pension or salary, a rental property, or any other source.

- The company’s revenue crosses Rs.2 crore.

Sugam or ITR-4

HUFs, Partnership Firms, and Indian residents who earn money from a profession or company must use the ITR-4 form. Limited Liability Partnerships (LLPs) cannot, however, choose this option. This form should be used by people who have chosen the presumptive income plan under Section 44AD, Section 44ADA, and Section 44AE of the Income Tax Act 1961.

ITR-5

ITR-5 is required for investment funds, business trusts, insolvent estates, deceased estates, Artificial Juridical Persons (AJPs), Body of Individuals (BOIs), Associations of Persons (AOPs), LLPs, and businesses.

ITR-6

ITR-6, This form must be selected by any companies that are not claiming Section 11 exclusions. The only way for businesses to file returns under this section is to do so electronically.

ITR-7

ITR-7, This form must be used by individuals and businesses who have filed returns under Section 139(4A), Section 139(4B), Section 139(4C), Section 139(4D), Section 139(4E), or Section 139(4F).

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar

ITAT Amritsar: No Section 269SS Violation for One-Time Cash Payment Before Sub-Registrar  Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption

Tax Officials Unleash Digital Dragnet: How New Raid Powers Redefine Privacy, Property Rights in India and likely to Fuel Corruption  Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide

Income Tax Department Rewards for Reporting Tax Evasion: A Comprehensive Guide  Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?

Forfeiture of Gratuity by Employer- What are the Remedies for an employee- Can employer be challenged?  Employer can forfeit gratuity of an employee in case of moral turpitude

Employer can forfeit gratuity of an employee in case of moral turpitude  Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income

Diving Deeper: The Impact of the New Tax Bill on Dairy and Farming Income